The dissolution of a corporation package contains all forms to dissolve a corporation in Delaware, step by step instructions, addresses, transmittal letters, and other information.

Delaware Dissolution Package to Dissolve Corporation

Description

How to fill out Delaware Dissolution Package To Dissolve Corporation?

The larger quantity of documents you must prepare - the more stressed you become.

You can discover numerous Delaware Dissolution Package to Dissolve Corporation templates online, yet you are uncertain which to trust.

Eliminate the hassle to make locating samples much easier with US Legal Forms. Obtain precisely formulated documents that are designed to comply with state regulations.

Locate each document you receive in the My documents menu. Simply navigate there to fill in a new copy of your Delaware Dissolution Package to Dissolve Corporation. Even with well-prepared templates, it's still advisable to consider consulting a local attorney to verify that your document is filled out correctly. Achieve more for less with US Legal Forms!

- Verify if the Delaware Dissolution Package to Dissolve Corporation is applicable in your state.

- Double-check your choice by reviewing the description or utilizing the Preview feature if available for the selected document.

- Click Buy Now to initiate the registration process and select a pricing option that fits your needs.

- Provide the requested information to create your account and pay for your order using PayPal or a credit card.

- Select a suitable file format and retrieve your copy.

Form popularity

FAQ

While a plan of dissolution is generally not required in Delaware, creating one is often beneficial. It provides structure to the dissolution process and ensures that everything is handled properly. It also helps prevent misunderstandings among shareholders and creditors. Consider using our Delaware Dissolution Package to Dissolve Corporation for guidance on drafting a comprehensive plan.

Section 271 of the Delaware corporate law outlines the conditions under which a corporation may sell its assets or dissolve. This section is essential for corporate governance and ensures proper conduct during asset disposition. Understanding its implications is vital when planning your corporation's dissolution. Discover more details with our Delaware Dissolution Package to Dissolve Corporation.

Delaware Code 272 pertains to the procedures for corporate dissolution and is crucial for understanding the legal framework governing this process. It details the requirements for managing corporate assets and liabilities during dissolution. Familiarity with this code can ease the dissolution journey. You can gain insights into this code through our Delaware Dissolution Package to Dissolve Corporation.

In Delaware, a plan of dissolution is not mandatory for most corporations. However, it can provide a clear outline of how assets and liabilities will be handled during the dissolution process. It is advisable to create one to ensure all stakeholders are informed and aligned. Our Delaware Dissolution Package to Dissolve Corporation includes recommendations on creating an effective dissolution plan.

