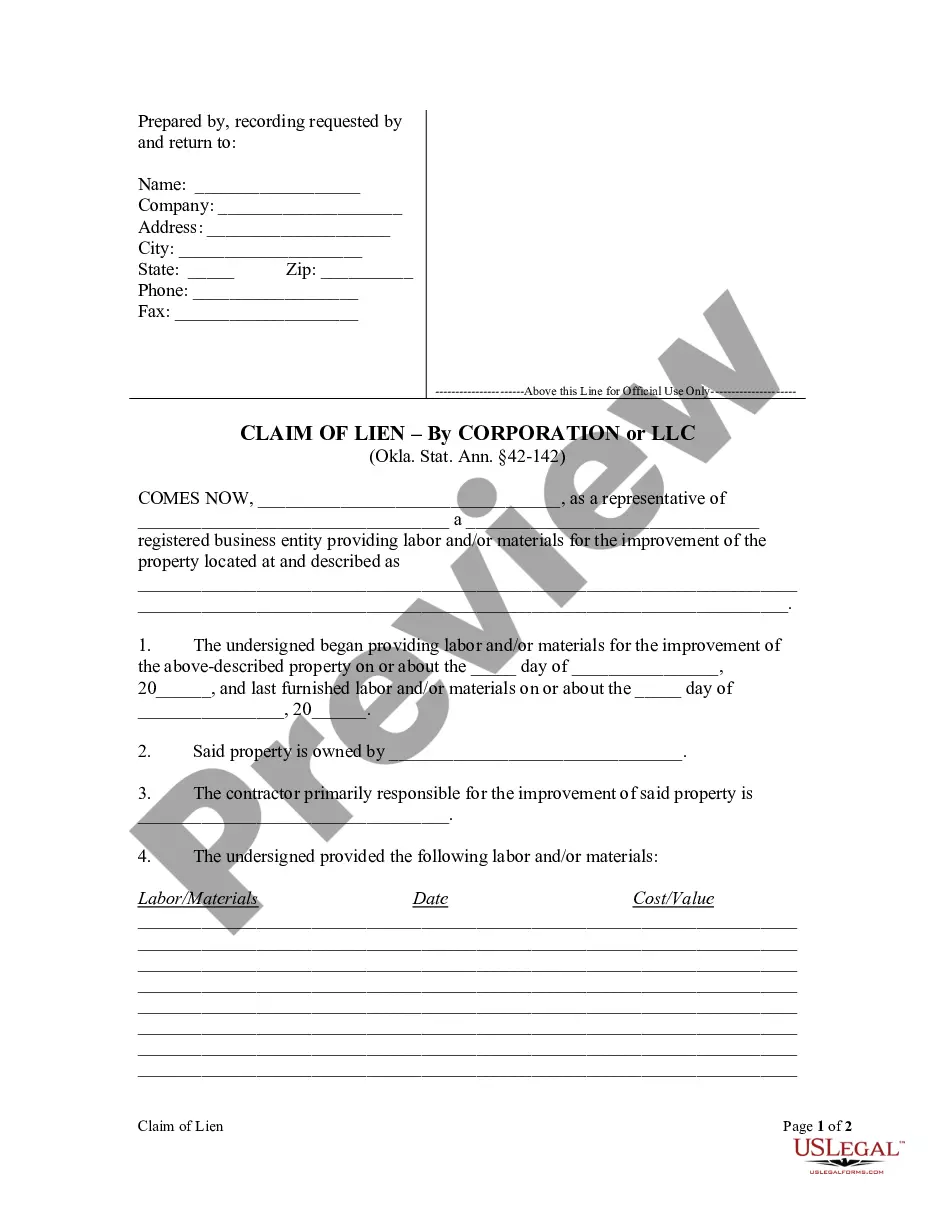

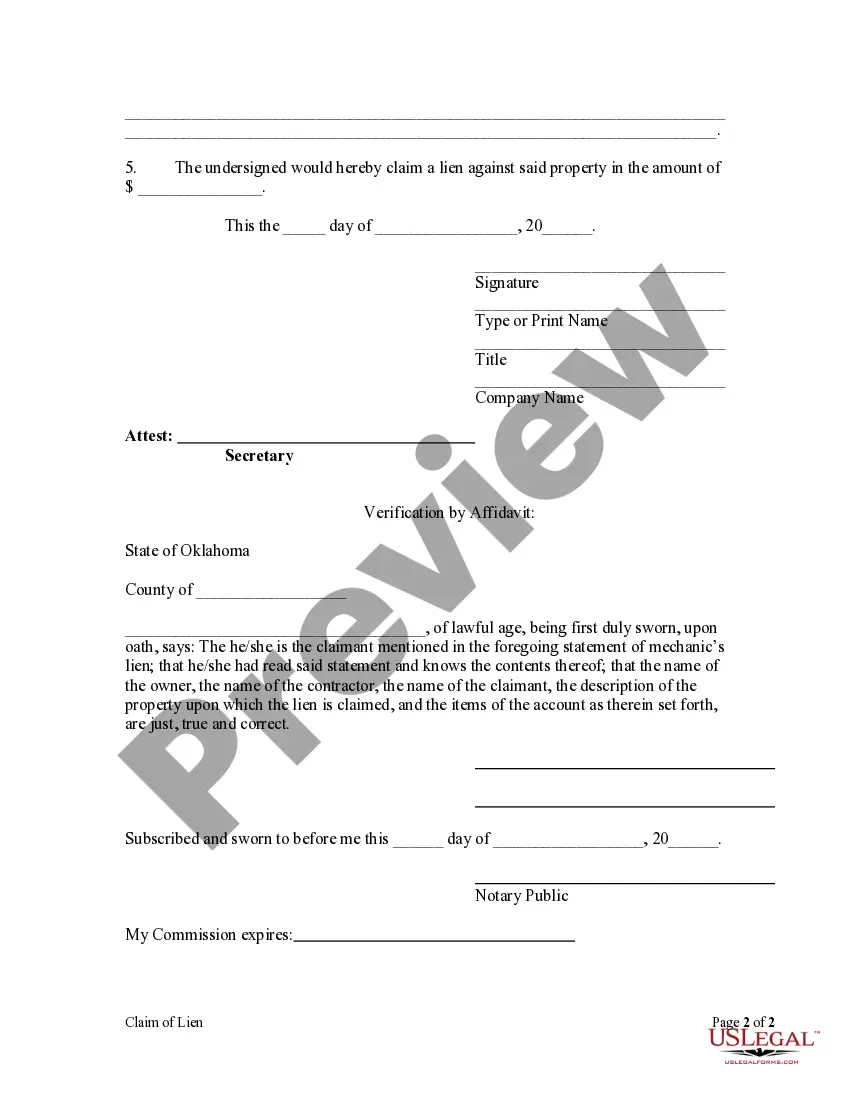

Any person who shall, under oral or written contract with the owner of any tract or piece of land, perform labor, furnish material or lease or rent equipment used on said land shall have a lien upon the whole of said tract or piece of land. Any person claiming a lien as aforesaid shall file in the office of the county clerk of the county in which the land is situated a statement setting forth the amount claimed and the items thereof as nearly as practicable, the names of the owner, the contractor, the claimant, and a legal description of the property subject to the lien, verified by affidavit. Such statement shall be filed within four (4) months after the date upon which material or equipment used on said land was last furnished or labor last performed under contract.

Oklahoma Claim of Lien by Contractor as Corporation

Description

How to fill out Oklahoma Claim Of Lien By Contractor As Corporation?

In terms of filling out Oklahoma Claim of Lien by Contractor as Corporation or LLC, you most likely think about an extensive procedure that involves finding a perfect sample among numerous very similar ones and after that needing to pay a lawyer to fill it out to suit your needs. In general, that’s a slow and expensive option. Use US Legal Forms and select the state-specific template in just clicks.

For those who have a subscription, just log in and then click Download to get the Oklahoma Claim of Lien by Contractor as Corporation or LLC sample.

In the event you don’t have an account yet but need one, stick to the point-by-point guideline listed below:

- Make sure the file you’re downloading is valid in your state (or the state it’s required in).

- Do this by reading the form’s description and through visiting the Preview function (if available) to view the form’s information.

- Simply click Buy Now.

- Select the appropriate plan for your financial budget.

- Sign up for an account and select how you want to pay: by PayPal or by card.

- Save the file in .pdf or .docx format.

- Find the document on your device or in your My Forms folder.

Professional lawyers work on drawing up our templates to ensure that after saving, you don't need to worry about enhancing content material outside of your personal info or your business’s details. Sign up for US Legal Forms and receive your Oklahoma Claim of Lien by Contractor as Corporation or LLC sample now.

