Add Amount Field Legal Indiana Accounting Forms For Free

How it works

-

Import your Indiana Accounting Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Indiana Accounting Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Amount Field Legal Indiana Accounting Forms For Free

Are you tired of constant document printing, scanning, postal delivery, and wasting precious time and resources with manual fill-out? The times have moved on, and the best way to Add Amount Field Legal Indiana Accounting Forms For Free and make any other essential changes to your forms is by managing them online. Choose our quick and reliable online editor to fill out, edit, and execute your legal documentation with maximum productivity.

Here are the steps you should take to Add Amount Field Legal Indiana Accounting Forms For Free easily and quickly:

- Upload or import a file to the service. Drag and drop the template to the upload area, import it from the cloud, or use an alternative option (extensive PDF library, emails, URLs, or direct form requests).

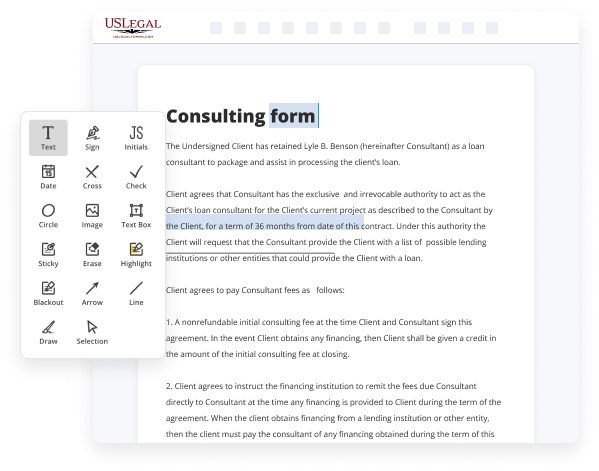

- Provide the required information. Complete blank fields utilizing the Text, Check, and Cross tools from our upper pane. Use our editor’s navigation to make sure you’ve completed everything. Accentuate the most important details with the Highlight option and erase or blackout fields with no value.

- Adjust and rearrange the form. Use our upper and side toolbars to change your content, drop extra fillable fields for different data types, re-order pages, add new ones, or remove redundant ones.

- Sign and request signatures. No matter which method you select, your eSignature will be legally binding and court-admissible. Send your form to other people for signing through email or signing links. Notarize the paperwork right in our editor if it needs witnessing.

- Share and save the copy. Download or export your completed documentation to the cloud in the format you need, print it out if you require a physical copy, and select the most suitable file-sharing option (email, fax, SMS, or sent by snail mail using the USPS).

With our service, you don’t have any more excuses to accomplish legal documents manually. Save time and effort executing them online twice as fast and more properly. Try it out now!

Benefits of Editing Indiana Accounting Forms Online

Top Questions and Answers

Section 35-41-5-2 - Conspiracy (a) A person conspires to commit a felony when, with intent to commit the felony, the person agrees with another person to commit the felony. A conspiracy to commit a felony is a felony of the same level as the underlying felony.

Video Guide to Add Amount Field Legal Indiana Accounting Forms For Free

Rules and forms rules in this segment you will find the relevant rules and regulations for each and every module you can select the rule from the filtering option along with the rule number to read about the records connected to a particular rule click on the rule and click on see more and this will give you interconnected documents

Related to the rule such as cases relevant articles relevant sections relevant forms and commentary the commentary gives you taxman's analysis on each and every rule moving on to forms forms are generally found within the rules but we have segmented them separately to make it easy for you you can click on forms select the category of the form

Tips to Add Amount Field Legal Indiana Accounting Forms For Free

- Understand the purpose of the Amount Field: Make sure you know why you are adding an amount field and how it will be used.

- Use clear labels: Clearly label your amount fields to avoid confusion for anyone filling out the form.

- Set appropriate field sizes: Make sure the field is large enough for the expected amount, so it can accommodate various figures.

- Format the field correctly: Use proper numeric formatting (such as commas and decimal points) to ensure accuracy.

- Validate input: Ensure the form can check if the input is a valid number and prompt for corrections if needed.

- Provide examples: If necessary, include examples of acceptable amounts to guide users.

- Test the field: Before finalizing the document, test the amount field to check for any issues or required adjustments.

You may need to edit the Add Amount Field Legal Indiana Accounting Forms when you're dealing with new entries or changes in financial figures that require accurate representation on your forms.

The Foundation's tax identification number 35-6032377 must be assigned to all Indiana IOLTA accounts. IndianaDocs is a collection of more than 200 forms covering a range of practice areas, from litigation and family law to criminal pleadings and estate planning. The state board of accounts shall from time to time make and enforce changes in the system and forms of accounting and reporting as necessary to conform to law. This User Guide focuses on the Gateway AFR application, which enables local units of government to enter their AFR via the web. Pursuant to Indiana Supreme Court Rule 1.15, the IOLTA funds are used to support civil legal assistance and pro bono i n i t i a t i v e s throughout Indiana. In addition, you will need to complete Form 103N, Schedule II. The leasing company will complete Form 103O, Schedule. In addition, the Pennsylvania Inheritance Tax will be assessed on the full value of the assets. (The Official Forms may be purchased at legal stationery stores or download. If you are not enrolled in Medicare, leave this field blank. Amounts treated as compensation.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.