Add a Date Legal Mississippi Mortgages Forms For Free

How it works

-

Import your Mississippi Mortgages Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

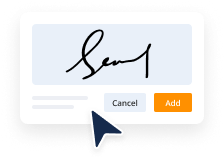

Sign your Mississippi Mortgages Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add a Date Legal Mississippi Mortgages Forms For Free

Are you tired of constant document printing, scanning, postal delivery, and spending precious time and resources with manual fill-out? The times have moved on, and the easiest way to Add a Date Legal Mississippi Mortgages Forms For Free and make any other essential updates to your forms is by managing them online. Choose our quick and trustworthy online editor to complete, adjust, and execute your legal documentation with greatest productivity.

Here are the steps you should take to Add a Date Legal Mississippi Mortgages Forms For Free easily and quickly:

- Upload or import a file to the service. Drag and drop the template to the upload area, import it from the cloud, or use another option (extensive PDF library, emails, URLs, or direct form requests).

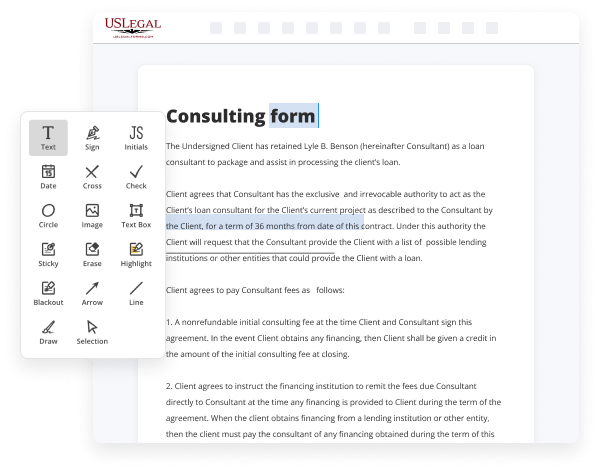

- Provide the required information. Complete empty fields using the Text, Check, and Cross tools from our upper pane. Use our editor’s navigation to make sure you’ve filled in everything. Accentuate the most significant facts with the Highlight option and erase or blackout areas with no value.

- Modify and rearrange the form. Use our upper and side toolbars to change your content, drop additional fillable fields for different data types, re-order sheets, add new ones, or delete unnecessary ones.

- Sign and collect signatures. No matter which method you choose, your eSignature will be legally binding and court-admissible. Send your form to other people for signing through email or signing links. Notarize the paperwork right in our editor if it needs witnessing.

- Share and save the copy. Download or export your completed documentation to the cloud in the file format you need, print it out if you prefer a physical copy, and select the most appropriate file-sharing option (email, fax, SMS, or delivered by snail mail using the USPS).

With our service, you don’t have any more excuses to prepare legal documents manually. Save time and effort executing them online twice as quickly and more successfully. Give it a try now!

Benefits of Editing Mississippi Mortgages Forms Online

Top Questions and Answers

Once a creditor has obtained all the information it normally considers in making a credit decision, the application is complete and the creditor has 30 days in which to notify the applicant of the credit decision.

Video Guide to Add a Date Legal Mississippi Mortgages Forms For Free

Assets assets are divided into two types one liquid assets which are used for down payment and closing costs and two long-term assets which can be used to cover the two months payments required for reserves to verify the borrower's assets you can use bank statements investment statements and verification of deposits down payment options cash cannot be used unless

It is deposited into an account and has at least 60 days seasoning verified deposits and checking accounts and savings accounts are most often used for down payments an additional down payment option would be a gift from a blood relative or significant other and a letter that shows no requirement for repayment there are also down payment assistance programs

Related Searches

Are you looking for a loan agreement form in Mississippi? Download our free Mississippi Loan Agreement Form which is available as PDF or Word documents. Effective July 1, 2012, Miss. Code §15-1-81 sets the statute of limitations for enforcing a non-negotiable promissory note at 6 years from the due date. (a) Name of applicant and co-applicant, if applicable;. (b) Date of application;. Under Mississippi law, you may reinstate the loan any time before the sale. "Closing Date" shall mean the date upon which the related Mortgage Loan is closed with a Mortgagor. The LIBOR Act was signed into law on March 15, 2022, to provide a federal solution for transitioning LIBOR contracts. Under Mississippi law, you may reinstate the loan any time before the sale.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.