Add a Formula Legal Wisconsin Accounting Forms For Free

How it works

-

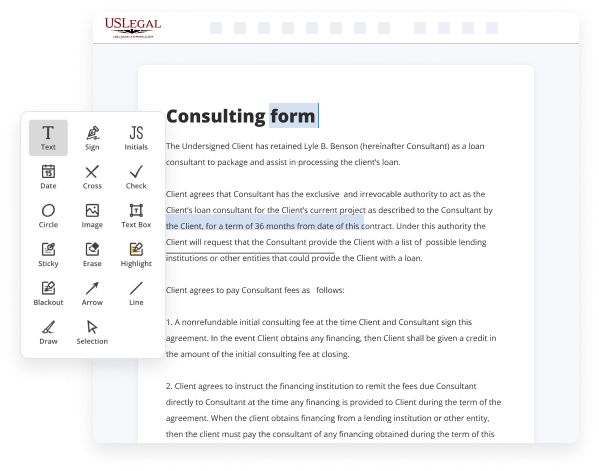

Import your Wisconsin Accounting Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Wisconsin Accounting Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add a Formula Legal Wisconsin Accounting Forms For Free

Online document editors have proved their reliability and effectiveness for legal paperwork execution. Use our secure, fast, and straightforward service to Add a Formula Legal Wisconsin Accounting Forms For Free your documents any time you need them, with minimum effort and maximum accuracy.

Make these quick steps to Add a Formula Legal Wisconsin Accounting Forms For Free online:

- Import a file to the editor. You can choose from several options - add it from your device or the cloud or import it from a form library, external URL, or email attachment.

- Complete the blank fields. Place the cursor on the first empty field and use our editor’s navigation to move step-by-step to avoid missing anything on your template. Use Text, Initials, Cross, and Check tools.

- Make your necessary modifications. Update the form with inserted pictures, draw lines and symbols, highlight important components, or erase any pointless ones.

- Drop more fillable fields. Adjust the template with a new area for fill-out if neccessary. Utilize the right-side tool pane for this, drop each field where you expect other participants to provide their data, and make the remaining fields required, optional, or conditional.

- Organize your pages. Remove sheets you don’t need any longer or create new ones using the appropriate button, rotate them, or alter their order.

- Generate eSignatures. Click on the Sign option and choose how you’d insert your signature to the form - by typing your name, drawing it, uploading its picture, or using a QR code.

- Share and send for eSigning. Finish your editing using the Done button and send your copy to other people for approval via an email request, with a Link to Fill option, in an SMS or fax message. Request a prompt online notarization if needed.

- Save the file in the format you need. Download your paperwork, save it to cloud storage in its current format, or transform it as you need.

And that’s how you can complete and share any individual or business legal paperwork in clicks. Give it a try now!

Benefits of Editing Wisconsin Accounting Forms Online

Top Questions and Answers

Schedule 3K-1 shows each partner's share of the partnership's income, deductions, credits, etc., which have been sum- marized on Schedule 3K. Like Schedule 3K, Schedule 3K-1 requires an entry for the federal amount, adjustment, and amount determined under Wisconsin law of each applicable item.

Video Guide to Add a Formula Legal Wisconsin Accounting Forms For Free

Laws calm legal forms guide form five Wisconsin corporation franchise or income tax return corporations doing business in Wisconsin use a form five in order to file their franchise or income tax owed to the state this document can be found on the website of the Wisconsin Department of Revenue step one at the top of the form if you

Are not filing for the calendar year in question give the beginning and ending dates of your fiscal year step to enter your corporations name and address step three inbox a give your federal employer identification number in box be give your NAICS classification code step 4 in boxee give the state in which your business was incorporated and the

Tips to Add a Formula Legal Wisconsin Accounting Forms For Free

- Make sure you have the correct form downloaded from the official Wisconsin state website.

- Open the form in a compatible PDF editor or accounting software that allows formula inputs.

- Identify the fields where you want to add the formula, such as totals or calculations.

- Use clear and simple formulas to avoid confusion, such as SUM for adding numbers or AVERAGE for calculating averages.

- Test the formula by entering sample data to ensure it calculates as expected.

- Save a copy of the original form before making changes, in case you need to revert back to it later.

The ability to add formulas to Legal Wisconsin Accounting Forms may be needed when you want to automate calculations, making it easier to fill out these forms accurately.

Related Searches

Every partnership and limited liability company treated as a partnership with income from Wisconsin sources, regard- less of the amount, must file Form 3. You must electronically file (efile) the Financial Report Form (MFR) with the Wisconsin Department of Revenue. Tax 2.01 Residence (p. 10). Tax 2.02 Reciprocity (p. 10). Under Wisconsin law, formula apportionment is used to determine taxable income in. All Accounting Forms; Bursar's Office Forms; Capital Equipment Forms; Cash Management Forms; Custodian Funds Forms; Gifts Forms; Purchasing Forms. The WisDOT CFR Instructions includes directions for creating the CFR and submitting it in Masterworks. Additional information about Masterworks is available. Partnerships are required to file Form 1065 and related forms and schedules electronically if they file 10 or more returns of any type during the tax year. Attach to the Wisconsin return, for the first taxable year for which the change applies, a copy of the Internal Revenue Service's notice of approval of ac-.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.