Add Checkboxes To Legal North Carolina Garnishment Forms For Free

How it works

-

Import your North Carolina Garnishment Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your North Carolina Garnishment Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Checkboxes To Legal North Carolina Garnishment Forms For Free

Online PDF editors have proved their trustworthiness and efficiency for legal paperwork execution. Use our secure, fast, and user-friendly service to Add Checkboxes To Legal North Carolina Garnishment Forms For Free your documents any time you need them, with minimum effort and greatest precision.

Make these simple steps to Add Checkboxes To Legal North Carolina Garnishment Forms For Free online:

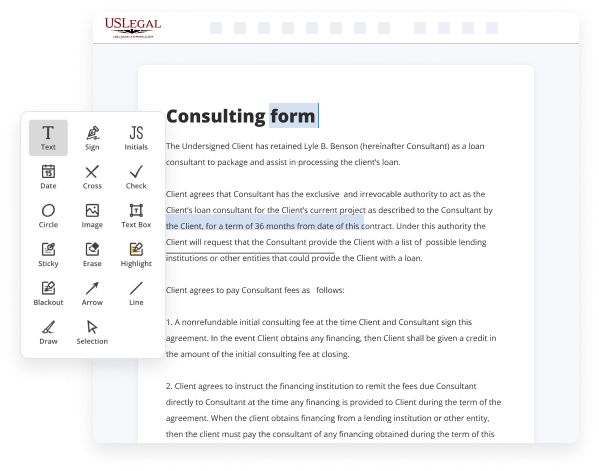

- Import a file to the editor. You can select from a couple of options - upload it from your device or the cloud or import it from a form library, external URL, or email attachment.

- Complete the blank fields. Put the cursor on the first empty area and make use of our editor’s navigation to move step-by-step to avoid missing anything on your template. Use Text, Initials, Cross, and Check tools.

- Make your necessary modifications. Update the form with inserted pictures, draw lines and symbols, highlight important components, or remove any pointless ones.

- Add more fillable fields. Modify the template with a new area for fill-out if required. Utilize the right-side tool pane for this, place each field where you expect other participants to provide their data, and make the rest of the areas required, optional, or conditional.

- Organize your pages. Delete sheets you don’t need anymore or create new ones making use of the appropriate button, rotate them, or change their order.

- Create eSignatures. Click on the Sign option and decide how you’d insert your signature to the form - by typing your name, drawing it, uploading its image, or using a QR code.

- Share and send for eSigning. End your editing using the Done button and send your copy to other people for signing via an email request, with a Link to Fill option, in an SMS or fax message. Request a quick online notarization if required.

- Save the file in the format you need. Download your document, save it to cloud storage in its present format, or transform it as you need.

And that’s how you can prepare and share any personal or business legal paperwork in minutes. Try it now!

Benefits of Editing North Carolina Garnishment Forms Online

Top Questions and Answers

Wages Garnished The employer is required to send 10% of the taxpayer's gross wages per pay period until the amount requested is paid, including the service or collection fee, or until they receive a Release of Garnishment from the Tax Office.

Video Guide to Add Checkboxes To Legal North Carolina Garnishment Forms For Free

Generally speaking wages cannot be garnished in North Carolina now I say generally speaking because there are always caveats and there's a caveat to that general statement as well so the IRS or the federal government can garnish your wages even if you're in North Carolina however your general run-of-the-mill creditor credit cards medical bills personal loans mortgage companies car

Finance companies they cannot garnish your wages if your payroll is based in North Carolina if your payroll is based out of other states then there's the possibility that they could try to go after and garnish those wages but if it's based in North Carolina North Carolina at the making of this video the data the making of this

Tips to Add Checkboxes To Legal North Carolina Garnishment Forms For Free

- Ensure that the checkboxes are clearly labeled and easy to understand.

- Place the checkboxes next to the corresponding options or statements on the form.

- Use a consistent design for all checkboxes to maintain a professional look.

- Make sure the checkboxes are large enough for easy selection.

- Include instructions on how to properly fill out the checkboxes if needed.

Adding checkboxes to legal North Carolina garnishment forms can help make the document easier to understand and fill out. This feature may be needed when there are multiple options or statements that require a simple yes or no response from the recipient. By adding checkboxes, you can make it clear which options or statements apply to the individual's situation, reducing confusion and ensuring all necessary information is provided.

Related Searches

The Department will send a garnishment release letter to the taxpayer's employer once the tax liability is paid in full. If the taxpayer has a bank garnishment, ... 04-Feb-2022 ? Power of Attorney and Declaration of Representative, Form GEN-58. ... North Carolina Department of Revenue. PO Box 25000. Raleigh, NC 27640- ... Search statewide judicial forms. Narrow your search by entering a keyword, General Statute, form number, form title, etc. 28-Feb-2023 ? Do you have to garnish your employees wages? Did you get a wage garnishment letter? Here's exactly what to do if you have to garnish wages ... 04-May-2023 ? Bad Check/EFT Penalty: The new law clarifies that the bad check or electronic funds transfer (EFT) penalties apply to a garnishee who issues a ... Under North Carolina law, an employer may be ordered to withhold wages from an employee and pay them to a creditor for the following types of debts: taxes, Instructs employers and federal agencies on how to process income withholding orders including examples of calculations. 15-Sept-2014 ? Four states ? Texas, Pennsylvania, North Carolina and South Carolina ? largely prohibit wage garnishment stemming from consumer debt. Most ... Once a judgment is entered, the judgment creditors seek garnishments in 78% of cases. ? Creditors are almost always represented in debt collection cases, but ... Under North Carolina law, an employer may be ordered to withhold wages from an employee and pay them to a creditor for the following types of debts: taxes,

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.