Add Comments To Legal Maine Debt Settlement Agreement Forms For Free

How it works

-

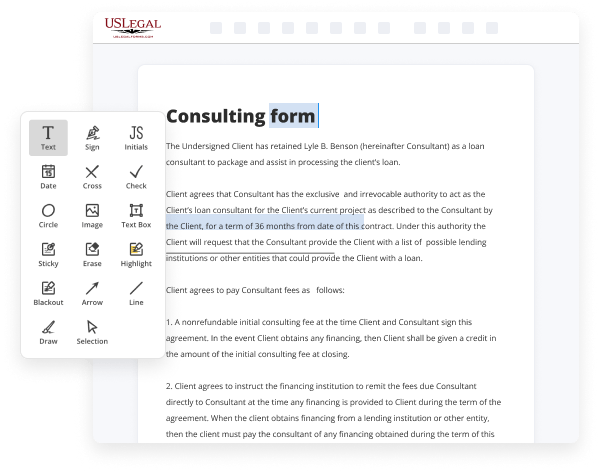

Import your Maine Debt Settlement Agreement Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Maine Debt Settlement Agreement Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Comments To Legal Maine Debt Settlement Agreement Forms For Free

Online PDF editors have proved their reliability and effectiveness for legal paperwork execution. Use our safe, fast, and straightforward service to Add Comments To Legal Maine Debt Settlement Agreement Forms For Free your documents whenever you need them, with minimum effort and highest precision.

Make these quick steps to Add Comments To Legal Maine Debt Settlement Agreement Forms For Free online:

- Upload a file to the editor. You can choose from several options - upload it from your device or the cloud or import it from a form library, external URL, or email attachment.

- Fill out the blank fields. Put the cursor on the first empty field and make use of our editor’s navigation to move step-by-step to avoid missing anything on your template. Use Text, Initials, Cross, and Check tools.

- Make your necessary modifications. Update the form with inserted pictures, draw lines and signs, highlight important elements, or erase any pointless ones.

- Add more fillable fields. Modify the template with a new area for fill-out if neccessary. Make use of the right-side toolbar for this, drop each field where you want others to leave their details, and make the remaining fields required, optional, or conditional.

- Arrange your pages. Delete sheets you don’t need anymore or create new ones utilizing the appropriate button, rotate them, or alter their order.

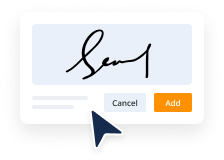

- Generate eSignatures. Click on the Sign tool and choose how you’d insert your signature to the form - by typing your name, drawing it, uploading its image, or using a QR code.

- Share and send for eSigning. End your editing using the Done button and send your copy to other people for signing via an email request, with a Link to Fill option, in an SMS or fax message. Request a quick online notarization if needed.

- Save the file in the format you need. Download your document, save it to cloud storage in its current format, or convert it as you need.

And that’s how you can complete and share any personal or business legal documentation in minutes. Try it today!

Benefits of Editing Maine Debt Settlement Agreement Forms Online

Top Questions and Answers

?Offering 25%-50% of the total debt as a lump sum payment may be acceptable. The actual percentage may vary depending on the circumstances of the borrower as well as the prevailing practices of that particular collection agency.? One benefit of negotiating settlement terms is likely to reduce stress.

Video Guide to Add Comments To Legal Maine Debt Settlement Agreement Forms For Free

Hello guys welcome back to my channel writing practices today we are going to learn how to write a debt settlement letter what is a debt settlement letter a debt settlement letter is a written communication between a debtor and a creditor typically used when a debtor is experiencing financial hardship and unable to repay a debt in full in

This letter the debtor proposes a settlement offer to the creditor which usually involves paying a reduced amount to satisfy the debt often in a lump sum or through a structured payment plan the Creditor May accept or negotiate the offer and if an agreement is reached the terms are documented in the debt settlement letter once both parties agree

Tips to Add Comments To Legal Maine Debt Settlement Agreement Forms For Free

- 1. Use a separate document or software to add comments to the agreement form

- 2. Clearly label your comments to indicate they are not part of the official agreement

- 3. Be concise and to the point with your comments, focusing on key issues or concerns

- 4. Use track changes or highlighting features to make your comments stand out

- 5. Make sure to provide specific suggestions for revisions or additions to the agreement

Adding comments to a legal Maine debt settlement agreement form can help clarify any unclear terms, raise important questions, or propose changes for consideration. This editing feature may be needed when multiple parties are involved in negotiations and need to communicate their thoughts and concerns effectively.

Related Searches

Pursuant to 5 M.R.S.A. Section 1660-H, this document presents implementing regulations for the Maine Uniform Accounting and Auditing Practices for Community ... Updated June 23, 2023. A debt settlement agreement is a contract signed between a creditor and debtor to re-negotiate or compromise on a debt. Debt settlement is an agreement between a lender and a borrower in which the borrower repays a portion of a loan balance and the lender forgives the remainder. DEBT SETTLEMENT AGREEMENT. This Debt Settlement Agreement is entered into as of [Date, Month, and Year] by and between:- Debtor [Name, s/o, Occupation and ... The contract must contain the following notice written in a clear and conspicuous manner: "MAINE CONSUMER'S RIGHT TO. CANCELLATION: YOU MAY CANCEL THIS CONTRACT ... If you're worried about how to get out of debt, here are some things to know ? and how to find legitimate help. What You Can Do On Your Own; Credit Counseling ... 12-Oct-2021 ? The Debt Settlement Agreement is a written agreement between a debtor and creditor where the debtor agrees to pay the creditor the outstanding ... What Should a Loan Agreement Include? · Loan Amount · Interest rate · Length of the Contract · Method of Payment · Repayment Schedule · Late or Missed Payments. A promissory note is a written commitment to pay someone. The document enforces a borrower's promise to pay back a lender by a specified period of time. All of the security instruments, notes, riders & addenda, and special purpose documents that should be used in connection with regularly amortizing one- to ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.