Form popularity

FAQ

For a Lien only: $10.00 Lien fee plus $1.55 Mail fee. 3. The MLA will stamp and record the date, time and receipt number on the face of the titling documentation and attach one copy of the MV-21-A and one copy of the lien fee receipt.

Filing a construction lien on residential projects requires filing a Notice of Unpaid Balance and Right to File Lien within 90 days of the last day of service. The homeowner must also get a copy of that notice within 10 days of its filing.

A federal tax lien is the government's legal claim against your business assets. The IRS will file a lien, and this happens as a result of tax debt not being paid.By filing a lien, the IRS is marking your business assets bank accounts, building, land, etc.

Even though these states may permit project participants to secure lien rights and claim a mechanics lien even without a written contract, it is generally best practice to have a signed written contract for work provided.

Avoid harassing the people that owe you money. Keep phone calls short. Write letters. Get a collection agency to write demand letters. Offer to settle for less than is due. Hire a collection agency. Small claims court. File a lawsuit.

Any person who performs labor or furnishes material may file a lien on the real estate that received the labor or materials. You must serve a pre-lien notice if the amount is over $10,000. You must serve your pre-lien notice within 75 days. You must file your lien within 120 days.

A contractor's lien (often known as a mechanic's lien, or a construction lien) is a claim made by contractors or subcontractors who have performed work on a property, and have not yet been paid.After all, contractors would rather work out a deal than go through the hassle of filing a lien against your property.

Anyone who makes or causes to make improvements by providing work or materials in Alberta for an owner, contractor or subcontractor may file an Alberta Builders Lien.

When your efforts to collect a bill from a business that owes you money have been unsuccessful, you can place a lien on the assets of the business. As a lienholder, you gain legal rights to the company's property and the authority to sell the property and use the proceeds to repay what is owed to you.