Add a Calculated Field Legal Idaho Accounting Forms For Free

How it works

-

Import your Idaho Accounting Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

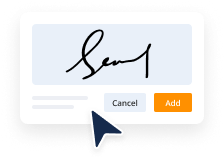

Sign your Idaho Accounting Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add a Calculated Field Legal Idaho Accounting Forms For Free

Legal documentation requires maximum precision and prompt execution. While printing and filling forms out often takes plenty of time, online PDF editors demonstrate their practicality and efficiency. Our service is at your disposal if you’re looking for a trustworthy and simple-to-use tool to Add a Calculated Field Legal Idaho Accounting Forms For Free quickly and securely. Once you try it, you will be amazed at how effortless dealing with formal paperwork can be.

Follow the instructions below to Add a Calculated Field Legal Idaho Accounting Forms For Free:

- Add your template through one of the available options - from your device, cloud, or PDF library. You can also get it from an email or direct URL or through a request from another person.

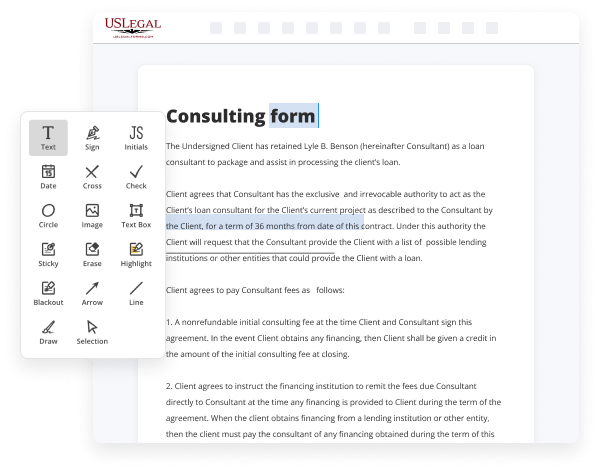

- Use the upper toolbar to fill out your document: start typing in text areas and click on the box fields to select appropriate options.

- Make other required modifications: add pictures, lines, or symbols, highlight or delete some details, etc.

- Use our side tools to make page arrangements - add new sheets, alter their order, delete unnecessary ones, add page numbers if missing, etc.

- Drop extra fields to your document requesting various types of data and place watermarks to protect the contents from unauthorized copying.

- Check if everything is correct and sign your paperwork - generate a legally-binding electronic signature the way you prefer and place the current date next to it.

- Click Done when you are ready and choose where to save your form - download it to your device or export it to the cloud in whatever file format you need.

- Share a copy with others or send it to them for approval through email, a signing link, SMS, or fax. Request online notarization and obtain your form promptly witnessed.

Imagine doing all the above manually in writing when even a single error forces you to reprint and refill all the data from the beginning! With online solutions like ours, things become much more manageable. Give it a try now!

Benefits of Editing Idaho Accounting Forms Online

Top Questions and Answers

Some customers are exempt from paying sales tax under Idaho law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

Video Guide to Add a Calculated Field Legal Idaho Accounting Forms For Free

Hey this is Ralph and in this video I want to create another form but this one's gonna be focused on the clients where I can keep track of a running outstanding balance for the various transactions that they've occurred so here's how we're gonna do this I'm gonna go ahead and create a form but I'm gonna create it

Using the form wizard so I'll start up the form wizard and I'm gonna grab both fields from my clients table then I'm gonna jump over and I'm gonna go to my transactions table and I'm gonna grab transaction date transaction hours from the employees table I'll grab let's see I'll do employee ID and employee wage then I'll click

Tips to Add a Calculated Field Legal Idaho Accounting Forms For Free

- Open the Idaho accounting form you need to edit.

- Look for the 'Add Calculated Field' option in the tool menu.

- Click on the option to create a new field.

- Choose the type of calculation you want to perform, such as sum, average, or custom formula.

- Enter the criteria or fields that the calculation will use.

- Label the calculated field clearly so you can identify it later.

- Review the calculation to ensure it’s accurate and does what you expect.

- Save the changes to your form before exiting.

This editing feature for adding a calculated field to Idaho accounting forms may be needed when you want to automate calculations, reduce manual entry errors, or customize your forms for specific accounting needs.

The following STARS tables and PDF forms are used to support the budgeting activities. See the STARS Manual > Forms link on the left side of this page. Enter N in the Filing Code column. Complete Form ID K-1 for each owner. Trial Court Financing Report. Use Schedule C (Form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. This form is used to reconcile meal money provided to all traveling participants in group travel (i.e. This course is designed as a comprehensive guide to the core concepts of trust and estate income tax preparation. The responses contained in the 2018 "Hotline Top Questions" are based on the law in effect at the time, and the IR forms as printed in 2018. To change your accounting method, you must generally file Form 3115.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.