Add a Calculated Field Legal Connecticut Partnerships Forms For Free

How it works

-

Import your Connecticut Partnerships Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Connecticut Partnerships Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add a Calculated Field Legal Connecticut Partnerships Forms For Free

Online PDF editors have demonstrated their trustworthiness and effectiveness for legal paperwork execution. Use our safe, fast, and intuitive service to Add a Calculated Field Legal Connecticut Partnerships Forms For Free your documents whenever you need them, with minimum effort and maximum precision.

Make these quick steps to Add a Calculated Field Legal Connecticut Partnerships Forms For Free online:

- Upload a file to the editor. You can choose from several options - upload it from your device or the cloud or import it from a form library, external URL, or email attachment.

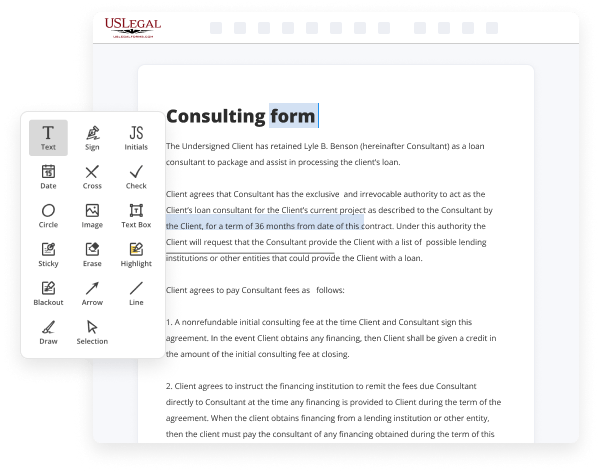

- Fill out the blank fields. Place the cursor on the first empty field and make use of our editor’s navigation to move step-by-step to avoid missing anything on your template. Use Text, Initials, Cross, and Check tools.

- Make your necessary modifications. Update the form with inserted images, draw lines and signs, highlight significant elements, or erase any pointless ones.

- Drop more fillable fields. Adjust the template with a new area for fill-out if required. Make use of the right-side toolbar for this, drop each field where you expect other participants to provide their data, and make the remaining fields required, optional, or conditional.

- Arrange your pages. Remove sheets you don’t need anymore or create new ones making use of the appropriate button, rotate them, or change their order.

- Generate eSignatures. Click on the Sign tool and decide how you’d add your signature to the form - by typing your name, drawing it, uploading its picture, or using a QR code.

- Share and send for eSigning. End your editing using the Done button and send your copy to other parties for signing via an email request, with a Link to Fill option, in an SMS or fax message. Request a quick online notarization if necessary.

- Save the file in the format you need. Download your document, save it to cloud storage in its current format, or convert it as you need.

And that’s how you can complete and share any individual or business legal documentation in minutes. Give it a try today!

Benefits of Editing Connecticut Partnerships Forms Online

Top Questions and Answers

The law imposes a 6.99 percent tax on partnerships, LLCs, and S corporations. The tax is imposed on either the entity's entire Connecticut-sourced taxable income or an alternative tax base, which reduces taxable income by the percentage of nonresident ownership.

Video Guide to Add a Calculated Field Legal Connecticut Partnerships Forms For Free

Hey everyone this is Nadia from the cognitive forums team and in this video we're gonna walk through the basics of working with calculations the cognitive forms builder supports robust calculations that allow you to compute field values set default values control the visibility of fields implement field validation and much much more calculations can be quite simple for example

You could add up the values from two number fields or you can build calculations that are far more complex depending on what you're trying to accomplish for now we're just going to cover the basics if you open the form builder you'll find the calculation field over in the add field menu in the calculation box you can enter

Tips to Add a Calculated Field Legal Connecticut Partnerships Forms For Free

- Understand what a calculated field is and how it works in your form.

- Identify the specific data fields that you want to use for your calculations.

- Determine the type of calculation you need, whether it’s addition, subtraction, multiplication, or division.

- Use clear and simple expressions for your calculations to avoid confusion.

- Make sure to test the calculated field for accuracy before finalizing the form.

- Incorporate comments or help text to explain the purpose of the calculated field to users.

- Review any legal requirements related to the calculations in Connecticut partnerships.

- Regularly update the calculated fields if the underlying data changes.

You may need to use this editing feature when there are changes in the laws or regulations governing partnerships in Connecticut, or if you want to improve the usability of your forms.

Related Searches

In this article, Schatz examines recent legislative revisions to the Connecticut passthrough entity tax. Electronically filed returns. Connecticut Partnerships Form Availability (full-service only). Print. E-file. Schedule CT-AB, Alternative Base Calculation. available. available. The. PE must first complete either federal Form 1065,. Order in Which to Complete Schedules. General information. Purpose of Form IT-204. The Connecticut Partnership Plan offers comprehensive medical and dental benefits similar to those offered to employees in many Connecticut municipalities. For tax years beginning after 2022, certain corporations must determine whether they are subject to the new CAMT and calculate CAMT if applicable.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.