Add a Formula Legal Kentucky Business Forms For Free

How it works

-

Import your Kentucky Business Forms from your device or the cloud, or use other available upload options.

-

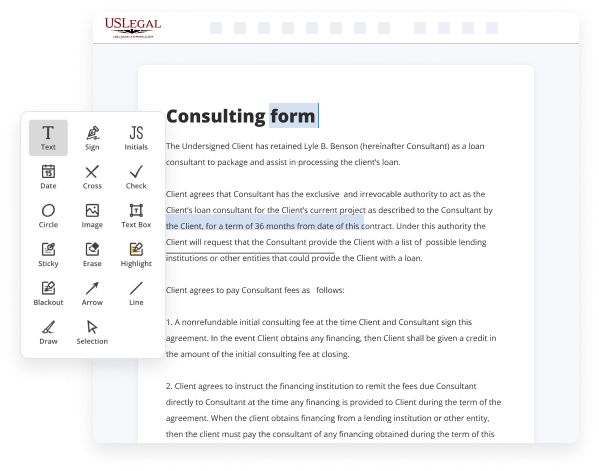

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Kentucky Business Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add a Formula Legal Kentucky Business Forms For Free

Online PDF editors have proved their trustworthiness and efficiency for legal paperwork execution. Use our secure, fast, and straightforward service to Add a Formula Legal Kentucky Business Forms For Free your documents any time you need them, with minimum effort and maximum accuracy.

Make these quick steps to Add a Formula Legal Kentucky Business Forms For Free online:

- Upload a file to the editor. You can select from a couple of options - add it from your device or the cloud or import it from a form library, external URL, or email attachment.

- Complete the blank fields. Put the cursor on the first empty area and make use of our editor’s navigation to move step-by-step to prevent missing anything on your template. Use Text, Initials, Cross, and Check features.

- Make your necessary edits. Update the form with inserted pictures, draw lines and icons, highlight important elements, or remove any pointless ones.

- Drop more fillable fields. Modify the template with a new area for fill-out if neccessary. Utilize the right-side toolbar for this, drop each field where you expect other participants to leave their details, and make the remaining areas required, optional, or conditional.

- Arrange your pages. Delete sheets you don’t need any longer or create new ones using the appropriate key, rotate them, or alter their order.

- Create eSignatures. Click on the Sign tool and choose how you’d add your signature to the form - by typing your name, drawing it, uploading its picture, or utilizing a QR code.

- Share and send for eSigning. Finish your editing with the Done button and send your copy to other parties for signing through an email request, with a Link to Fill option, in an SMS or fax message. Request a quick online notarization if required.

- Save the file in the format you need. Download your document, save it to cloud storage in its current format, or transform it as you need.

And that’s how you can prepare and share any personal or business legal documentation in minutes. Give it a try now!

Benefits of Editing Kentucky Business Forms Online

Top Questions and Answers

The LLET may be calculated using the lesser of $0.095/$100 of Kentucky gross receipts or $0.75/$100 of Kentucky gross profits. A minimum tax of $175 applies regardless of the method used. Sole proprietorships and pass-through entities are exempt from state corporate income taxes.

Video Guide to Add a Formula Legal Kentucky Business Forms For Free

Welcome back to our Channel where we help entrepreneurs and small business owners navigate the exciting world of starting and growing a business in today's video we'll be discussing why starting a limited liability company LLC is a great option for aspiring entrepreneurs particularly in Kentucky we'll also provide you with a detailed step-by-step guide on how to start an

LLC and obtain an employer identification number Ein in the state of Kentucky so let's get started Kentucky is a fantastic state to start a business with a vibrant economy a supportive business environment and a thriving entrepreneurial spirit it's no wonder many individuals choose to launch their Ventures here one of the first decisions you'll face as a business

Related Searches

Many of the forms and instructions you may need to file with the Secretary of State's office are available for download below. Attach to Form 720, 720U (for entities using 3–Factor Apportionment), PTE, or 725. To provide forms which allow for the review of a prospective seller's offering of business opportunities for conformity with the business opportunity act. Kentucky has some of the most competitive tax rates in the country. Below is an outline of state taxes impacting Kentucky business. Below you'll find answers to some of the most common questions about the kinds of taxes Kentucky small businesses need to plan for. There is no minimum earned income amount before you are liable for filling a tax return. The main form that you need to form an LLC in Kentucky will ask you about the management of your company and the company's registered agent. You can compute your liability with a threestep process: 1) Adjust your federal taxable income for Kentucky's tax laws. If you're a sole proprietor, your business name is your name, unless you register a DBA.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.