Add Comments To Legal Indiana Sale Of Business Forms For Free

How it works

-

Import your Indiana Sale Of Business Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Indiana Sale Of Business Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Comments To Legal Indiana Sale Of Business Forms For Free

Legal documentation requires maximum precision and prompt execution. While printing and filling forms out often takes considerable time, online PDF editors prove their practicality and effectiveness. Our service is at your disposal if you’re searching for a reliable and easy-to-use tool to Add Comments To Legal Indiana Sale Of Business Forms For Free quickly and securely. Once you try it, you will be amazed at how effortless dealing with formal paperwork can be.

Follow the instructions below to Add Comments To Legal Indiana Sale Of Business Forms For Free:

- Upload your template through one of the available options - from your device, cloud, or PDF catalog. You can also get it from an email or direct URL or through a request from another person.

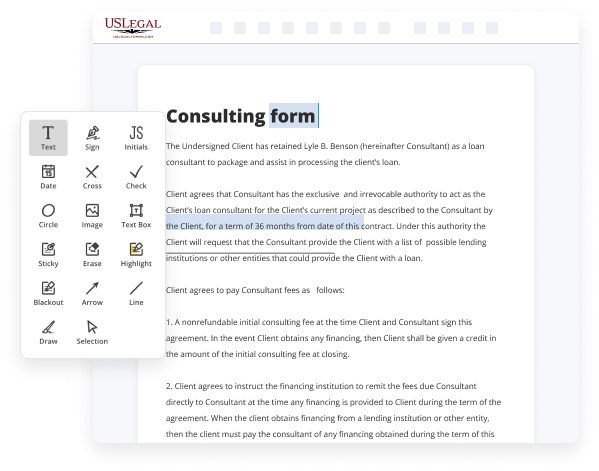

- Utilize the top toolbar to fill out your document: start typing in text fields and click on the box fields to choose appropriate options.

- Make other required adjustments: insert images, lines, or icons, highlight or remove some details, etc.

- Use our side tools to make page arrangements - insert new sheets, change their order, remove unnecessary ones, add page numbers if missing, etc.

- Add extra fields to your document requesting different types of data and place watermarks to protect the contents from unauthorized copying.

- Check if everything is correct and sign your paperwork - generate a legally-binding eSignature in your preferred way and place the current date next to it.

- Click Done when you are ready and decide where to save your form - download it to your device or export it to the cloud in any file format you need.

- Share a copy with others or send it to them for approval through email, a signing link, SMS, or fax. Request online notarization and get your form quickly witnessed.

Imagine doing all of that manually in writing when even a single error forces you to reprint and refill all the data from the beginning! With online solutions like ours, things become much more manageable. Give it a try now!

Benefits of Editing Indiana Sale Of Business Forms Online

Top Questions and Answers

Purpose: Form BT-1 is an application used when registering with the Indiana Department of Revenue for Sales Tax, Withholding Tax, Out-of- State Use Tax, Food and Beverage Tax, County Innkeepers Tax, Tire Fee, and Motor Vehicle Rental Excise Tax, or a combination of these taxes.

Video Guide to Add Comments To Legal Indiana Sale Of Business Forms For Free

Hey gang jim hart back at you here from hawthorne law are you operating your business as an llc did you form an llc recently and are you wondering whether or not you're handling everything properly now that you've started your llc today's video i'm going to share with you all the things that you need to do once you

Start your llc to make sure you don't mess everything up with your business moving forward hey my name is jim hart i'm the founding attorney here at hawthorne law we help online businesses and entrepreneurs to get their legal house in order so that they can focus on doing what they do best and that's helping other people and

Tips to Add Comments To Legal Indiana Sale Of Business Forms For Free

- Read through the Legal Indiana Sale Of Business Form carefully before adding comments.

- Use clear and concise language to ensure your comments are easily understandable.

- Be specific in your comments and provide reasoning or explanations for your suggestions.

- Make sure your comments are relevant to the content of the form and address any issues or concerns you have.

- Consider the perspective of the reader and ensure your comments are helpful and constructive.

The editing feature for adding comments to Legal Indiana Sale Of Business Forms may be needed when reviewing a complex agreement, proposing changes for clarity, or discussing potential legal implications with other stakeholders.

Related Searches

Secretary of State forms are NOT for use by Insurance Corporations or Financial ... Indiana Department of Insurance: (317)-232-5692; Indiana Department of ... Registration for Sales, Use, and Income Taxes. How to Register: A single application (Form BT-1) is used to register with the Indiana Department of Revenue for ... Our drag-and-drop form builder is a game changer. Create your Indiana bill of sale, send it straight to your buyers, and start collecting signatures seamlessly. Contracts that prohibit honest reviews, or threaten legal action over them, harm people who rely on reviews when making their purchase decisions. Consumer Complaint Against A Business/Company. If you prefer to contact us by regular mail, download this form, then print, fill in, and mail. This publication discusses common business expenses and explains what is and is not de- ductible. The general rules for deducting busi-. Vendor Support Center Research the federal market, report sales, and upload contract ... Training & Videos Suggested training for doing business with GSA. Sales tax is a combination of ?occupation? taxes that are imposed on sellers' ... and facilities, county school facility tax, and business district taxes. WB-1, ?Residential Listing Contract Exclusive Right to Sell ... ?Offer to Purchase - Business Without Real Estate. ?WB-24 The tax law also permits certain corporations to be taxed like partnerships and yet retain the other advantages of the corporate form. Such corporations (?S ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.