The form is used when the Assignor transfers, assigns, and conveys to Assignee an overriding royalty interest in the Leases and all of the oil, gas and other minerals produced, saved and marketed from the Lease equal to a pecentage of 8/8 (the Override ).

How To Calculate Overriding Royalty Interest

Description Assignment Of Overriding Royalty Interest Form

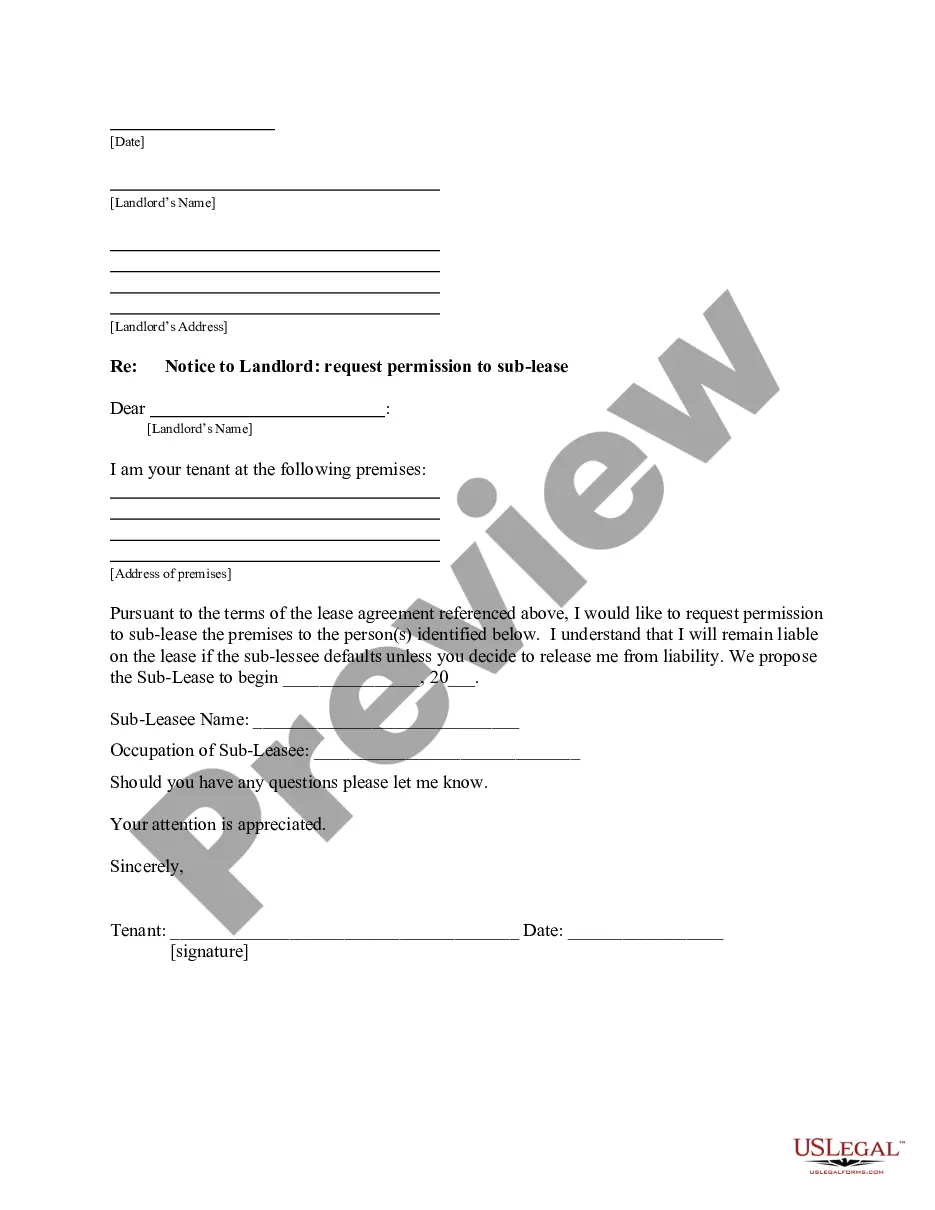

How to fill out Assignment Of Overriding Royalty Interest By Overriding Royalty Interest Owner, No Proportionate Reduction,?

