Add a Formula Legal South Dakota Accounting Forms For Free

How it works

-

Import your South Dakota Accounting Forms from your device or the cloud, or use other available upload options.

-

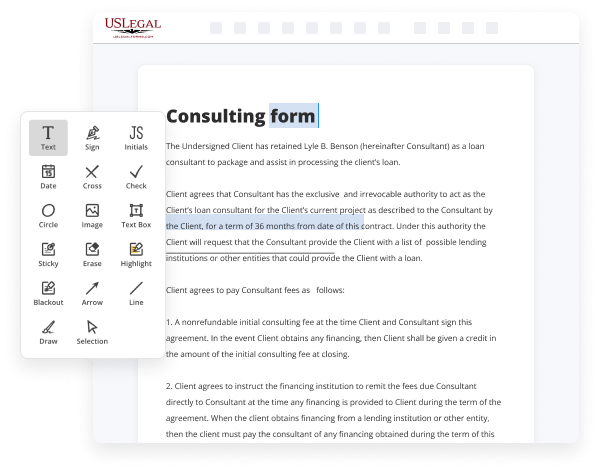

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

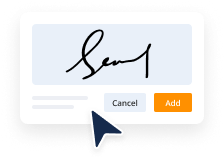

Sign your South Dakota Accounting Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add a Formula Legal South Dakota Accounting Forms For Free

Are you tired of constant document printing, scanning, postal delivery, and wasting precious time and resources with manual fill-out? The times have moved on, and the best way to Add a Formula Legal South Dakota Accounting Forms For Free and make any other critical updates to your forms is by handling them online. Choose our quick and reliable online editor to complete, adjust, and execute your legal documentation with highest efficiency.

Here are the steps you should take to Add a Formula Legal South Dakota Accounting Forms For Free quickly and effortlessly:

- Upload or import a file to the editor. Drag and drop the template to the upload pane, import it from the cloud, or use another option (extensive PDF library, emails, URLs, or direct form requests).

- Provide details you need. Complete empty fields using the Text, Check, and Cross tools from our upper pane. Use our editor’s navigation to ensure you’ve filled in everything. Point out the most significant facts with the Highlight option and erase or blackout areas with no value.

- Modify and rearrange the form. Use our upper and side toolbars to change your content, drop extra fillable fields for various data types, re-order sheets, add new ones, or delete unnecessary ones.

- Sign and collect signatures. No matter which method you choose, your electronic signature will be legally binding and court-admissible. Send your form to others for approval using email or signing links. Notarize the document right in our editor if it needs witnessing.

- Share and save the copy. Download or export your completed documentation to the cloud in the file format you need, print it out if you require a hard copy, and choose the most appropriate file-sharing option (email, fax, SMS, or delivered by snail mail using the USPS).

With our service, you don’t have any more excuses to complete legal documents manually. Save time and effort executing them online twice as quickly and more efficiently. Give it a try now!

Benefits of Editing South Dakota Accounting Forms Online

Top Questions and Answers

South Dakota, like nearly every other state, has four main areas for applicants to satisfy: education, CPA exam scores, an ethics test and experience. The state neither requires in-state residency for licensure, nor does it ask that you be a U.S. citizen, it even makes the Social Security number optional.

Video Guide to Add a Formula Legal South Dakota Accounting Forms For Free

I want to explain to you how tax brackets work in the USA so let's say that you make $100,000 a year this pile of money represents $100,000 so let's get this organized by tax brackets so you're looking at a total of $100,000 in the first pile of money is $111,000 in the second pile $ 33,785 thirdd pile

$50,605 $4,625 the reason why I'm showing you this $100,000 organized into these four piles is because that's how tax brackets work so you see the first $111,000 that you make will be taxed at 10% the next $33,750 that you make will be taxed at a rate of 12% the next $50,605 of 22% the next $4,625 that you

Related Features

Tips to Add a Formula Legal South Dakota Accounting Forms For Free

- Open the South Dakota accounting form you need to edit.

- Locate the section where you want to add a formula.

- Identify the type of formula you need, such as addition, subtraction, or multiplication.

- Use clear and simple references to other fields within the form when creating your formula.

- Ensure all necessary values are included in the formula for accurate calculations.

- Test the formula with sample data to ensure it works correctly.

- Save a copy of the form before making changes, in case you need to revert back.

- Consult South Dakota accounting guidelines to ensure compliance with local regulations.

This editing feature for adding a formula to South Dakota accounting forms may be needed when there are complex calculations required, such as during tax season or while preparing financial statements.

A Certificate of Experience form should be obtained from the Board office. :. Accounting records. All required fields on the form will have a box. Click on the form fields and type, tab to the next field. Use the March 2024 revision of Form 941 to report taxes for the first quarter of 2024; don't use an earlier revision to report taxes for 2024. April 18, 2023 is the due date for filing your return and paying your tax due. • File electronically—it's fast, easy, and secure. Economic nexus is a connection between a state and a business that allows the state to require the business to register to collect and remit sales tax. And all liability as to all matters set forth in the accounting. This comprehensive publication provides quick access to every NAIC Model Law, Regulation, and Guideline.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.