Add Date To Legal Nebraska Accounts Receivables Forms For Free

How it works

-

Import your Nebraska Accounts Receivables Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Nebraska Accounts Receivables Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Date To Legal Nebraska Accounts Receivables Forms For Free

Legal paperwork requires highest accuracy and prompt execution. While printing and completing forms usually takes plenty of time, online document editors prove their practicality and effectiveness. Our service is at your disposal if you’re looking for a trustworthy and easy-to-use tool to Add Date To Legal Nebraska Accounts Receivables Forms For Free rapidly and securely. Once you try it, you will be amazed at how effortless working with official paperwork can be.

Follow the instructions below to Add Date To Legal Nebraska Accounts Receivables Forms For Free:

- Add your template through one of the available options - from your device, cloud, or PDF library. You can also get it from an email or direct URL or through a request from another person.

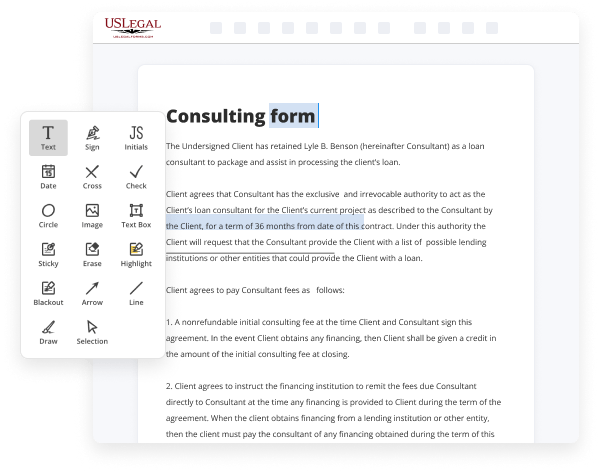

- Use the upper toolbar to fill out your document: start typing in text fields and click on the box fields to select appropriate options.

- Make other required modifications: insert pictures, lines, or signs, highlight or delete some details, etc.

- Use our side tools to make page arrangements - insert new sheets, alter their order, delete unnecessary ones, add page numbers if missing, etc.

- Add extra fields to your document requesting various types of data and place watermarks to protect the contents from unauthorized copying.

- Check if all information is correct and sign your paperwork - generate a legally-binding electronic signature in your preferred way and place the current date next to it.

- Click Done once you are ready and decide where to save your form - download it to your device or export it to the cloud in whatever file format you need.

- Share a copy with other people or send it to them for approval through email, a signing link, SMS, or fax. Request online notarization and get your form quickly witnessed.

Imagine doing all the above manually on paper when even a single error forces you to reprint and refill all the data from the beginning! With online services like ours, things become much more manageable. Give it a try now!

Benefits of Editing Nebraska Accounts Receivables Forms Online

Top Questions and Answers

Employers who cancel their income tax withholding account within 30 days after discontinuing business must file a final Nebraska Reconciliation of Income Tax Withheld, Form W-3N, and attach the state copy of each Federal Form W-2, Wage and Tax Statement, that was issued to each employee.

Video Guide to Add Date To Legal Nebraska Accounts Receivables Forms For Free

Creating an llc in nebraska is pretty straightforward but when you finally get around to fleshing out your operating agreement there are important decisions to make that set the tone of exactly how you will do business and get paid operating agreements are the lifeblood of your company and may be the most important document that you will create throughout

The life of your business with that let's go over a few important things to know before creating your agreement in this video we'll cover a quick overview of llc's and operating agreements laws specific to the state of nebraska what to include in your operating agreement and where to find an official template first what is an llc in

Related Features

Tips to Add Date To Legal Nebraska Accounts Receivables Forms For Free

- Make sure to include a section for the date on the Accounts Receivables form

- Consider using a date format that is commonly used and easily understood

- Clearly label where the date should be written on the form

- Provide instructions for the person filling out the form on where to add the date

- Regularly review and update the Accounts Receivables forms to ensure the date field is still relevant and necessary

Adding the date to Legal Nebraska Accounts Receivables forms is important for keeping accurate records of when payments are received. This information can be helpful for tracking transactions, identifying trends, and resolving any discrepancies that may arise. It is also crucial for complying with legal requirements and ensuring that all payments are properly documented. This editing feature may be needed whenever a new Accounts Receivables form is created, or when updates are made to existing forms that require the inclusion of a date field.

Related Searches

The records required to substantiate any return must be retained and be available for at least 3 years following the date the value was certified. Accounting ... Unsettled accounts draw interest at legal rate beginning six months from date of last item, whether it be debit or credit, but greater rate may be agreed upon. The due date for furnishing statements to recipients for Forms 1099-B, 1099-S, and 1099-MISC (if amounts are reported in boxes 8 or 10) is February 15, ... However, employers that pay qualified sick and family leave wages in 2022 for leave taken after March 31, 2020, and before October 1, 2021, are eligible to. Forms Search the database of GSA forms, standard (SF) and optional (OF) ... GSA1582, Revocable License for Non-Federal Use of Real Property, Legal and ... This legal blog by Sam Turco provides exclusive insight for consumers in Nebraska facing a wide spectrum of debt relief and bankruptcy ... If a taxpayer transfers, sells, assigns, or otherwise disposes of an account receivable, he or she shall be deemed to have received the full balance of the ... Establishing an Overpayment and Accounts Receivable in N-FOCUS for months ... SNAP benefits will be terminated as of (worker to add date) for refusal to ... We reviewed the State agency's current policies, procedures and controls over the drug rebate program and the accounts receivable data reported ... Case Citations?Most Common Form. Illustrations ... Accts. Receivable Mgmt. , 497 Fed. ... consists of the docket number and date in the format shown here.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.