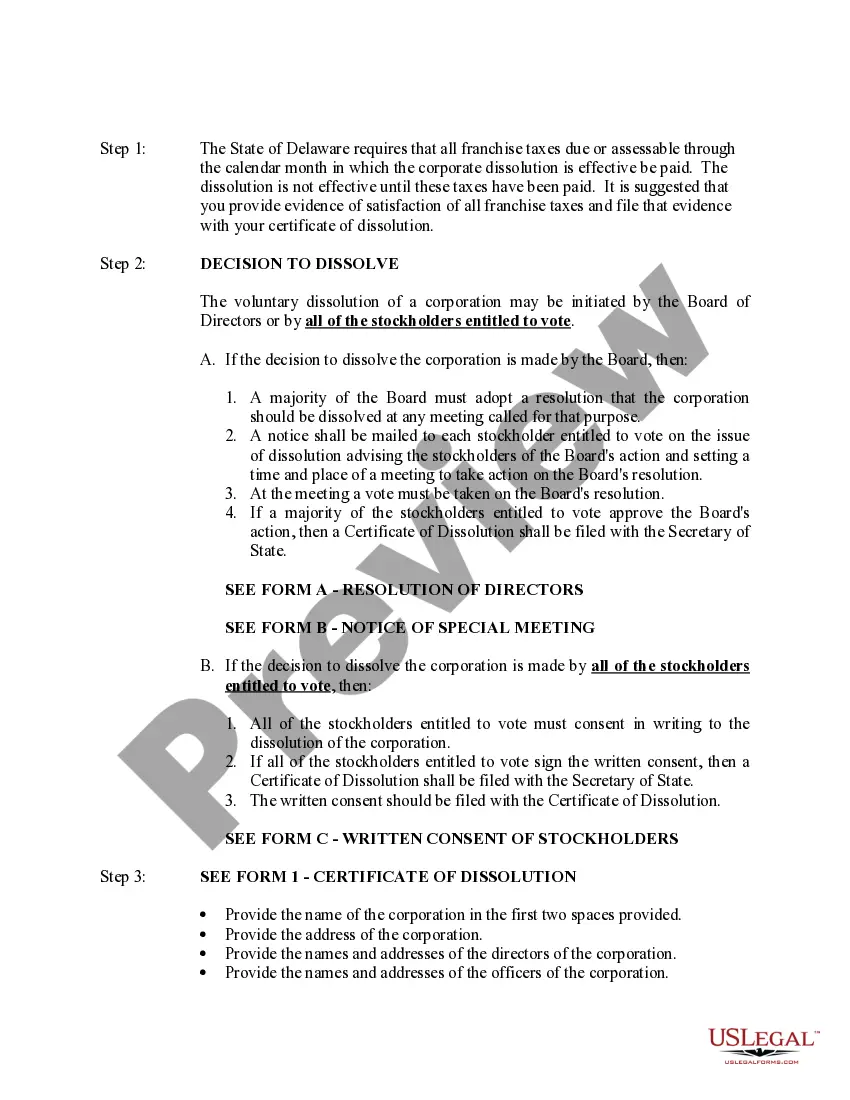

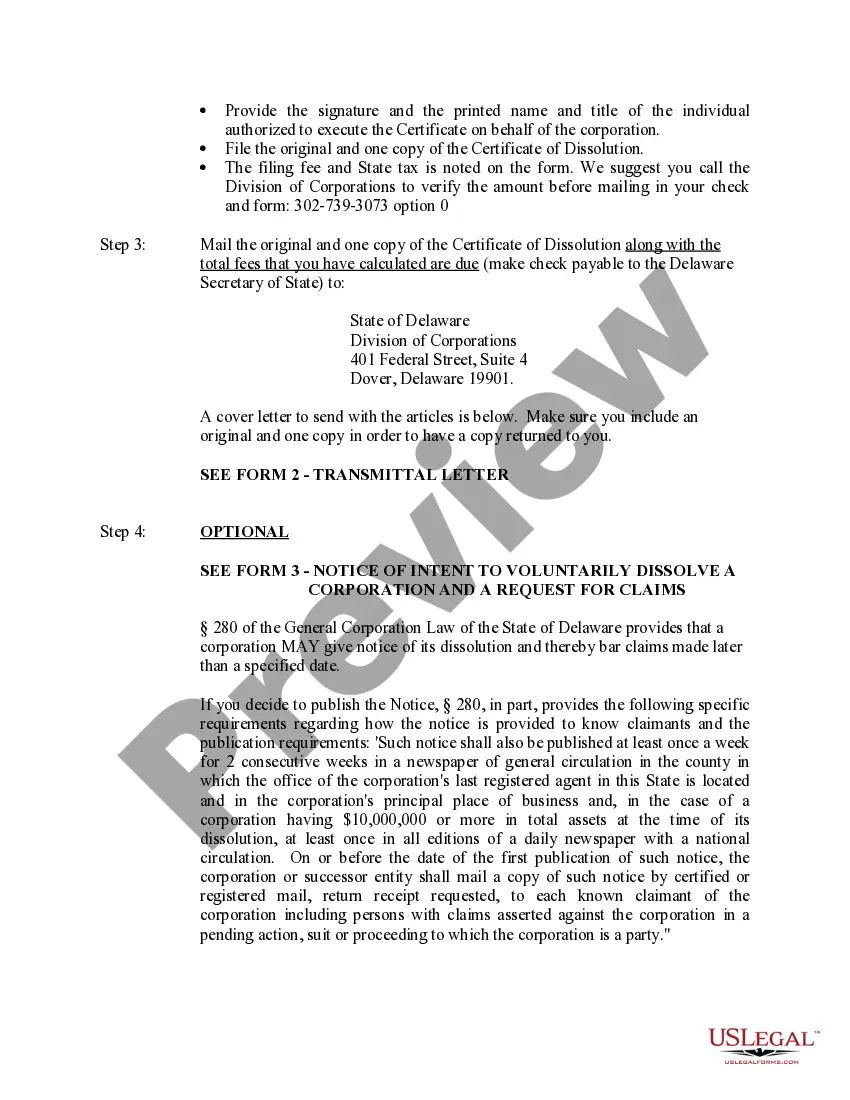

Dissolving a corporation involves several steps, including obtaining board approval, notifying shareholders, and filing necessary documents with the state. You must also resolve the company's debts and distribute any remaining assets. Taking these steps methodically ensures compliance with Delaware laws. Using our Delaware Dissolution Package to Dissolve Corporation can simplify this process.

Section 276 of the Delaware Corporation law addresses the process by which a corporation can be dissolved. This section outlines the requirements for voluntarily winding up corporate affairs and distributing assets. Understanding this section is crucial when considering the dissolution of your corporation. Our Delaware Dissolution Package to Dissolve Corporation can guide you through these regulations.

To dissolve a corporation in Delaware, you must file a Certificate of Dissolution with the Secretary of State. This process may include settling any outstanding debts and obligations. After filing, ensure compliance with any remaining legal requirements. You can efficiently manage this process with our Delaware Dissolution Package to Dissolve Corporation.

Not dissolving a Delaware corporation can leave it active, which means it remains subject to taxes and regulatory requirements. This situation can complicate your financial responsibilities and require further action down the line. To avoid these pitfalls, use the Delaware Dissolution Package to Dissolve Corporation from US Legal, which simplifies the dissolution process, ensuring you address all necessary steps in a timely manner.

If a corporation is not properly dissolved, it may continue to incur legal and financial obligations, including taxes and annual fees. This ongoing status can lead to complications down the road, including potential liabilities. To prevent this, consider using our Delaware Dissolution Package to Dissolve Corporation to manage the dissolution effectively and avoid such issues.

Failing to file an annual report in Delaware can lead to penalties, including fines and even the possible dissolution of your corporation. Delaware requires annual reports to keep your corporation in good standing. Utilizing the Delaware Dissolution Package to Dissolve Corporation from US Legal can help ensure you understand all filing requirements, making compliance easier.