Add a Number Field Legal Vermont Business Sale Forms For Free

How it works

-

Import your Vermont Business Sale Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Vermont Business Sale Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add a Number Field Legal Vermont Business Sale Forms For Free

Online PDF editors have proved their trustworthiness and efficiency for legal paperwork execution. Use our safe, fast, and user-friendly service to Add a Number Field Legal Vermont Business Sale Forms For Free your documents whenever you need them, with minimum effort and maximum accuracy.

Make these simple steps to Add a Number Field Legal Vermont Business Sale Forms For Free online:

- Import a file to the editor. You can select from several options - add it from your device or the cloud or import it from a form library, external URL, or email attachment.

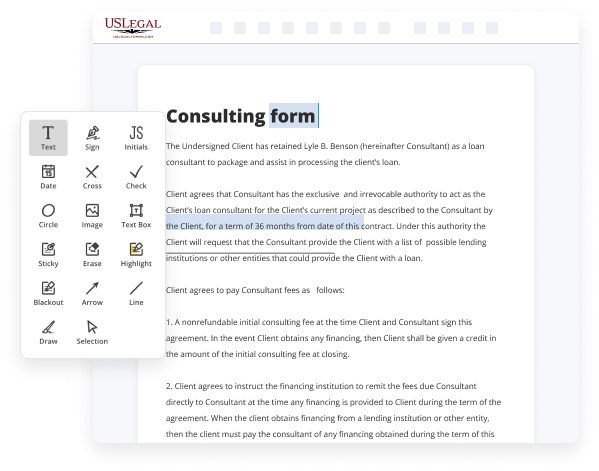

- Fill out the blank fields. Put the cursor on the first empty field and make use of our editor’s navigation to move step-by-step to avoid missing anything on your template. Use Text, Initials, Cross, and Check tools.

- Make your necessary modifications. Update the form with inserted pictures, draw lines and icons, highlight important elements, or remove any pointless ones.

- Drop more fillable fields. Modify the template with a new area for fill-out if neccessary. Make use of the right-side tool pane for this, place each field where you expect other participants to leave their data, and make the remaining areas required, optional, or conditional.

- Organize your pages. Remove sheets you don’t need anymore or create new ones making use of the appropriate key, rotate them, or change their order.

- Create electronic signatures. Click on the Sign tool and decide how you’d add your signature to the form - by typing your name, drawing it, uploading its image, or utilizing a QR code.

- Share and send for eSigning. Finish your editing using the Done button and send your copy to other people for signing via an email request, with a Link to Fill option, in an SMS or fax message. Request a quick online notarization if necessary.

- Save the file in the format you need. Download your paperwork, save it to cloud storage in its present format, or transform it as you need.

And that’s how you can prepare and share any individual or business legal paperwork in minutes. Give it a try today!

Benefits of Editing Vermont Business Sale Forms Online

Top Questions and Answers

The Vermont Sales and Use Tax is 6%. To determine tax due, multiply the sales amount by 6% (or 7% if the sale is subject to local option tax), and round up to the nearest whole cent ing to the following rules: Tax computation must be carried to the third decimal place, and.

Tips to Add a Number Field Legal Vermont Business Sale Forms For Free

- Ensure you have the correct form: Verify you are using the official Vermont business sale forms.

- Identify where the number field is needed: Determine which section of the form requires the addition of a number field.

- Use clear labels: Clearly label the number field to indicate what kind of number should be entered, like quantity or price.

- Keep it simple: Make sure the number field is easy to understand and fill out.

- Test the form: Before finalizing, test the form to ensure the number field works as intended.

- Consider formatting: If it's a digital form, ensure the number field accepts only numeric inputs.

Editing the number field in the Vermont Business Sale Forms may be necessary when you encounter unique situations, such as needing to provide specific quantities or financial figures during a transaction.

Related Searches

Find information on Vermont laws pertaining to business, scam prevention, community resources, and commonly asked business-related questions. This document is a form of contract and as long is has signatures of the seller and the buyer, it binds the parties legally. CAFS offers a comprehensive sustainable food and agriculture law and policy program with residential, distance learning, and summer courses. Edit, sign, and share Commercial Property Sales Package - Vermont online. For most small businesses, registering your business is as simple as registering your business name with state and local governments. Use Value Appraisal, or "Current Use" as it is commonly known, is a property tax incentive available to owners of agricultural and forestry land in Vermont. When FEMA responds to a disaster, our goal is to contract with local businesses in the affected area, whenever practical and feasible. Check or add your phone numbers to the Pennsylvania Do Not Call Registry. The type of sales and amount of sales determine if a business is a restaurant. Vermont law specifically defines.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.