Add Alternative Choice PDF Fair Debt Credit Templates For Free

How it works

-

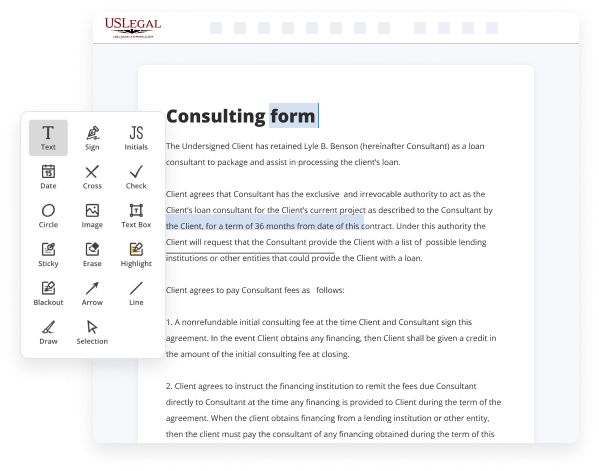

Import your Fair Debt Credit Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Fair Debt Credit Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Alternative Choice PDF Fair Debt Credit Templates For Free

Are you tired of constant document printing, scanning, postal delivery, and spending precious time and resources with manual fill-out? The times have moved on, and the simplest way to Add Alternative Choice PDF Fair Debt Credit Templates For Free and make any other essential changes to your forms is by managing them online. Take advantage of our quick and trustworthy online editor to complete, modify, and execute your legal paperwork with highest productivity.

Here are the steps you should take to Add Alternative Choice PDF Fair Debt Credit Templates For Free easily and quickly:

- Upload or import a file to the service. Drag and drop the template to the upload area, import it from the cloud, or use another option (extensive PDF library, emails, URLs, or direct form requests).

- Provide the required information. Complete blank fields using the Text, Check, and Cross tools from our top pane. Use our editor’s navigation to make certain you’ve filled in everything. Point out the most important facts with the Highlight option and erase or blackout fields with no value.

- Modify and rearrange the template. Use our upper and side toolbars to update your content, place additional fillable fields for various data types, re-order pages, add new ones, or remove redundant ones.

- Sign and request signatures. Whatever method you select, your electronic signature will be legally binding and court-admissible. Send your form to other people for approval using email or signing links. Notarize the document right in our editor if it needs witnessing.

- Share and save the copy. Download or export your completed paperwork to the cloud in the file format you need, print it out if you require a physical copy, and choose the most appropriate file-sharing option (email, fax, SMS, or delivered by snail mail using the USPS).

With our service, you don’t have any more excuses to accomplish legal documents manually. Save time and effort executing them online twice as fast and more successfully. Try it out now!

Benefits of Editing Fair Debt Credit Forms Online

Top Questions and Answers

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Video Guide to Add Alternative Choice PDF Fair Debt Credit Templates For Free

What is a debt validation letter how do you use it how does it protect your rights and should you bother using one at all my name is michael wasslick i'm one of the lawyers at ricardo and wassup here in florida and together with my partner jason ricardo i help people just like you overcome foreclosure and debt collection

With dignity today i'm going to talk about what a debt validation letter is how you can use it and how you can use it to protect your rights and when and how you need to send it what it needs to contain all of that great stuff so before i launch into the nitty-gritty details about debt validation i

Related Searches

The Fair Credit Reporting Act does not require that a furnisher (whether creditor or collection agency) prove the consumer owes the debt. A 1977 law that prohibits third-party collection agencies from harassing, threatening and inappropriately contacting someone who owes money. Request to Add Item(s) to GSA Retail Stock, Contracting and Procurement. GSA. Federal "Fair Debt Collection Practices Act", 15 U.S.C. sec. If you exceed your credit limit, additional fees and charges also can be added. For example, you still might be sued or have the status of the debt reported to a credit bureau. Template letter begins on the next page. Some creditors hire third-party debt collectors to seek repayment of consumer loans or other forms of debt that have become past-due. The forms include a Loan Estimate Disclosure, Fair Lending Notice, and a California Credit Disclosure. NOTE: Under the Fair Debt Collection Practices Act (FDCPA), creditors collecting for themselves are not "debt collectors.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.