New Jersey Estate and Inheritance Tax: Understanding the Basics In the state of New Jersey, estate tax and inheritance tax are two separate taxes imposed on the transfer of assets after an individual's death. These taxes can have significant financial implications, and it is essential to understand their mechanisms to plan your estate effectively. In this article, we will delve into the details of both New Jersey estate and inheritance tax, including their differences, exemptions, rates, and different types. New Jersey Estate Tax: The New Jersey Estate Tax is a tax imposed on the overall value of an individual's estate at the time of their death. It is crucial to note that this tax is not based on the beneficiaries receiving the assets; instead, it is determined based on the total estate value. The estate tax applies to estates with a gross value exceeding $675,000 as of the year 2021, with the potential for this threshold to change in the future. However, it is important to highlight that New Jersey is in the process of phasing out its estate tax. As of January 1, 2018, the state no longer imposes an estate tax on estates below $2 million. While this is good news for many individuals, estates with a value exceeding $2 million are still subject to the estate tax, which can range from 11% to 16% depending on the estate's total value. Proper estate planning is critical to navigate this tax and minimize its impact on your assets. New Jersey Inheritance Tax: Unlike the estate tax, the New Jersey Inheritance Tax is a tax levied on individuals who inherit assets from a deceased person, based on their relationship to the deceased. The tax rate is determined by the type of relationship shared with the decedent and the value of the assets received. There are different classes of beneficiaries with various tax rates under the inheritance tax law in New Jersey: 1. Class A Beneficiaries: This category includes spouses, civil union partners, domestic partners, parents, grandparents, and descendants (children, grandchildren, etc.). Class A beneficiaries are exempt from inheritance tax and pay no tax on their inheritance. 2. Class C Beneficiaries: Class C includes siblings and other heirs not mentioned in the other classes. For Class C beneficiaries, the tax rate ranges from 11% to 16% for inheritances above $25,000. 3. Class D Beneficiaries: This class consists of individuals, other than Class A or Class C beneficiaries, such as friends, distant relatives, and charities. Class D beneficiaries have a fixed tax rate of 15% on inheritances exceeding $500. It is essential to note that the inheritance tax does not apply to life insurance proceeds, retirement accounts, and certain other exempt assets. Conclusion: Understanding New Jersey estate and inheritance tax is crucial for effective estate planning to minimize tax liabilities and ensure the smooth transfer of assets to your loved ones. While New Jersey is phasing out its estate tax, estate planning is still crucial for those with estates exceeding $2 million. Additionally, being aware of the different classes of beneficiaries and their respective tax rates under the inheritance tax law provides more clarity on potential tax implications for different individuals. Always consult with an experienced estate planning attorney or tax professional to navigate these taxes effectively and customize a plan that suits your specific needs and circumstances.

