Add Alternative Choice Legal Pennsylvania Accounts Receivables Forms For Free

How it works

-

Import your Pennsylvania Accounts Receivables Forms from your device or the cloud, or use other available upload options.

-

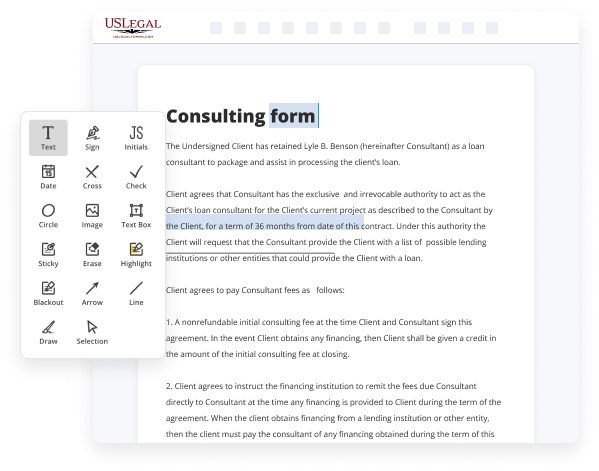

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Pennsylvania Accounts Receivables Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Alternative Choice Legal Pennsylvania Accounts Receivables Forms For Free

Online PDF editors have proved their reliability and effectiveness for legal paperwork execution. Use our secure, fast, and intuitive service to Add Alternative Choice Legal Pennsylvania Accounts Receivables Forms For Free your documents whenever you need them, with minimum effort and greatest precision.

Make these simple steps to Add Alternative Choice Legal Pennsylvania Accounts Receivables Forms For Free online:

- Upload a file to the editor. You can select from a couple of options - add it from your device or the cloud or import it from a template library, external URL, or email attachment.

- Fill out the blank fields. Place the cursor on the first empty field and make use of our editor’s navigation to move step-by-step to prevent missing anything on your template. Use Text, Initials, Cross, and Check tools.

- Make your necessary edits. Update the form with inserted pictures, draw lines and signs, highlight important elements, or remove any unnecessary ones.

- Create additional fillable fields. Modify the template with a new area for fill-out if neccessary. Use the right-side toolbar for this, place each field where you expect other participants to leave their details, and make the rest of the fields required, optional, or conditional.

- Organize your pages. Remove sheets you don’t need anymore or create new ones while using appropriate button, rotate them, or change their order.

- Create eSignatures. Click on the Sign option and choose how you’d insert your signature to the form - by typing your name, drawing it, uploading its picture, or utilizing a QR code.

- Share and send for eSigning. Finish your editing using the Done button and send your copy to other people for signing via an email request, with a Link to Fill option, in an SMS or fax message. Request a quick online notarization if necessary.

- Save the file in the format you need. Download your document, save it to cloud storage in its current format, or transform it as you need.

And that’s how you can complete and share any personal or business legal documentation in minutes. Try it today!

Benefits of Editing Pennsylvania Accounts Receivables Forms Online

Top Questions and Answers

Pennsylvania does not permit the IRC § 732(d) or IRC § 754 election. The partnership must allocate each item of income (loss) by class to the partners in the same proportion that it uses for federal purposes.

Video Guide to Add Alternative Choice Legal Pennsylvania Accounts Receivables Forms For Free

Let’s examine the difference between accounts receivable vs accounts payable. Accounts receivable -- or AR -- is the amount of money owed to a company by its customers. AR is recorded as an asset on a company’s balance sheet. Accounts payable -- or AP -- is the amount of money a company owes its suppliers and vendors. AP is

Recorded as a liability on a company’s balance sheet. Every company needs to closely track AR and AP in order to fully understand its financial situation. By properly striking a balance between AR and AP, businesses are in a better position to avoid problems with cash flow, can better plan for the future and can continue to scale successfully.

Tips to Add Alternative Choice Legal Pennsylvania Accounts Receivables Forms For Free

- Gather all necessary information about the accounts receivable.

- Ensure you have the correct legal forms for Pennsylvania.

- Review the instructions for the alternative choice legal forms carefully.

- Check for any specific requirements for the format or content of the forms.

- Consult with a legal professional if you have any doubts about the forms.

- Use clear and simple language when filling out the forms.

- Double-check all entries for accuracy before submission.

- Keep a copy of the completed forms for your records.

You may need this editing feature when you realize that some information has changed, or if you need to correct any mistakes on the Add Alternative Choice Legal Pennsylvania Accounts Receivables Forms.

Please type or print this form. Be sure it is completely legible. The SAP system's accounts receivable module gives Commonwealth agencies the ability to manage accounts receivable efficiently and effectively. Bystep guide on the way to Insert Alternative Choice in the Accounts Receivable Purchase Agreement. Please type or laser-print this form. This security agreement gives the bank a "Security Interest" in the "Collateral" or "Security Property" (the car). Choose to use an alternative confidential financial disclosure form and procedure in lieu of the OGE Form 450. Extensions. If a new MA form is not on your version of the MA 300X, you are permitted to add the form to the MA 300X. 01. Upload a document from your computer or cloud storage. Note: This is the Word version that is available for accessibility purposes.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.