Add Conditional Fields Legal North Dakota Mortgage Satisfaction Forms For Free

How it works

-

Import your North Dakota Mortgage Satisfaction Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your North Dakota Mortgage Satisfaction Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Conditional Fields Legal North Dakota Mortgage Satisfaction Forms For Free

Online document editors have demonstrated their reliability and efficiency for legal paperwork execution. Use our secure, fast, and intuitive service to Add Conditional Fields Legal North Dakota Mortgage Satisfaction Forms For Free your documents any time you need them, with minimum effort and maximum accuracy.

Make these simple steps to Add Conditional Fields Legal North Dakota Mortgage Satisfaction Forms For Free online:

- Import a file to the editor. You can select from several options - upload it from your device or the cloud or import it from a template catalog, external URL, or email attachment.

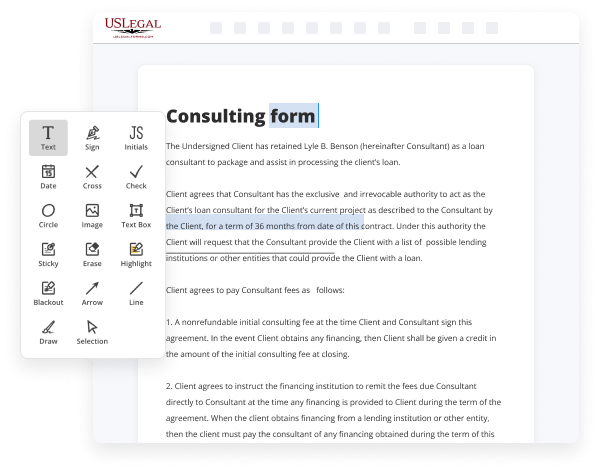

- Complete the blank fields. Place the cursor on the first empty field and make use of our editor’s navigation to move step-by-step to prevent missing anything on your template. Use Text, Initials, Cross, and Check tools.

- Make your necessary edits. Update the form with inserted images, draw lines and signs, highlight significant parts, or remove any pointless ones.

- Drop more fillable fields. Modify the template with a new area for fill-out if neccessary. Use the right-side tool pane for this, drop each field where you expect other participants to leave their details, and make the rest of the fields required, optional, or conditional.

- Arrange your pages. Remove sheets you don’t need any longer or create new ones while using appropriate key, rotate them, or alter their order.

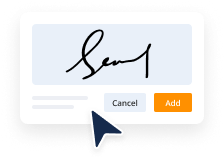

- Create electronic signatures. Click on the Sign option and choose how you’d insert your signature to the form - by typing your name, drawing it, uploading its image, or using a QR code.

- Share and send for eSigning. Finish your editing using the Done button and send your copy to other people for approval via an email request, with a Link to Fill option, in an SMS or fax message. Request a prompt online notarization if needed.

- Save the file in the format you need. Download your document, save it to cloud storage in its current format, or convert it as you need.

And that’s how you can prepare and share any personal or business legal documentation in clicks. Try it today!

Benefits of Editing North Dakota Mortgage Satisfaction Forms Online

Top Questions and Answers

Lenders use due-on-sale clauses to prevent the buyer of a property from assuming the current loan at the original interest rate. They are often used in a rising interest rate environment.

Video Guide to Add Conditional Fields Legal North Dakota Mortgage Satisfaction Forms For Free

Welcome to county office your ultimate guide to local government services and public records let's get started how to know if I have overdraft protection to determine if you have overdraft protection you should start by reviewing your deposit account agreement this document outlines the terms and conditions of any overdraft protection programs your bank may offer check with your

Bank directly to find out the specifics of their overdraft prot protection programs banks are not required to offer overdraft protection and even if they do they may retain discretion to pay or not pay a particular overdraft transaction overdraft protection typically involves linking a checking account to another account such as a savings account line of credit or credit

Explore North Dakota Real Estate Forms and find the form that suits your needs. Satisfaction of mortgage in the common form may be recorded at any time. 3. This law digest was last updated in 2015, and is used for survey law references in the NDSPLS Manual of Practice for Land. 43-9-10 Conditional limitation--Remainder limited on contingency. If the use is not legal, the property is not eligible for FHA mortgage insurance. View on Westlaw or start a FREE TRIAL today, § 11. Satisfaction or release of mortgage—North Dakota—By assignee, Legal Forms. ND Rent Help (NDRH) assists qualifying households experiencing homelessness. Conditional Ownership: The borrower grants conditional ownership of the property to the lender until the loan is repaid in full. Bank of North Dakota (BND) is required to disclose and collect specific documents from each borrower prior to disbursing the DEAL loan funds to the school.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.