Illinois Renunciation and Disclaimer of Real Property Interest

Description

Key Concepts & Definitions

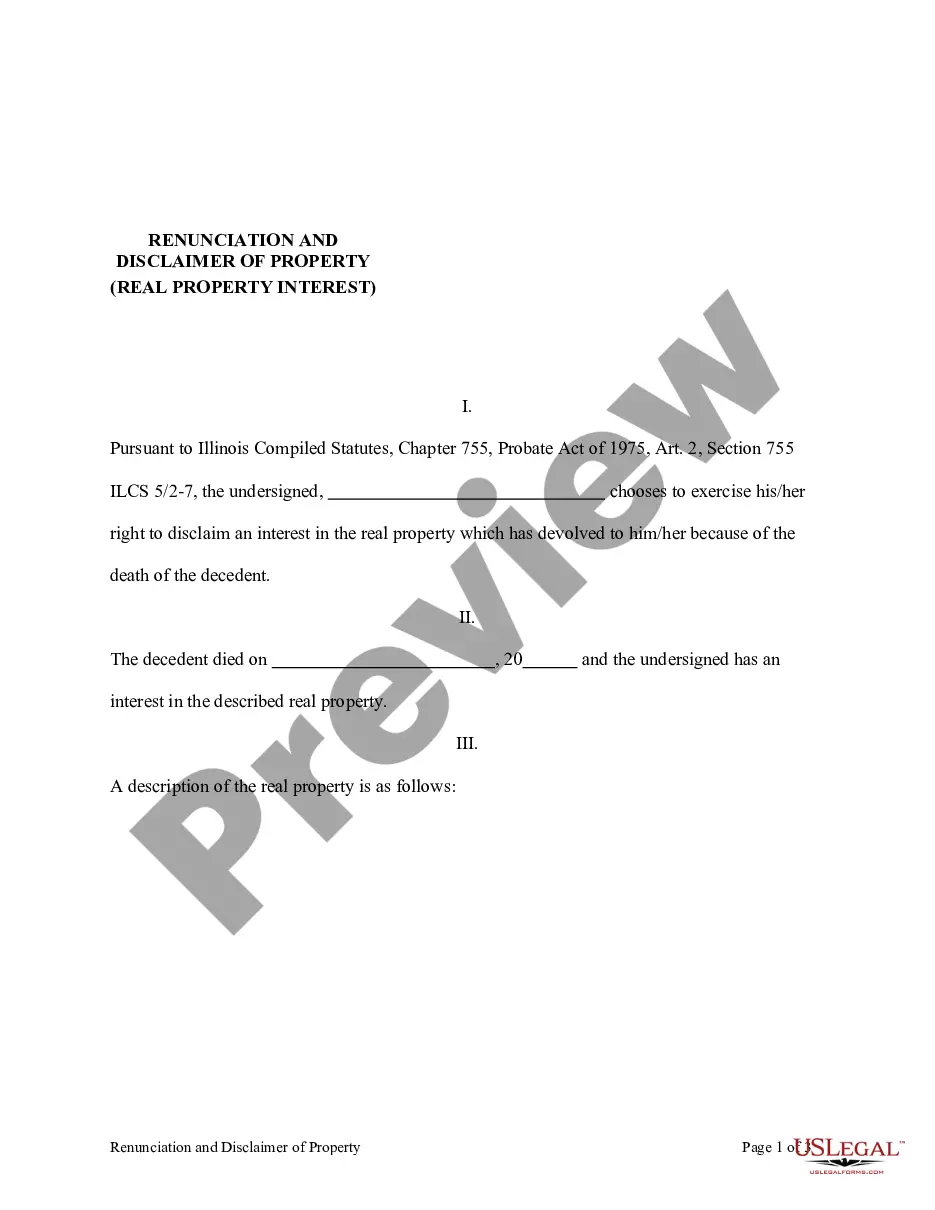

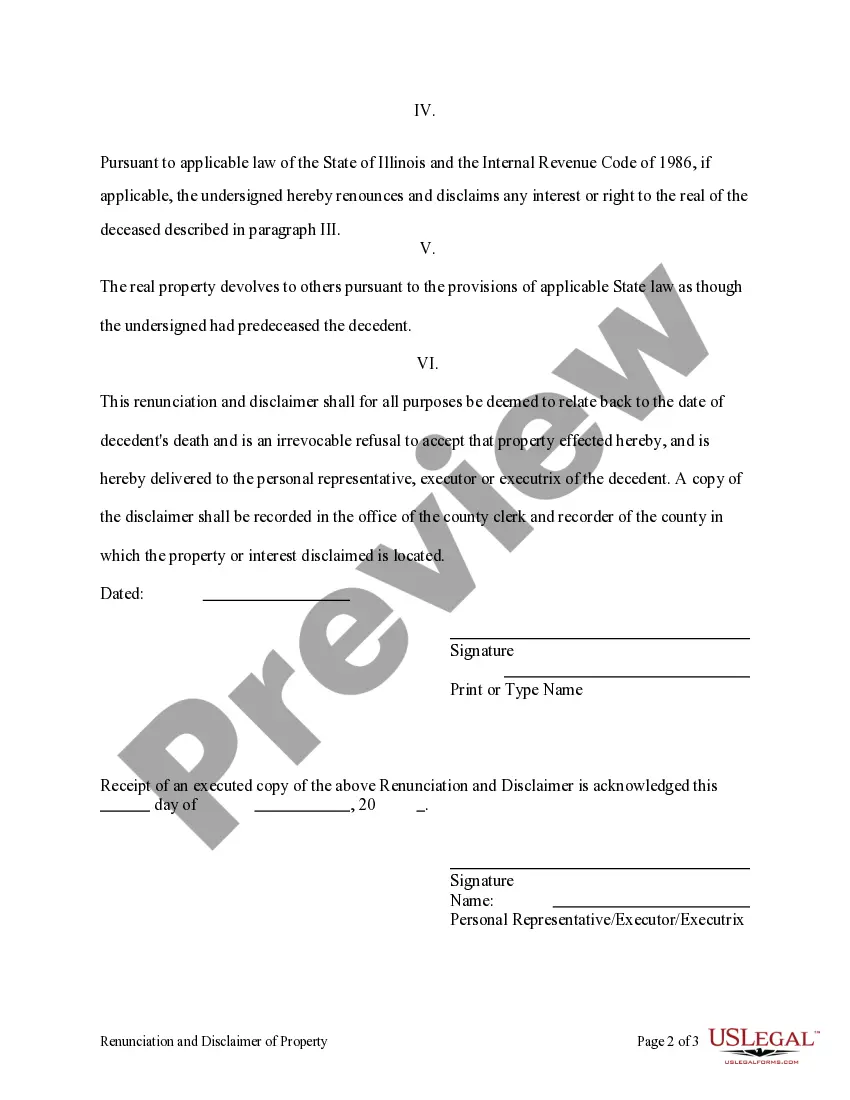

Illinois Renunciation and Disclaimer of Real Property: A legal declaration whereby an individual, such as a surviving spouse or heir, chooses to refuse their right to inherit property. Disclaimer of Property Interest: In estate planning, this refers to formally declining interests in real estate or other property, which can affect the distribution of the property under state law.

Step-by-Step Guide to Renouncing Property Interests in Illinois

- Contact a legal expert specializing in estate planning, such as OFlaherty Law, to understand your rights and obligations.

- Review the property part and determine which property interest you intend to disclaim.

