Add Checkmark To Legal Mississippi Loans Lending Forms For Free

How it works

-

Import your Mississippi Loans Lending Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Mississippi Loans Lending Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Checkmark To Legal Mississippi Loans Lending Forms For Free

Online document editors have demonstrated their reliability and efficiency for legal paperwork execution. Use our secure, fast, and intuitive service to Add Checkmark To Legal Mississippi Loans Lending Forms For Free your documents whenever you need them, with minimum effort and highest precision.

Make these simple steps to Add Checkmark To Legal Mississippi Loans Lending Forms For Free online:

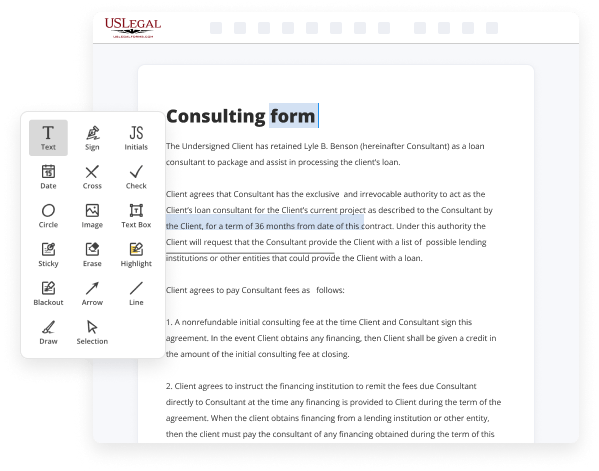

- Upload a file to the editor. You can choose from a couple of options - add it from your device or the cloud or import it from a template library, external URL, or email attachment.

- Fill out the blank fields. Place the cursor on the first empty field and make use of our editor’s navigation to move step-by-step to prevent missing anything on your template. Use Text, Initials, Cross, and Check features.

- Make your necessary modifications. Update the form with inserted images, draw lines and icons, highlight important parts, or remove any unnecessary ones.

- Drop more fillable fields. Modify the template with a new area for fill-out if required. Use the right-side tool pane for this, drop each field where you want others to leave their data, and make the rest of the fields required, optional, or conditional.

- Organize your pages. Remove sheets you don’t need anymore or create new ones while using appropriate button, rotate them, or change their order.

- Generate electronic signatures. Click on the Sign tool and decide how you’d insert your signature to the form - by typing your name, drawing it, uploading its image, or utilizing a QR code.

- Share and send for eSigning. End your editing using the Done button and send your copy to other people for signing via an email request, with a Link to Fill option, in an SMS or fax message. Request a prompt online notarization if required.

- Save the file in the format you need. Download your paperwork, save it to cloud storage in its present format, or convert it as you need.

And that’s how you can prepare and share any personal or business legal documentation in minutes. Give it a try now!

Benefits of Editing Mississippi Loans Lending Forms Online

Top Questions and Answers

With 15,000 salary, borrowers can easily avail small cash loans ranging from 50,000 to 5,00,000. This is easy to repay when broken down into EMIs. However, the loan amount can vary from lender to lender.

Video Guide to Add Checkmark To Legal Mississippi Loans Lending Forms For Free

Today I'm gonna give you a few tips on how to file your title and your bill of sale when you're buying a used car so today I'm gonna give you a few tips on how to fill out your title and your bill of sale usually if you're buying a car from a dealership they will take care of

All of this they'll do the paperwork for everything pretty much but if you're buying a car from somebody else then you have to make sure that everything is correct on the title and that everything is correct on the bill of sales because then you have to go to the DMV and file everything yourself so first on the

Tips to Add Checkmark To Legal Mississippi Loans Lending Forms For Free

- Use a digital editing tool or software to add a checkmark icon next to the required fields on the form

- Ensure that the checkmark is clear and legible for easy verification by the lender

- Double-check the form before submitting to make sure all necessary checkmarks have been added

- Consider using a checkbox instead of a checkmark for easier editing and readability

Adding a checkmark to legal Mississippi loans lending forms can help streamline the verification process for lenders and borrowers. This editing feature may be needed when filling out loan applications or other financial documents that require confirmation of specific information or terms.

Related Searches

Edit Mississippi - UCC1 FINANCING STATEMENT (IN LIEU). Effortlessly add and underline text, insert images, checkmarks, and symbols, drop new fillable fields, .. 6 days ago ? Use our safe, fast, and user-friendly service to Add Watermark To Legal Mississippi Satisfaction Of Mortgage Forms your documents any time ... Eligible Loan Area: The entire geographical area of the State of Mississippi. Equal Credit Opportunity Act (ECOA): A federal law that prohibits lenders from ... Consumer Loan Broker Forms and Applications · The initial license and renewal license fee are each $300. · Surety Bond of $25,000 for appropriate licensing period ... 28-Jun-2016 ? 2504 amends the continuing education requirements under the SAFE Act by (1) reducing the number of hours of education a licensed mortgage loan ... CoreVest Finance provides DSCR loans in Mississippi, which are ideal for real estate investors seeking to purchase, refinance, or renovate commercial or ... Services offered under the CSO programs include credit-related services such as arranging loans with independent third-party lenders and assisting in the ... Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 ... Before the Court is a class action amended complaint setting forth numerous challenges to the lending and insurance practices of Tower and American Federated. Before the Court is a class action amended complaint setting forth numerous challenges to the lending and insurance practices of Tower and American Federated.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.