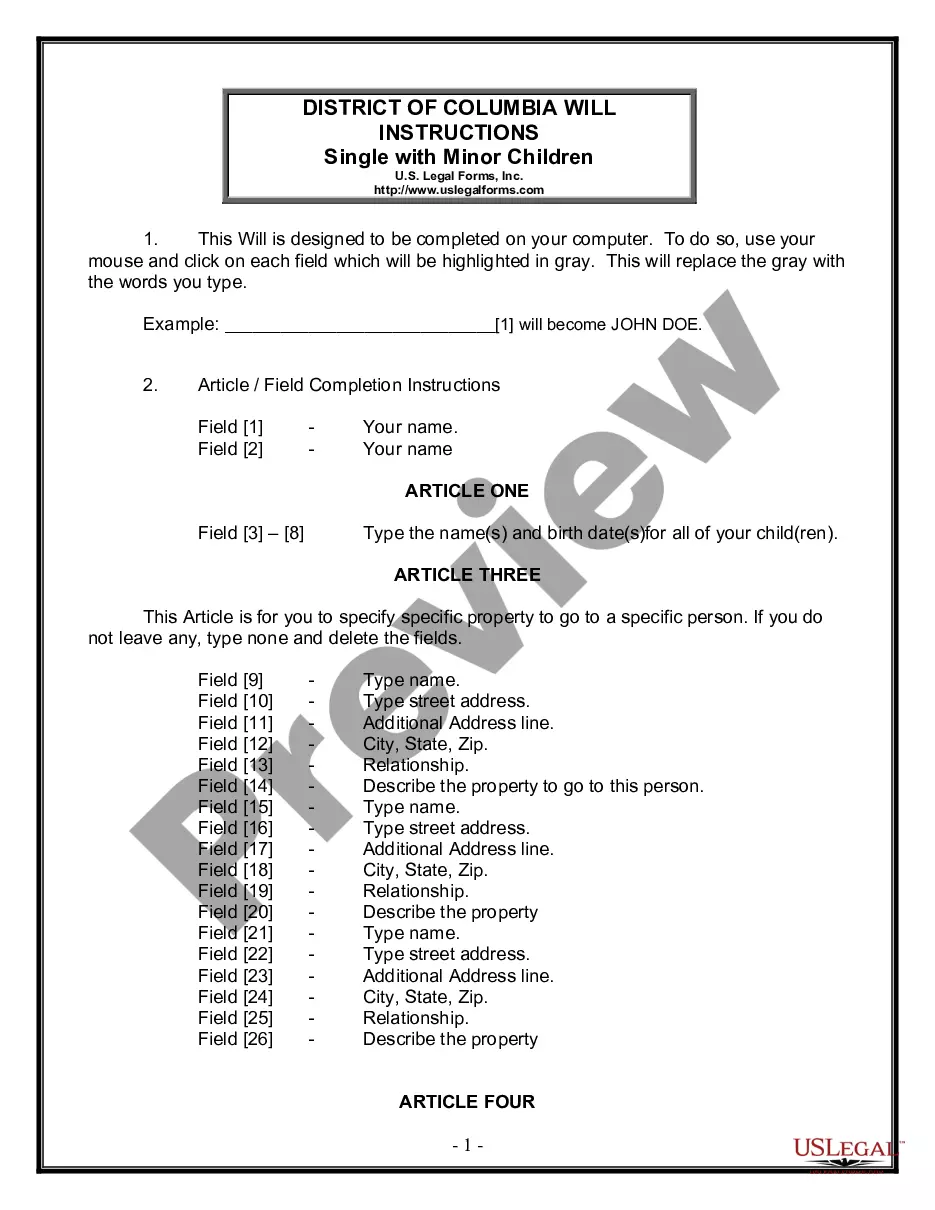

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

Title: Understanding the Role of an Executor for an Estate with No Assets — Types and Responsibilities Introduction: In the world of estate administration, an executor has various duties and responsibilities. This detailed description aims to shed light on the role of an executor for an estate with no assets, encompassing different types of executors who assume this position. We will explore the executor's primary tasks and elaborate on key keywords related to estate administration. 1. Executor of a No-Asset Estate: When an individual passes away with no significant assets or properties, the administration of their estate is still necessary. Even though there may not be substantial wealth involved, the executor holds a critical role in settling outstanding debts and distributing what little assets there may be. 2. Types of Executors for No-Asset Estates: a) Court-Appointed Executor: In cases where a deceased individual does not leave a will or appoint an executor, a court-appointed executor is designated by judicial authorities. This executor ensures that the estate's affairs are diligently managed, following the applicable laws and regulations. b) Named Executor: Sometimes, a person may specifically appoint an executor for their estate, even if there are no significant assets involved. The named executor is responsible for fulfilling their duties diligently and acting in the best interests of the deceased. c) Professional Executor: In certain situations, a professional executor, such as a lawyer or a trust company, might be hired to handle the estate administration process, irrespective of the presence of assets. Their expertise in legal matters ensures that the estate is properly settled, and any legal hurdles are addressed efficiently. 3. Responsibilities of an Executor for a No-Asset Estate: a) Notification and Documentation: The executor must notify relevant parties, including creditors and beneficiaries, of the individual's demise. They complete paperwork, such as obtaining the death certificate and filing necessary legal documents, to initiate the estate settlement process. b) Debt Settlement: Even in the absence of assets, the executor must ascertain any outstanding debts or liabilities and work towards their settlement. This involves notifying creditors and negotiating payment arrangements, utilizing any available funds or liquidating minimal assets if required. c) Distribution of Residual Assets: If any residual assets exist, the executor ensures their proper distribution among beneficiaries as per the deceased person's wishes or statutory guidelines, depending on the specific case. d) Tax Obligations: The executor is responsible for addressing any tax-related matters, such as filing final income tax returns for the deceased individual and ensuring all required taxes, if any, are paid from available funds. e) Estate Finalization: Once all debts have been settled, assets distributed if applicable, and tax obligations fulfilled, the executor can finalize the estate. This includes obtaining necessary documentation to close bank accounts, cancel credit cards, and release any remaining responsibilities connected to the estate's existence. Conclusion: Even when an estate lacks significant assets, the role of an executor remains crucial. Executors for no-asset estates, whether court-appointed, named, or professional, undertake responsibilities such as correctly administrating the estate, settling debts, and ensuring the distribution of residual assets, if any. Understanding the tasks and various types of executors involved in these situations helps to shed light on the intricacies of estate administration for estates with no assets.