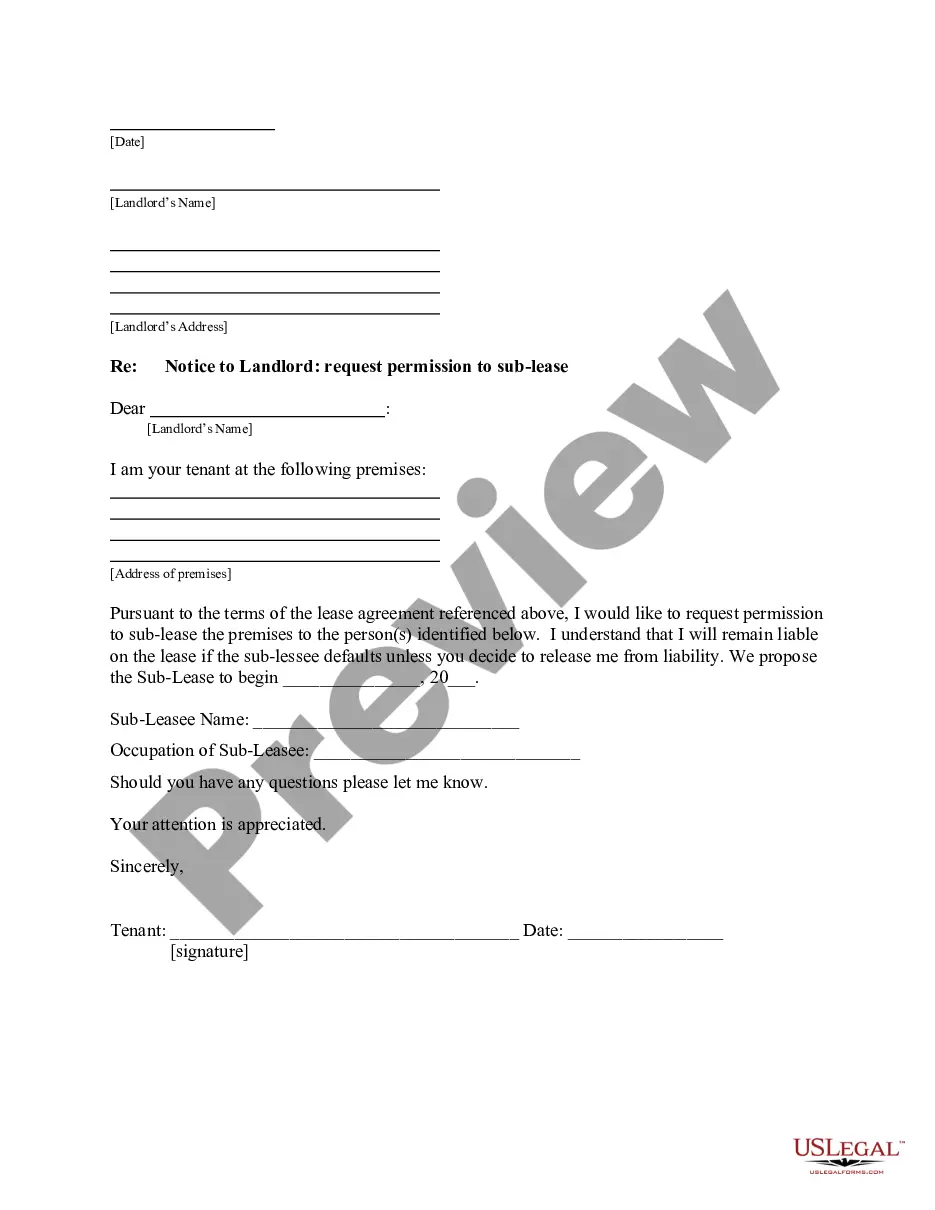

- Fill out the necessary disclaimer forms, which must be in writing and clearly describe the interest disclaimed.

- File the disclaimer within the specific time frame (usually within 9 months of the transfer).

- Ensure the filed disclaimer is recorded in a manner that alerts any necessary public or private parties, such as a security resource or county real estate records.

