Add Comments To Legal Maryland Independent Contractors Forms For Free

How it works

-

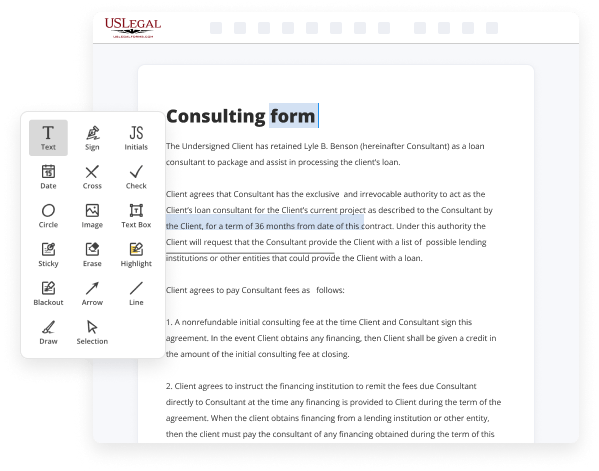

Import your Maryland Independent Contractors Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Maryland Independent Contractors Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Comments To Legal Maryland Independent Contractors Forms For Free

Online document editors have proved their trustworthiness and efficiency for legal paperwork execution. Use our secure, fast, and intuitive service to Add Comments To Legal Maryland Independent Contractors Forms For Free your documents whenever you need them, with minimum effort and greatest accuracy.

Make these quick steps to Add Comments To Legal Maryland Independent Contractors Forms For Free online:

- Upload a file to the editor. You can select from several options - upload it from your device or the cloud or import it from a template catalog, external URL, or email attachment.

- Complete the blank fields. Place the cursor on the first empty field and make use of our editor’s navigation to move step-by-step to prevent missing anything on your template. Use Text, Initials, Cross, and Check features.

- Make your necessary edits. Update the form with inserted pictures, draw lines and signs, highlight significant parts, or erase any pointless ones.

- Create additional fillable fields. Modify the template with a new area for fill-out if neccessary. Make use of the right-side tool pane for this, drop each field where you expect others to leave their details, and make the rest of the areas required, optional, or conditional.

- Organize your pages. Delete sheets you don’t need anymore or create new ones making use of the appropriate key, rotate them, or change their order.

- Generate eSignatures. Click on the Sign tool and decide how you’d insert your signature to the form - by typing your name, drawing it, uploading its picture, or using a QR code.

- Share and send for eSigning. End your editing with the Done button and send your copy to other people for signing through an email request, with a Link to Fill option, in an SMS or fax message. Request a prompt online notarization if required.

- Save the file in the format you need. Download your paperwork, save it to cloud storage in its current format, or convert it as you need.

And that’s how you can complete and share any personal or business legal documentation in minutes. Try it today!

Benefits of Editing Maryland Independent Contractors Forms Online

Top Questions and Answers

It is a crime in this state for any person to engage in or transact any home improvement business, or hold himself out to the public as doing home improvement business, unless he/she is licensed by the Maryland Home Improvement Commission (MHIC). The provisions of this state law may be waived by agreement.

Video Guide to Add Comments To Legal Maryland Independent Contractors Forms For Free

Filing taxes can be complex and daunting especially for self-employed individuals what's most important is filling out the correct tax forms for self-employed people that form is a W-9 with that said here is a step-by-step guide to completing a W-9 form the first two sections of this form are quite simple as they only require your name and the

Name of the business you worked for line three requires you to check the appropriate box for your federal tax classification options include sole proprietorship or single member LLC C corporation S corporation partnership and trust or estate categorizing your business can get tricky so if you need help determining which box to check consult a Tax Advisor for help

Tips to Add Comments To Legal Maryland Independent Contractors Forms For Free

- 1. Use clear and concise language when adding comments to avoid any confusion.

- 2. Clearly identify the section of the form you are commenting on to provide context for the reader.

- 3. Be objective and professional in your comments to maintain credibility.

- 4. Avoid making derogatory or offensive remarks in your comments.

- 5. Make sure your comments are relevant and add value to the form.

Adding comments to legal Maryland independent contractors forms can help clarify information, provide additional insights, or highlight any discrepancies. It is important to follow the tips listed above to ensure that your comments are effective and professional. This editing feature may be needed when there are ambiguous terms or clauses in the form that need further explanation or clarification.

Related Searches

Employee or Independent Contractor? - The Maryland Guide to Wage Payment and Employment Standards - Employment Standards Service-Wage and Hour Information. An independent contractor agreement is a contract between a freelancer and a client outlining work specifics. Protect yourself by including the right terms. Notice to be signed by both parties and retained by the person or business for which the individual performs services: Notice to Independent Contractors and ... 25-Sept-2020 ? All comments must be received by p.m. on October 26, 2020 for consideration in this rulemaking. Commenters should transmit comments early ... This form is used to authorize the use of Independent Activity Funds (IAF) to pay for consultant/independent contractor (vendor) services. You can file a complaint by calling 609-292-2321 or emailing misclass@dol.nj.gov. If your employer is audited by our Division of Employer Accounts, you may ... If you have an employee who expects to have less than $12,950 in income during 2022, you are not required to withhold Maryland state and local income tax. 12-Oct-2022 ? Of the two methods, the Department strongly recommends that commenters submit their comments electronically via to ... Misclassification means treating workers as independent contractors when legally they should be employees. If you think an employer is violating the law by ... Write the Independent Contractor number (ICQ 001) within the Comments section of the eVA order, on all contracts and invoices prior to sending to Accounts ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.