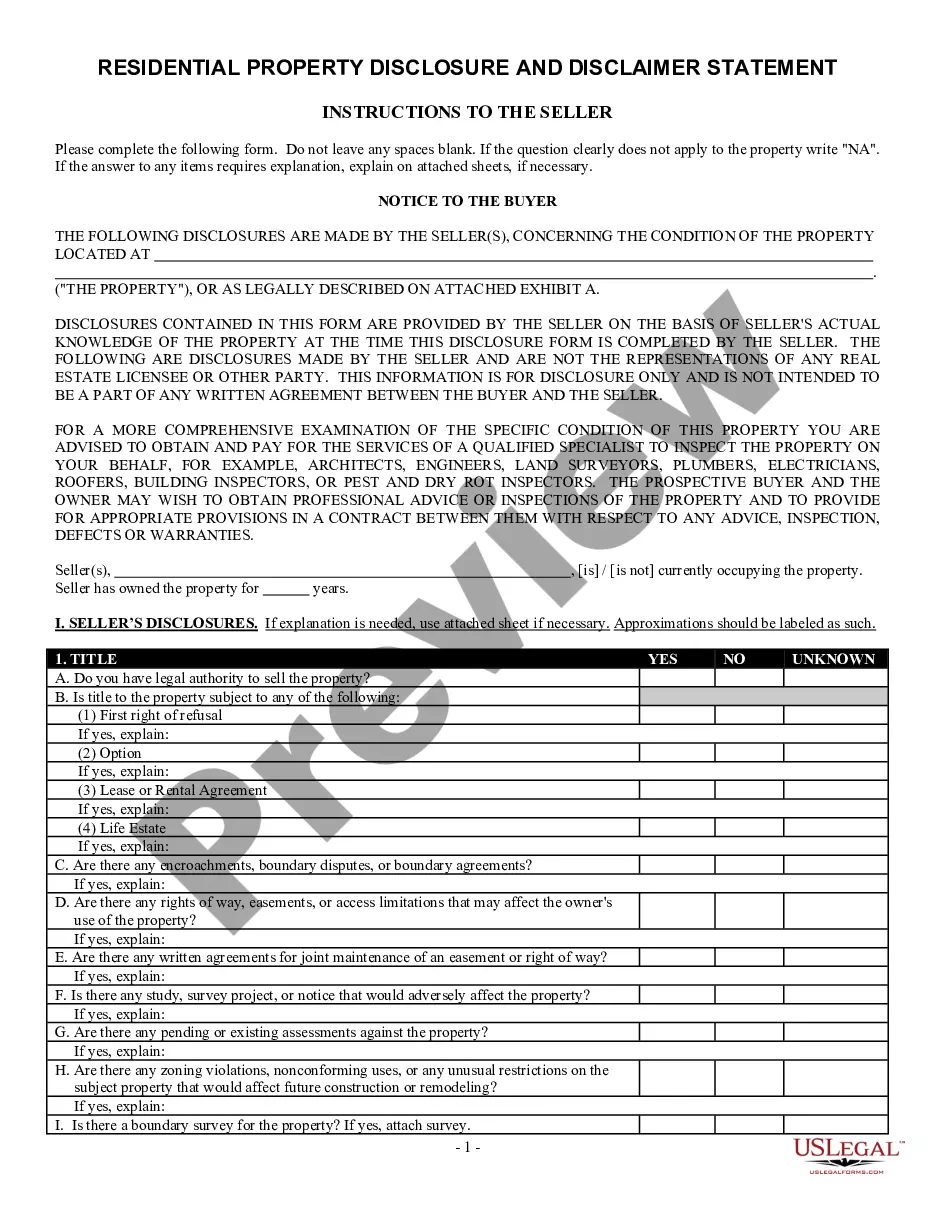

Nj Real Estate Disclosure

Description New Jersey Estate

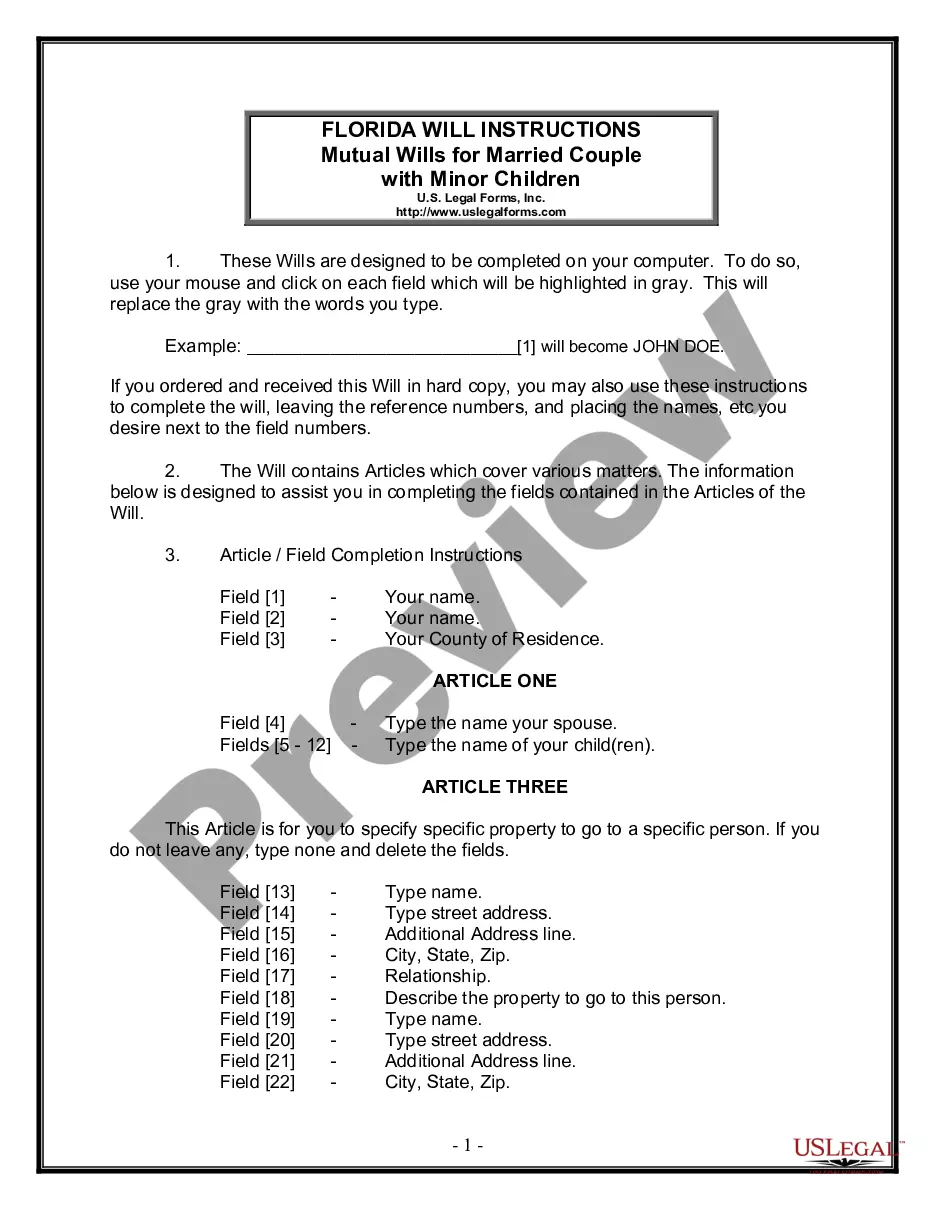

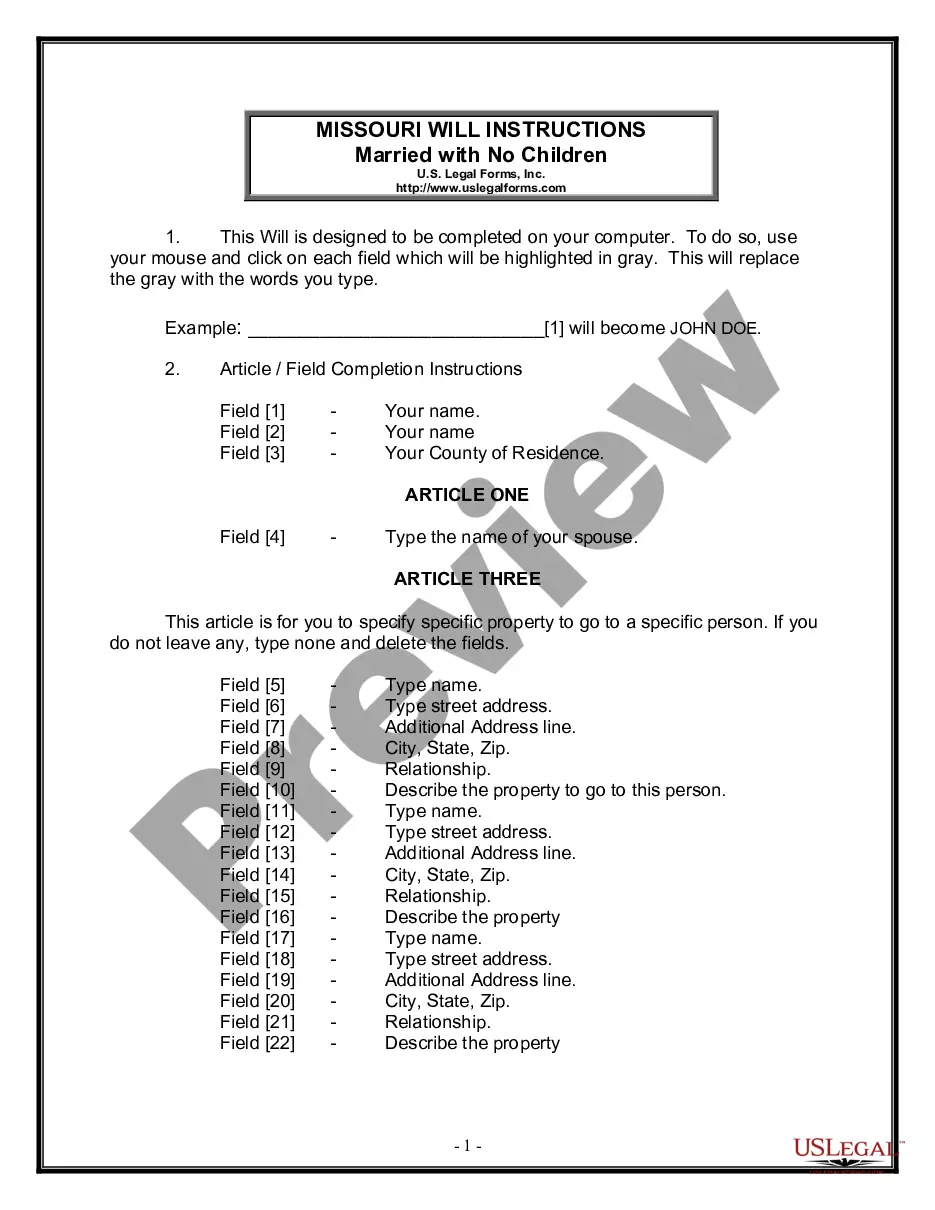

How to fill out Real Estate Form?

US Legal Forms is a special platform to find any legal or tax document for filling out, such as New Jersey Residential Real Estate Sales Disclosure Statement. If you’re tired of wasting time seeking perfect samples and spending money on record preparation/attorney service fees, then US Legal Forms is exactly what you’re seeking.

To experience all the service’s benefits, you don't need to download any application but just choose a subscription plan and sign up an account. If you have one, just log in and get a suitable sample, download it, and fill it out. Saved documents are kept in the My Forms folder.

If you don't have a subscription but need to have New Jersey Residential Real Estate Sales Disclosure Statement, take a look at the instructions listed below:

- make sure that the form you’re looking at applies in the state you want it in.

- Preview the form and read its description.

- Simply click Buy Now to reach the register webpage.

- Select a pricing plan and keep on signing up by entering some information.

- Choose a payment method to finish the registration.

- Save the document by choosing your preferred file format (.docx or .pdf)

Now, submit the file online or print out it. If you are unsure concerning your New Jersey Residential Real Estate Sales Disclosure Statement sample, speak to a lawyer to analyze it before you decide to send or file it. Get started hassle-free!