Risk Analysis

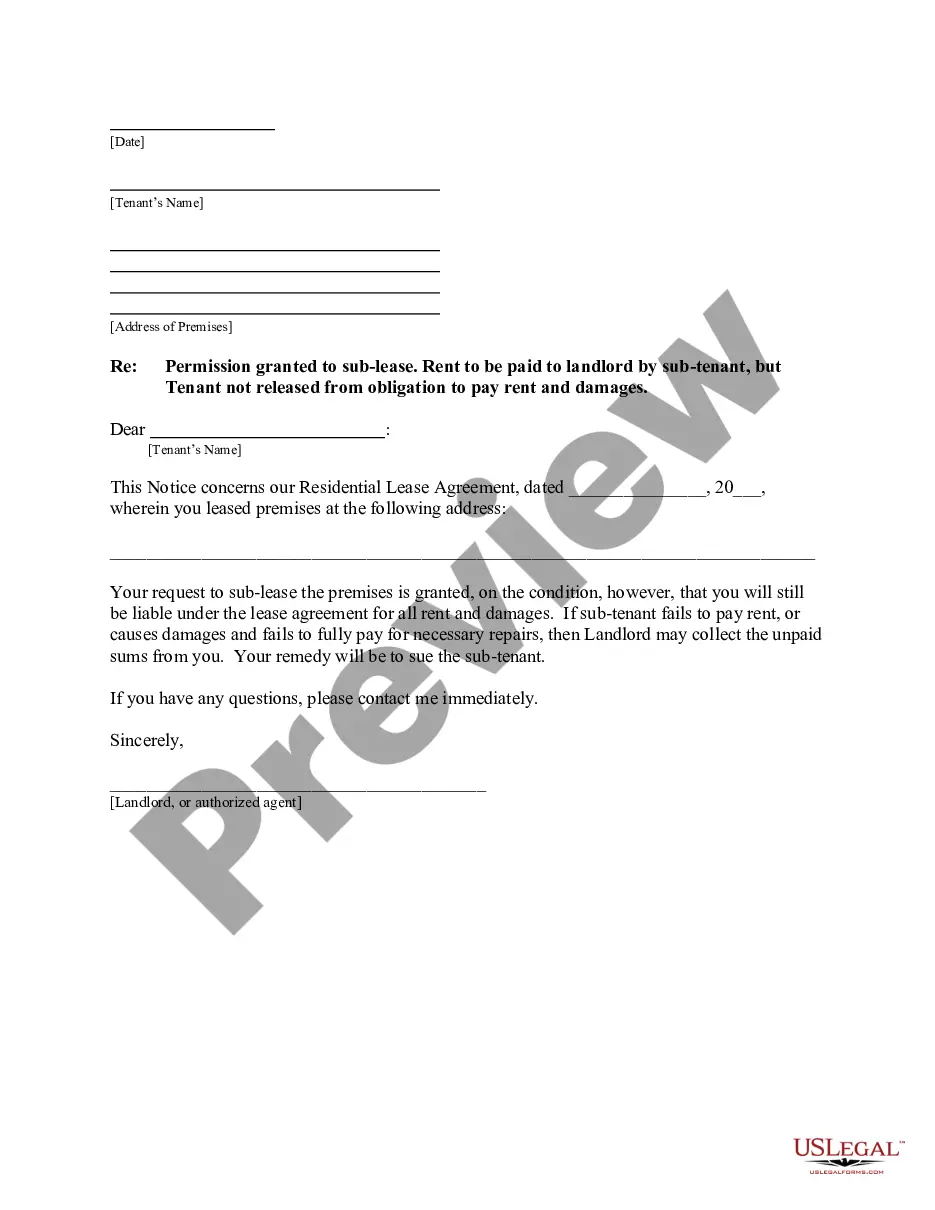

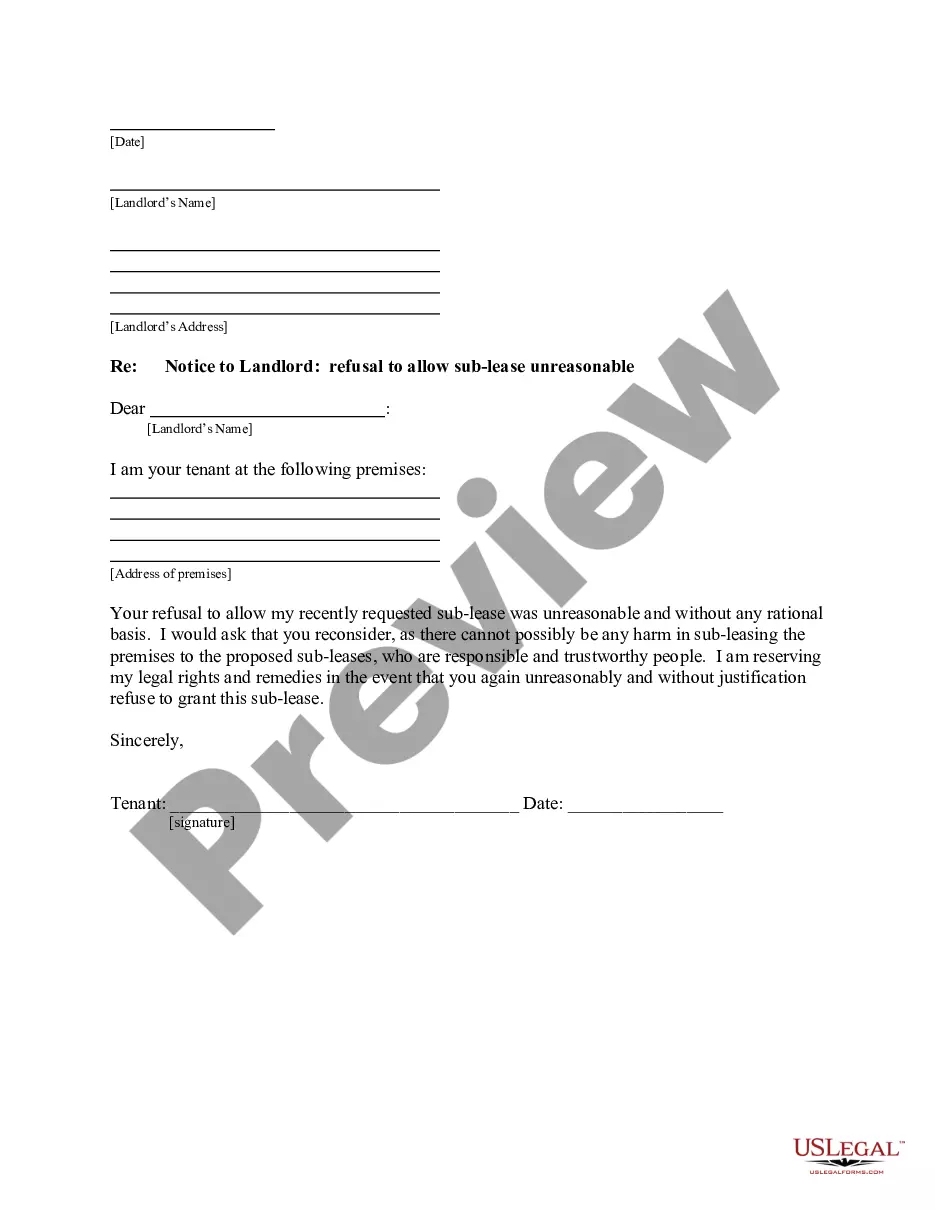

- Legal Risks: If not executed properly, disclaimers can lead to unintended tax consequences or disputes among heirs.

- Financial Risks: Failing to handle a disclaimer appropriately may affect the disclaimant's financial position and tax liabilities.

- Timing Risks: Missing the deadline for filing a disclaimer results in the automatic inheritance of the property, which might not align with the disclaimant's estate planning goals.

Common Mistakes & How to Avoid Them

- Not consulting with an attorney knowledgeable in local estate and probate laws.

- Failing to thoroughly document the disclaimer or notify relevant parties.

- Miscalculating the timeframe for a valid disclaimer.

Always seek professional legal advice and double-check all paperwork and deadlines to avoid these common pitfalls.

FAQ

- What is an interest disclaimed? It refers to any potential ownership the disclaimant might have inherited, which they legally refuse.

- Can a surviving spouse disclaim property received from a deceased spouse? Yes, the surviving spouse in Illinois can disclaim part or all of the property inherited.

- Are disclaimers applicable to both real and personal property? Yes, disclaimers can be applied to both types of property.

How to fill out Illinois Renunciation And Disclaimer Of Real Property Interest?

In search of Illinois Renunciation and Disclaimer of Real Property Interest sample and completing them can be quite a challenge. To save lots of time, costs and energy, use US Legal Forms and find the right template specifically for your state within a couple of clicks. Our legal professionals draft each and every document, so you just need to fill them out. It is really that easy.

Log in to your account and return to the form's web page and save the document. All of your saved templates are saved in My Forms and therefore are available always for further use later. If you haven’t subscribed yet, you have to register.

Check out our comprehensive instructions on how to get the Illinois Renunciation and Disclaimer of Real Property Interest sample in a couple of minutes:

- To get an entitled form, check its validity for your state.

- Have a look at the sample utilizing the Preview function (if it’s accessible).

- If there's a description, read it to learn the details.

- Click Buy Now if you identified what you're searching for.

- Select your plan on the pricing page and create an account.

