Add a Calculated Field Legal Nebraska Employment Forms For Free

How it works

-

Import your Nebraska Employment Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Nebraska Employment Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add a Calculated Field Legal Nebraska Employment Forms For Free

Online document editors have demonstrated their trustworthiness and effectiveness for legal paperwork execution. Use our safe, fast, and intuitive service to Add a Calculated Field Legal Nebraska Employment Forms For Free your documents whenever you need them, with minimum effort and greatest precision.

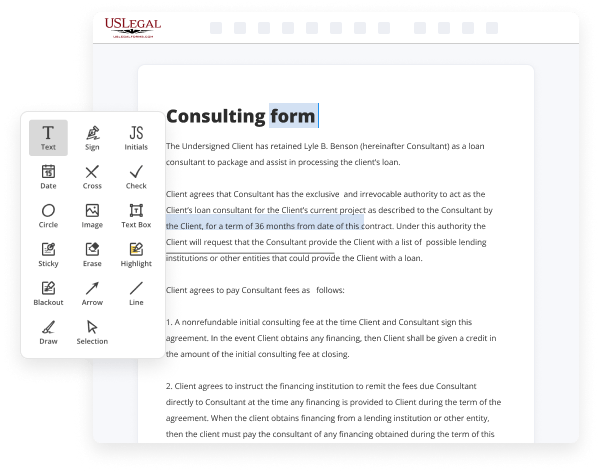

Make these quick steps to Add a Calculated Field Legal Nebraska Employment Forms For Free online:

- Upload a file to the editor. You can select from a couple of options - upload it from your device or the cloud or import it from a form catalog, external URL, or email attachment.

- Fill out the blank fields. Place the cursor on the first empty area and use our editor’s navigation to move step-by-step to avoid missing anything on your template. Use Text, Initials, Cross, and Check tools.

- Make your necessary edits. Update the form with inserted pictures, draw lines and symbols, highlight important parts, or erase any unnecessary ones.

- Drop more fillable fields. Modify the template with a new area for fill-out if neccessary. Make use of the right-side tool pane for this, drop each field where you want others to provide their details, and make the remaining fields required, optional, or conditional.

- Arrange your pages. Remove sheets you don’t need any longer or create new ones utilizing the appropriate button, rotate them, or alter their order.

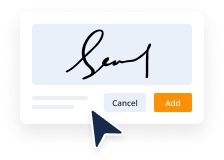

- Generate electronic signatures. Click on the Sign tool and choose how you’d add your signature to the form - by typing your name, drawing it, uploading its image, or utilizing a QR code.

- Share and send for eSigning. End your editing using the Done button and send your copy to other people for signing through an email request, with a Link to Fill option, in an SMS or fax message. Request a quick online notarization if necessary.

- Save the file in the format you need. Download your document, save it to cloud storage in its current format, or transform it as you need.

And that’s how you can complete and share any personal or business legal documentation in minutes. Try it now!

Benefits of Editing Nebraska Employment Forms Online

Top Questions and Answers

Pre-employment assessments or skills tests may be used to further gauge a candidate's suitability for the role. Once a candidate is selected, the next steps involve the provision and completion of mandatory paperwork, including the Form I-9, W-4, and Nebraska State Tax Withholding Forms.

Video Guide to Add a Calculated Field Legal Nebraska Employment Forms For Free

Hi welcome to easy payroll guide in this lesson we're going to be talking about how to use the IRS withholding tables to determine how much you should withhold from an employees paycheck for federal withholding there are two different methods and in this video we're going to talk about the wage bracket method whenever you're determining how much to

Withhold from an employees paycheck you need to make sure that you have the employees W4 form in front of you this form will detail all of the information that you need to know to accurately calculate this tax so this particular withholding form is for John Doe and we can see from the form that he is single and

Tips to Add a Calculated Field Legal Nebraska Employment Forms For Free

- Open your Nebraska Employment Forms document in the editing mode.

- Navigate to the section where you want to add the calculated field.

- Choose the 'Insert' menu or toolbar option, and select 'Calculated Field' or similar.

- Name your calculated field clearly so others know its purpose.

- Set up the formula or calculation you need, using the correct syntax.

- Test the calculated field with sample data to ensure it works as intended.

- Save your changes and review the form to check that the calculated field appears correctly.

You may need to use the editing feature to add a calculated field when you're customizing forms for payroll, benefits, or tracking hours to ensure accurate data calculations.

Related Searches

Income Tax Withholding Reminders for All Nebraska Employers. Instead of mailing your 2023 forms, e-file them. When an employee wants additional state income tax to be withheld, they complete line 2 on the Nebraska Form W-4N. Here is a complete list and location of all the federal payroll forms you should need. Use these instructions and the April 2024 revision of Form 941-X for all years for which the period of limitations on corrections hasn't expired. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local W4 information. Every employer who maintains an office or transacts business in Iowa and who is required to withhold federal income tax on any compensation paid to employees. If you have an employee who is not a resident of Nebraska, you will need to enter a non-resident percent of Nebraska state income tax to be withheld. Nebraska requires mandatory online filing for Quarterly unemployment. With that being said, calculating payroll taxes correctly is critical to your employees and your accountant.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.