Add a Calculated Field Legal Maryland Startup for S-Corporation Forms For Free

How it works

-

Import your Maryland Startup for S-Corporation Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Maryland Startup for S-Corporation Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add a Calculated Field Legal Maryland Startup for S-Corporation Forms For Free

Are you tired of endless document printing, scanning, postal delivery, and spending precious time and resources with manual fill-out? The times have moved on, and the easiest way to Add a Calculated Field Legal Maryland Startup for S-Corporation Forms For Free and make any other critical adjustments to your forms is by managing them online. Choose our quick and trustworthy online editor to complete, adjust, and execute your legal documentation with highest efficiency.

Here are the steps you should take to Add a Calculated Field Legal Maryland Startup for S-Corporation Forms For Free easily and quickly:

- Upload or import a file to the service. Drag and drop the template to the upload area, import it from the cloud, or use an alternative option (extensive PDF library, emails, URLs, or direct form requests).

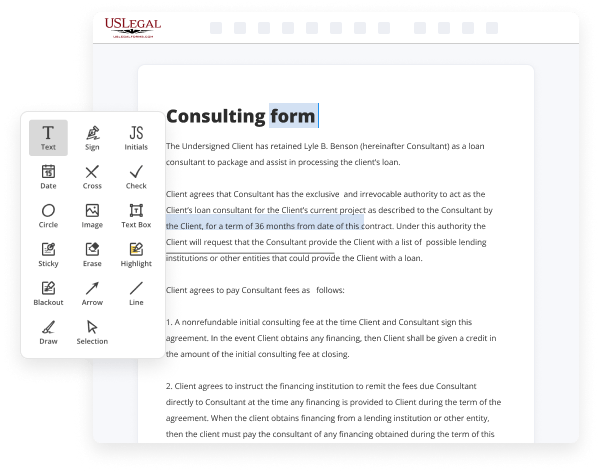

- Provide the required information. Complete empty fields utilizing the Text, Check, and Cross tools from our upper pane. Use our editor’s navigation to ensure you’ve completed everything. Point out the most important facts with the Highlight option and erase or blackout areas with no value.

- Modify and rearrange the form. Use our upper and side toolbars to update your content, place additional fillable fields for different data types, re-order pages, add new ones, or remove redundant ones.

- Sign and collect signatures. Whatever method you select, your eSignature will be legally binding and court-admissible. Send your form to other people for signing using email or signing links. Notarize the paperwork right in our editor if it needs witnessing.

- Share and save the copy. Download or export your completed documentation to the cloud in the format you need, print it out if you prefer a physical copy, and select the most appropriate file-sharing option (email, fax, SMS, or delivered by snail mail using the USPS).

With our service, you don’t have any more excuses to accomplish legal documents manually. Save time and effort executing them online twice as fast and more effectively. Give it a try now!

Benefits of Editing Maryland Startup for S-Corporation Forms Online

Top Questions and Answers

Typically, a C corporation or S corporation must file an income tax return on taxable income during the tax year unless it is exempt from taxes under Section 501 of the Internal Revenue Code.

Video Guide to Add a Calculated Field Legal Maryland Startup for S-Corporation Forms For Free

Welcome to pdf run in this video we'll guide you on how to fill out form one one two zero s form one one two zero s u s income tax return for an s corporation is an internal revenue service irs form used to report the income gains losses deductions credits and other relevant financial information of a domestic

Corporation or an s corporation you may get a copy of form one one two zero s at the official irs website you can also get a ready to use editable and fillable version here at pdfrun.com moving forward to begin filling out this document click on the fill online button this will redirect you to pdf runs online editor

Tips to Add a Calculated Field Legal Maryland Startup for S-Corporation Forms For Free

- Identify the specific data points you want to calculate within your S-Corporation forms.

- Determine the formula or calculation method you need to apply to those data points.

- Access the line or section of the form where you want to add the calculated field.

- Use simple and clear labeling for your calculated field to avoid confusion.

- Ensure all necessary fields are included in your calculation to maintain accuracy.

- Test the calculated field with sample data to confirm it works correctly.

- Consult a software guide or support for help if you're using a digital form builder.

You may need to use this editing feature when you want to customize the forms for specific needs of your S-Corporation, ensuring all calculations align with your financial records.

We offer several ways for you to obtain Maryland tax forms, booklets and instructions: To start a Maryland S corporation, you'll need to create either a limited liability company (LLC) or a C corporation if you haven't already done so. Electronically filed returns. The electronic filing threshold for corporate returns required to be filed on or after January 1, 2024,. This article focuses on how to form a stock corporation in Maryland. A corporation is a business entity having legal authority to act as a single person. Answer simple, plain-English questions, and TaxAct automatically calculates and enters your data into the appropriate tax forms. To apply for Scorp status, you'll first need to create either an LLC or a corporation, if you haven't already done so. Then, you'll file an election Form 2553. See Form 512-S, Part 2, Line 14, Column B. GENERAL FILING INFORMATION: INCOME TAX AND FRANCHISE TAX.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.