Add Date To Legal Colorado Accounting Forms For Free

How it works

-

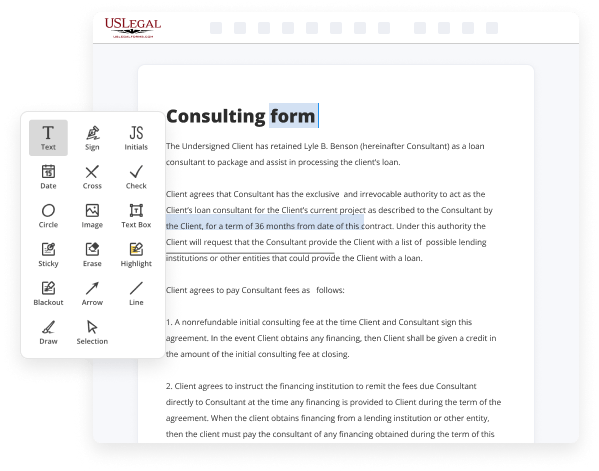

Import your Colorado Accounting Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Colorado Accounting Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Date To Legal Colorado Accounting Forms For Free

Are you tired of endless document printing, scanning, postal delivery, and spending precious time and resources with manual fill-out? The times have moved on, and the simplest way to Add Date To Legal Colorado Accounting Forms For Free and make any other essential updates to your forms is by managing them online. Select our quick and reliable online editor to fill out, modify, and execute your legal documentation with maximum effectiveness.

Here are the steps you should take to Add Date To Legal Colorado Accounting Forms For Free quickly and effortlessly:

- Upload or import a file to the editor. Drag and drop the template to the upload area, import it from the cloud, or use an alternative option (extensive PDF library, emails, URLs, or direct form requests).

- Provide details you need. Fill out blank fields using the Text, Check, and Cross tools from our top pane. Use our editor’s navigation to make certain you’ve filled in everything. Accentuate the most significant details with the Highlight option and erase or blackout areas with no value.

- Adjust and rearrange the template. Use our upper and side toolbars to change your content, drop extra fillable fields for different data types, re-order sheets, add new ones, or delete unnecessary ones.

- Sign and request signatures. Whatever method you select, your eSignature will be legally binding and court-admissible. Send your form to others for approval using email or signing links. Notarize the paperwork right in our editor if it needs witnessing.

- Share and save the copy. Download or export your accomplished documentation to the cloud in the format you need, print it out if you require a hard copy, and choose the most appropriate file-sharing option (email, fax, SMS, or sent by snail mail using the USPS).

With our service, you don’t have any more excuses to complete legal documents manually. Save time and effort executing them online twice as quickly and more efficiently. Try it out now!

Benefits of Editing Colorado Accounting Forms Online

Top Questions and Answers

Colorado's CPA certification requirement is relatively strict compared with other state standards. The exam requires no more than 150 hours of study. This will provide you with a comprehensive review of the Colorado Uniform CPA exam requirements, as well as the education and experience required to be a licensed CPA.

Video Guide to Add Date To Legal Colorado Accounting Forms For Free

Hello and welcome to the session in which we will discuss schedule M3 a form 1120. in the prior sessions we looked at schedule M1 and we looked at schedule M2 so it's very important to real quick review what's in schedule M1 in schedule M1 we looked at our book income or simply put Gap income then we compare

Gap income we reconcile we did not compare we reconcile Gap income to taxable income what is taxable income income under the the IRS rule so we looked at the differences because the IRS is interested in learning why you have for example High net income for Gap purposes but when it comes to taxes you have low net income

Tips to Add Date To Legal Colorado Accounting Forms For Free

- Make sure to include the date format required by Colorado accounting regulations

- Double check the accuracy of the date before submitting the form

- Consider using digital tools or software to easily add and update dates on the forms

- Follow any specific guidelines provided by the Colorado Department of Revenue for dating legal forms

- Keep a record of the date the form was prepared or signed for future reference

Adding the date to legal Colorado accounting forms is crucial for compliance and record-keeping purposes. This editing feature may be needed when preparing financial statements, tax returns, or any other official documents that require a date to be recorded.

Related Searches

List below each individual item of funds received or collected for this accounting period. Attach additional pages, if needed. Date. Description of Funds ... Add Watermark To Legal Colorado Accounting Forms with a comprehensive online service helping thousands of users process their paperwork quickly and easily. Interim Or Final Accounting Pursuant To Colorado Rules Of Probate Procedure Rule 31 Form. This is a Colorado form and can be use in Probate Statewide. Complete this form in accordance with section 39-22-303.6 C.R.S., and the regulations thereunder. DR 0112RF (10/24/22). COLORADO DEPARTMENT OF ... To resubmit a form with corrections, the taxpayer must initial and date each change, or add a new signature and date at the bottom. The taxpayer ... These forms are believed to satisfy minimum legal requirements as of their respective revision dates, compliance with applicable law, as the same may be amended ... A. These Peer Review requirements shall be effective for Certificate Holders and Firms upon renewal of. CPA certificates and Firm registrations in 2014. At that ... Please allow up to six weeks from your file completion date (when application, ... The Colorado Board of Accountancy requires that all licensure eligible ... Finance Procedural Statement: Business Expense Substantiation & Tax Implications. Effective Date: January 1, 2023 (see Revision Log for what changed on this ... Accounting Methods . ... See the March 2022 revision of the Instructions for Form 941 ... one has responded, or the IRS hasn't responded by the date.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.