Add Amount Field Legal Alabama Startup for S-Corporation Forms For Free

How it works

-

Import your Alabama Startup for S-Corporation Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Alabama Startup for S-Corporation Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Amount Field Legal Alabama Startup for S-Corporation Forms For Free

Online document editors have proved their reliability and efficiency for legal paperwork execution. Use our safe, fast, and straightforward service to Add Amount Field Legal Alabama Startup for S-Corporation Forms For Free your documents whenever you need them, with minimum effort and highest accuracy.

Make these quick steps to Add Amount Field Legal Alabama Startup for S-Corporation Forms For Free online:

- Import a file to the editor. You can select from a couple of options - upload it from your device or the cloud or import it from a form library, external URL, or email attachment.

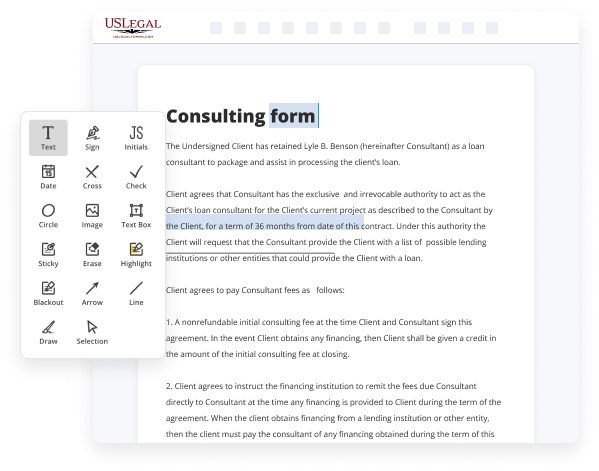

- Complete the blank fields. Put the cursor on the first empty area and use our editor’s navigation to move step-by-step to prevent missing anything on your template. Use Text, Initials, Cross, and Check tools.

- Make your necessary modifications. Update the form with inserted pictures, draw lines and symbols, highlight significant components, or remove any unnecessary ones.

- Add more fillable fields. Adjust the template with a new area for fill-out if required. Make use of the right-side tool pane for this, drop each field where you expect others to leave their details, and make the remaining areas required, optional, or conditional.

- Organize your pages. Delete sheets you don’t need anymore or create new ones making use of the appropriate button, rotate them, or alter their order.

- Create electronic signatures. Click on the Sign tool and decide how you’d insert your signature to the form - by typing your name, drawing it, uploading its image, or using a QR code.

- Share and send for eSigning. Finish your editing with the Done button and send your copy to other people for signing via an email request, with a Link to Fill option, in an SMS or fax message. Request a prompt online notarization if needed.

- Save the file in the format you need. Download your paperwork, save it to cloud storage in its present format, or transform it as you need.

And that’s how you can prepare and share any personal or business legal paperwork in clicks. Try it now!

Benefits of Editing Alabama Startup for S-Corporation Forms Online

Top Questions and Answers

You can accomplish this by filing Internal Revenue Service Form 8832. By filing Form 8832 with the IRS, you can choose a tax status for your entity besides the default status.

Video Guide to Add Amount Field Legal Alabama Startup for S-Corporation Forms For Free

Hi everyone I'm attorney Aiden Durham with 180 Loco in Colorado welcome back to all up in your business where today I'm going to tell you about six pretty common mistakes that you're going to want to avoid if you are forming or already operating as a single member LLC but first of course please do subscribe if you haven't

Already be sure to click that little bell so you get notified anytime I post a new video and you can check the description for links to some additional information and resources and while I am a lawyer I am not your lawyer the stuff I talk about in my videos isn't a substitute for actual legal advice if you

Tips to Add Amount Field Legal Alabama Startup for S-Corporation Forms For Free

- Check the form for specific instructions on where to input the amount.

- Ensure you are using the latest version of the S-Corporation forms available for Alabama.

- Verify that your calculations are correct before adding the amount.

- Double-check any requirements for minimum or maximum amounts allowed.

- Make sure to provide consistent formatting for the amount, such as using commas for thousands and two decimal places for cents.

You may need to edit the amount field when updating financial information or correcting previously submitted figures.

Gov) has available Alabama S corporation tax laws, regulations, forms and instructions. Corporations, financial institution groups, insurance companies, REITs, and business trusts must file Alabama Form PT. The S corporation has claimed an amount on page 1, line 24d, which is treated as tax-exempt income for purposes of S corporation allocations. File a Certificate of Formation with the state. Adopt an operating agreement. Form an S Corp today providing limited liability protection to owners, offering special IRS tax status and more. (b) The corporation will file a return on Form 20S for each year it qualifies as an Alabama S corporation. Each SCorporation, having modifications, must complete the Form. MO-1120S, Pages 1 and 2, Lines 1–15 and Page 3, the Allocation of. Learn how to set a reasonable salary for S Corporation owners.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.