Add a Formula Legal Missouri Startup for S-Corporation Forms For Free

How it works

-

Import your Missouri Startup for S-Corporation Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Missouri Startup for S-Corporation Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add a Formula Legal Missouri Startup for S-Corporation Forms For Free

Online document editors have demonstrated their trustworthiness and effectiveness for legal paperwork execution. Use our safe, fast, and straightforward service to Add a Formula Legal Missouri Startup for S-Corporation Forms For Free your documents any time you need them, with minimum effort and maximum precision.

Make these quick steps to Add a Formula Legal Missouri Startup for S-Corporation Forms For Free online:

- Import a file to the editor. You can choose from several options - add it from your device or the cloud or import it from a template catalog, external URL, or email attachment.

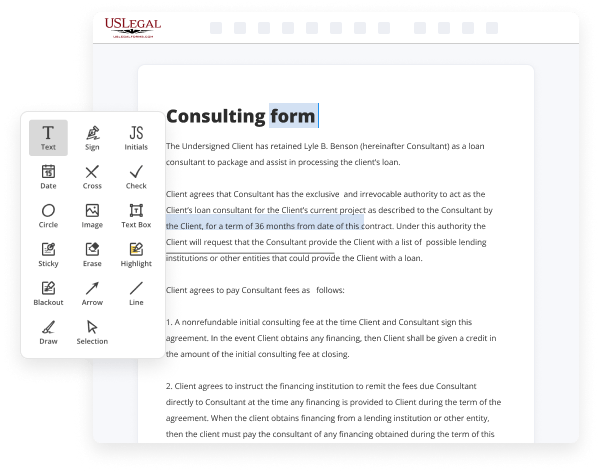

- Complete the blank fields. Place the cursor on the first empty area and make use of our editor’s navigation to move step-by-step to avoid missing anything on your template. Use Text, Initials, Cross, and Check features.

- Make your necessary edits. Update the form with inserted pictures, draw lines and icons, highlight important elements, or remove any pointless ones.

- Drop more fillable fields. Modify the template with a new area for fill-out if required. Make use of the right-side toolbar for this, drop each field where you want others to provide their details, and make the rest of the areas required, optional, or conditional.

- Arrange your pages. Delete sheets you don’t need any longer or create new ones using the appropriate button, rotate them, or alter their order.

- Create eSignatures. Click on the Sign tool and choose how you’d add your signature to the form - by typing your name, drawing it, uploading its picture, or using a QR code.

- Share and send for eSigning. End your editing using the Done button and send your copy to other people for approval via an email request, with a Link to Fill option, in an SMS or fax message. Request a prompt online notarization if required.

- Save the file in the format you need. Download your paperwork, save it to cloud storage in its current format, or convert it as you need.

And that’s how you can complete and share any personal or business legal documentation in minutes. Give it a try today!

Benefits of Editing Missouri Startup for S-Corporation Forms Online

Top Questions and Answers

Shareholders of S corporations report the flow-through of income and losses on their personal tax returns and are assessed tax at their individual income tax rates. This allows S corporations to avoid double taxation on the corporate income.

Video Guide to Add a Formula Legal Missouri Startup for S-Corporation Forms For Free

Okay for this video i wanted to go over the newly added irs form 7203 which is used to report the s corporation shareholders stock and debt basis so why has the irs added this form well if you're a shareholder in an s corporation you have always been required to adequately track your stock and debt basis because when

You prepare your 1040 if you have allocations of losses or if you have cash distributions and you don't have sufficient amount of basis then you can't take the losses on your tax return right you can only take losses to the extent you have basis well they've added this form because they found that taxpayers have done a really

Tips to Add a Formula Legal Missouri Startup for S-Corporation Forms For Free

- Choose a unique name for your S-Corporation that complies with Missouri naming requirements.

- Prepare and file Articles of Incorporation with the Missouri Secretary of State.

- Obtain an Employer Identification Number (EIN) from the IRS for tax purposes.

- Create corporate bylaws that outline how your S-Corporation will operate.

- File Form 2553 with the IRS to elect S-Corporation status.

- Keep accurate records and documents to support your S-Corporation's compliance.

- Consider hiring a lawyer or accountant for guidance on maintaining S-Corporation status.

This editing feature for Add a Formula Legal Missouri Startup for S-Corporation Forms may be needed when you make changes to your business structure or when updating your company's information for compliance.

Related Searches

Each S-Corporation, having modifications, must complete the Form. MO-1120S, Pages 1 and 2, Lines 1–15 and Page 3, the Allocation of. The corporation must enclose a pro forma Federal Form 1120, with all pertinent schedules, where in its separate federal taxable income is. For the latest information about developments related to Form. S and its instructions, such as legislation enacted after they were published, go to IRS. File as a general corporation to become a Subchapter S. Corporation, which is a federal designation for flow through tax. Incorporate a business online easily and affordably through LegalZoom. As defined in the income tax laws of Georgia, only in cases of nonresident shareholders who must complete Form 600SCA. It also provides for the. Gov website belongs to an official government organization in the United States.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.