Add Comments To Legal Texas Corporations And LLC Forms For Free

How it works

-

Import your Texas Corporations And LLC Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Texas Corporations And LLC Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Comments To Legal Texas Corporations And LLC Forms For Free

Online document editors have demonstrated their reliability and effectiveness for legal paperwork execution. Use our safe, fast, and user-friendly service to Add Comments To Legal Texas Corporations And LLC Forms For Free your documents whenever you need them, with minimum effort and maximum precision.

Make these simple steps to Add Comments To Legal Texas Corporations And LLC Forms For Free online:

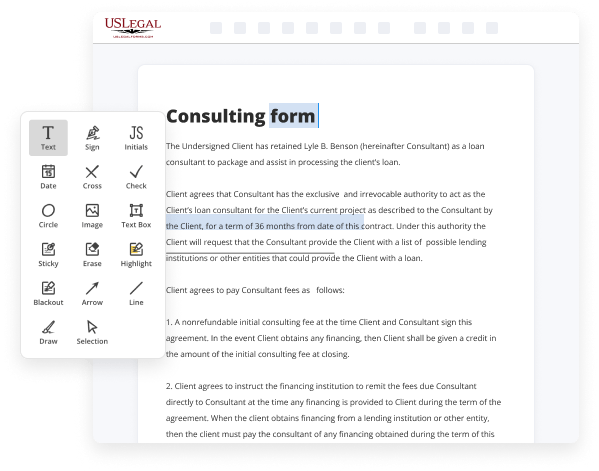

- Import a file to the editor. You can choose from several options - upload it from your device or the cloud or import it from a template catalog, external URL, or email attachment.

- Complete the blank fields. Place the cursor on the first empty area and use our editor’s navigation to move step-by-step to prevent missing anything on your template. Use Text, Initials, Cross, and Check tools.

- Make your necessary modifications. Update the form with inserted images, draw lines and icons, highlight significant components, or erase any pointless ones.

- Add more fillable fields. Adjust the template with a new area for fill-out if required. Use the right-side toolbar for this, drop each field where you expect other participants to leave their data, and make the rest of the fields required, optional, or conditional.

- Arrange your pages. Delete sheets you don’t need anymore or create new ones making use of the appropriate button, rotate them, or alter their order.

- Generate electronic signatures. Click on the Sign option and choose how you’d insert your signature to the form - by typing your name, drawing it, uploading its picture, or using a QR code.

- Share and send for eSigning. Finish your editing with the Done button and send your copy to other parties for signing via an email request, with a Link to Fill option, in an SMS or fax message. Request a quick online notarization if needed.

- Save the file in the format you need. Download your document, save it to cloud storage in its current format, or transform it as you need.

And that’s how you can prepare and share any individual or business legal paperwork in clicks. Give it a try today!

Benefits of Editing Texas Corporations And LLC Forms Online

Top Questions and Answers

Under Texas Business Organization Code section 101.105, a new member may be added to an LLC but only with the approval of all current members of the LLC. Thus, approval of the new member must be unanimous.

Video Guide to Add Comments To Legal Texas Corporations And LLC Forms For Free

Oftentimes small businesses don't consider corporate entities when forming their business those are reserved for the multi-billion dollar companies of the world but in fact these corporate structures can be an advantageous option for organizations of all sizes c corporations are the most common type of corporate tax entity and for a good reason their structure offers flexibility and opportunities

For growth while a c corp does offer a lot of benefits there are also some drawbacks here's everything you need to know about forming a c-corp a c-corp is a business structure that taxes the corporation separate from its members members of c-corps are shareholders and c-corps are legally independent of their owners more complex structures than other business

Tips to Add Comments To Legal Texas Corporations And LLC Forms For Free

- Always read and understand the form before adding comments.

- Use clear and concise language to make your comments easy to understand.

- Make sure your comments are relevant and address specific sections of the form.

- Use comments to point out errors or inconsistencies in the form.

- Avoid using comments to express personal opinions or unrelated information.

The ability to add comments to legal Texas Corporations and LLC forms can be helpful when reviewing and finalizing documents with multiple stakeholders or when seeking clarification on certain sections of the form. It may also be useful when working with legal counsel to ensure accuracy and compliance with state regulations.

Related Searches

If amending information relating to directors or governing persons, use a business or post office box address rather than a residence address if privacy ... Business and Nonprofit Forms · Formation of Business Entities and Nonprofit Corporations Under the Texas Business Organizations Code · Registering Out-of-State ... This form is used to change or add terms to a contract that has already been executed. Related Terms: Contracts, Forms & Applications, Contracts, ... Owned By, Corporation: Enter information for each (parent) corporation, LLC, LP, PA or financial institution, if any, that owns an interest of 10 percent or ... 02-Aug-2023 ? Learn how to start an LLC in Texas in just a few simple steps. Read our guide to learn about Texas LLC requirements, fees, registration and ... 17-May-2023 ? What To Include in a Texas LLC Operating Agreement · LLC member names · Each member's rights, roles and responsibilities · Financial contribution ... 15-Aug-2012 ? §. 153.110. 48 In Texas, a shareholder has no statutory right to withdraw or to ?put? the shareholder's shares to the corporation or the other. If the entity is a series LLC, different forms will need to be filed. We will make sure to prepare and file the correct forms for your company. There is no ... Startup Guide · Limited Liability Company, Corporation, Limited Partnership & Others. A LLC, INC, LP, LLP, or a Non-Profit business files with the Texas ... Call or text 800-929-1725. Should I form an LLC for my Texas business is a question answered by Attorneys Philip Hundl and Kari Wittig.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.