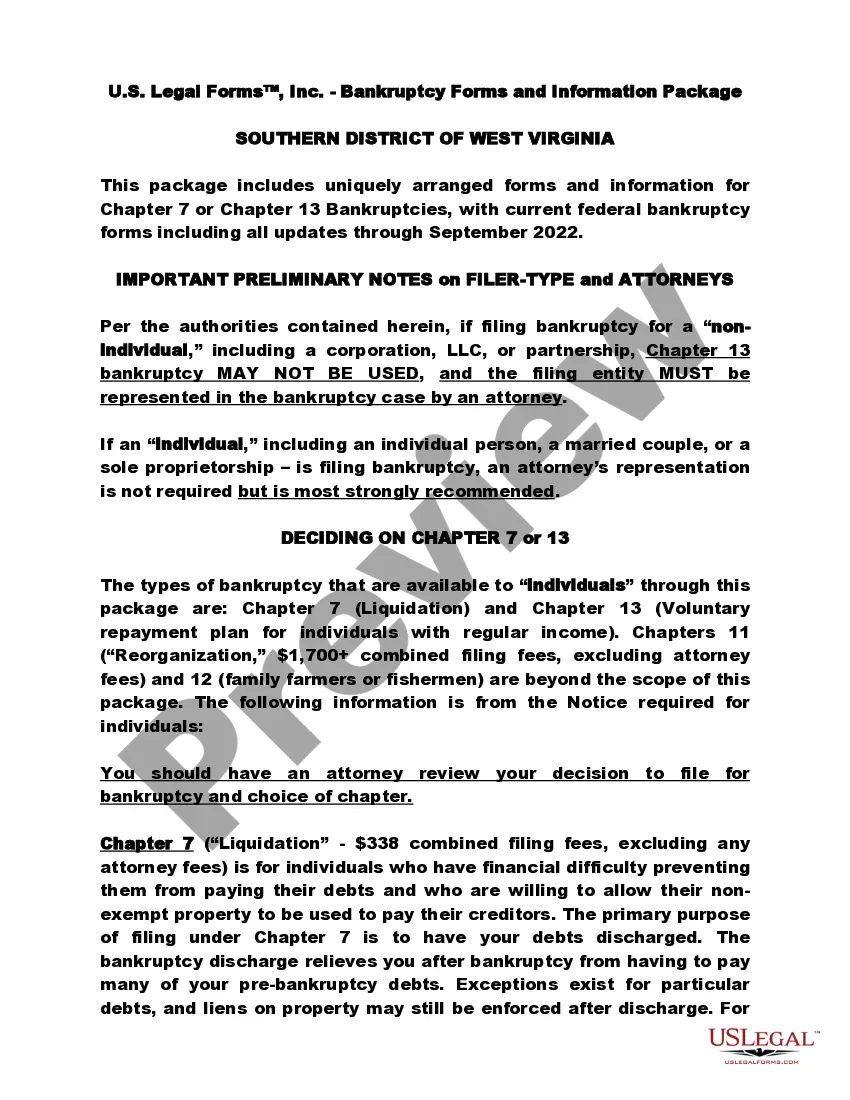

When it comes to drafting a legal form, it’s easier to leave it to the specialists. However, that doesn't mean you yourself cannot get a sample to utilize. That doesn't mean you yourself cannot get a template to utilize, however. Download Assignment of Overriding Royalty Interest by Overriding Royalty Interest Owner, No Proportionate Reduction, right from the US Legal Forms website. It offers a wide variety of professionally drafted and lawyer-approved documents and templates.

For full access to 85,000 legal and tax forms, customers simply have to sign up and select a subscription. After you are signed up with an account, log in, look for a certain document template, and save it to My Forms or download it to your device.

To make things much easier, we’ve incorporated an 8-step how-to guide for finding and downloading Assignment of Overriding Royalty Interest by Overriding Royalty Interest Owner, No Proportionate Reduction, quickly:

- Make sure the form meets all the necessary state requirements.

- If possible preview it and read the description prior to buying it.

- Hit Buy Now.

- Select the appropriate subscription to meet your needs.

- Make your account.

- Pay via PayPal or by debit/bank card.

- Choose a needed format if a number of options are available (e.g., PDF or Word).

- Download the document.

When the Assignment of Overriding Royalty Interest by Overriding Royalty Interest Owner, No Proportionate Reduction, is downloaded you can complete, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant documents in a matter of minutes in a preferable format with US Legal Forms!