- Select you would like to pay by a card or by PayPal.

- Save the file in the favored format.

Now you can print out the Illinois Renunciation and Disclaimer of Real Property Interest form or fill it out making use of any online editor. No need to concern yourself with making typos because your form may be applied and sent, and printed as many times as you would like. Try out US Legal Forms and get access to above 85,000 state-specific legal and tax documents.

Form popularity

FAQ

Property owned in joint tenancy automatically passes, without probate, to the surviving owner(s) when one owner dies. Setting up a joint tenancy is easy, and it doesn't cost a penny.

In law, a disclaimer is a statement denying responsibility intended to prevent civil liability arising for particular acts or omissions. Disclaimers are frequently made to escape the effects of the torts of negligence and of occupiers' liability towards visitors.

Any disclaimer of an interest in a trust by a trust beneficiary must be made to the trustee of that trust. For a disclaimer to be valid, it must be supported by some evidence that the beneficiary is disclaiming their interest. Silence or otherwise passive behaviour will not suffice.

Disclaim, in a legal sense, refers to the renunciation of an interest in, or an acceptance of, inherited assets, such as property, by way of a legal instrument. A person disclaiming an interest, right, or obligation is known as a disclaimant.

Disclaimer of interest, in the law of inheritance, wills and trusts, is a term that describes an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust. A disclaimer of interest is irrevocable.

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor,

Jointly owned property is treated as consisting of a both present and a future interest in the jointly owned property. Thus, a surviving spouse may disclaim the future interest in jointly owned property on the death of their spouse, including assets that were held by the spouses as tenants by the entirety.

What is a Deed of Disclaimer? A Deed of Disclaimer is a document that you can execute if you wish to Disclaim an inheritance due via the Rules of Intestacy and you are not applying for probate. A typical example of this is if a spouse of a deceased would prefer the estate passes to the children.

1a : a denial or disavowal of legal claim : relinquishment of or formal refusal to accept an interest or estate. b : a writing that embodies a legal disclaimer. 2a : denial, disavowal. b : repudiation.