Add Amount Field Legal Maryland Debt Relief Forms For Free

How it works

-

Import your Maryland Debt Relief Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Maryland Debt Relief Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Amount Field Legal Maryland Debt Relief Forms For Free

Legal paperwork requires highest accuracy and prompt execution. While printing and filling forms out usually takes considerable time, online PDF editors demonstrate their practicality and effectiveness. Our service is at your disposal if you’re looking for a trustworthy and straightforward-to-use tool to Add Amount Field Legal Maryland Debt Relief Forms For Free quickly and securely. Once you try it, you will be surprised how easy working with formal paperwork can be.

Follow the guidelines below to Add Amount Field Legal Maryland Debt Relief Forms For Free:

- Add your template via one of the available options - from your device, cloud, or PDF catalog. You can also obtain it from an email or direct URL or through a request from another person.

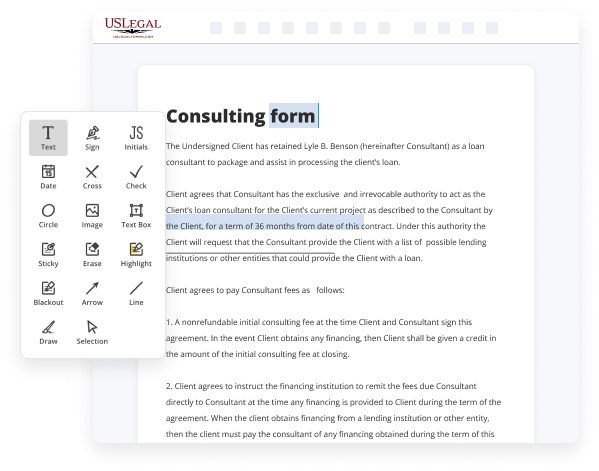

- Use the top toolbar to fill out your document: start typing in text fields and click on the box fields to select appropriate options.

- Make other essential changes: insert pictures, lines, or symbols, highlight or remove some details, etc.

- Use our side tools to make page arrangements - insert new sheets, alter their order, remove unnecessary ones, add page numbers if missing, etc.

- Add additional fields to your document requesting various types of data and place watermarks to protect the contents from unauthorized copying.

- Verify if all information is true and sign your paperwork - create a legally-binding electronic signature the way you prefer and place the current date next to it.

- Click Done when you are ready and decide where to save your form - download it to your device or export it to the cloud in whatever file format you need.

- Share a copy with other people or send it to them for signature via email, a signing link, SMS, or fax. Request online notarization and get your form promptly witnessed.

Imagine doing all of that manually in writing when even one error forces you to reprint and refill all the details from the beginning! With online services like ours, things become considerably easier. Try it now!

Benefits of Editing Maryland Debt Relief Forms Online

Top Questions and Answers

What is the senior tax credit? Formally known as the “Credit for the Elderly or the Disabled,” the federal senior tax credit is a credit of $3,750 to $7,500 that lowers federal tax bills for older adults and people who retired on permanent and total disability.

Video Guide to Add Amount Field Legal Maryland Debt Relief Forms For Free

Webinar topic entitled navigating the 2526 fast form for dependent students uh so we're thankful and grateful that you all joined in today today's presenter will be Mr Isaiah Ellis Outreach specialist for federal student aid will be conducting today's session so sit back enjoy and learn and Isaiah take it away thanks Fred and thank you all who are

Joining us whether you're joining us on your mobile phone desktop lapt top from different parts in the United States or in our neighboring islands and countries thank you all for taking time to join us to learn about navigating the 2526 passive forum for dependent students just to set the expectations we're going to start out with the presentation

Tips to Add Amount Field Legal Maryland Debt Relief Forms For Free

- Gather all relevant financial documentation before filling out the form.

- Make sure to clearly indicate the amount you are claiming or showing as owed.

- Double-check the math to ensure accuracy in the amounts provided.

- Use clear and legible handwriting if filling out the form manually.

- If using a digital form, ensure the right fields are filled out properly without errors.

- Follow any specific instructions provided for the amount field on the form.

The editing feature for the Add Amount Field Legal Maryland Debt Relief Forms may be needed when you realize there was an error in the amount after submitting the initial form or if there are changes in your financial situation.

Enter this amount on line 31 of Form 502; line 19 of Form 504. PART CC- REFUNDABLE INCOME TAX CREDITS. 1. NOTE: The amount of donation shown on line 2 of Part I on Form 502CR requires an addition to income. The five debt-relief programs offered in Maryland include debt management, debt settlement, debt consolidation loans, nonprofit debt settlement and bankruptcy. To enter the information for the Student Loan Debt Relief Tax Credit on your Maryland Tax Return: Open or continue your return in TurboTax. Get debt relief in Maryland. Forms of Student Loan Forgiveness that are not PSLF. There are also more types of student loan forgiveness for nonprofit employees in addition to the PSLF. Private-entity borrowers must demonstrate that loan funds will remain in the U.S.. What is an eligible area? If you receive a 1099-C, you may have to report the amount shown as taxable income on your income tax return.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.