Add Date To Legal Texas Accounts Receivables Forms For Free

How it works

-

Import your Texas Accounts Receivables Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Texas Accounts Receivables Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Date To Legal Texas Accounts Receivables Forms For Free

Online document editors have demonstrated their trustworthiness and efficiency for legal paperwork execution. Use our safe, fast, and user-friendly service to Add Date To Legal Texas Accounts Receivables Forms For Free your documents whenever you need them, with minimum effort and maximum accuracy.

Make these quick steps to Add Date To Legal Texas Accounts Receivables Forms For Free online:

- Import a file to the editor. You can select from a couple of options - upload it from your device or the cloud or import it from a template library, external URL, or email attachment.

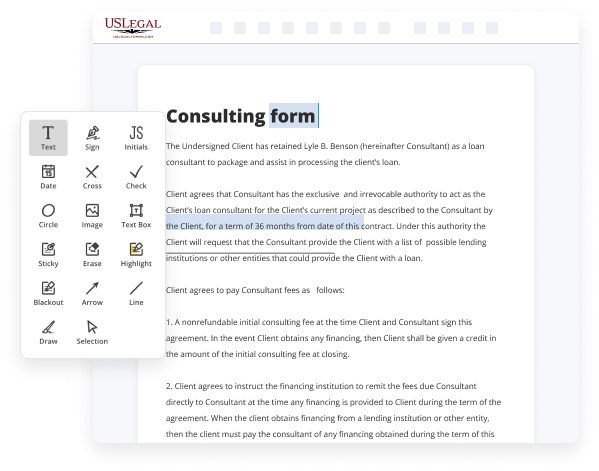

- Fill out the blank fields. Put the cursor on the first empty area and make use of our editor’s navigation to move step-by-step to prevent missing anything on your template. Use Text, Initials, Cross, and Check tools.

- Make your necessary modifications. Update the form with inserted images, draw lines and signs, highlight significant parts, or remove any pointless ones.

- Create additional fillable fields. Adjust the template with a new area for fill-out if neccessary. Make use of the right-side tool pane for this, drop each field where you expect other participants to leave their data, and make the rest of the areas required, optional, or conditional.

- Organize your pages. Delete sheets you don’t need any longer or create new ones utilizing the appropriate button, rotate them, or change their order.

- Generate electronic signatures. Click on the Sign option and choose how you’d insert your signature to the form - by typing your name, drawing it, uploading its image, or using a QR code.

- Share and send for eSigning. Finish your editing using the Done button and send your copy to other parties for signing through an email request, with a Link to Fill option, in an SMS or fax message. Request a quick online notarization if necessary.

- Save the file in the format you need. Download your paperwork, save it to cloud storage in its current format, or transform it as you need.

And that’s how you can complete and share any individual or business legal paperwork in minutes. Give it a try now!

Benefits of Editing Texas Accounts Receivables Forms Online

Top Questions and Answers

Average accounts receivable is calculated as the sum of starting and ending receivables over a set period of time (generally monthly, quarterly or annually), divided by two.

Video Guide to Add Date To Legal Texas Accounts Receivables Forms For Free

YouTube what's going on in this video I'm going to show you how I removed a collection off my credit report in 24 hours now this is not a substitution from the traditional way of sending out letters waiting sending out more letters and waiting even longer but before you go that long drown out route try the easy steps

First this being one of them and if it doesn't work then send your letters so if you're trying to get your credit together or just want the drop of all the latest financial news you've came to the right place this is a great channel to have in your back pocket covering everything from credit repair high limit credit

Tips to Add Date To Legal Texas Accounts Receivables Forms For Free

- Make sure to include the date prominently on the top of the Accounts Receivables form

- Use a consistent date format (e.g. MM/DD/YYYY or Month DD, YYYY) to avoid confusion

- Consider adding fields for both the current date and the date of the transaction

- Include a signature line with a space for the date to be written by the account holder

- Be sure to update the date each time a new transaction is recorded

Adding the date to legal Texas Accounts Receivables forms is important for providing clarity and establishing a timeline for transactions. This editing feature may be needed when creating or updating forms to ensure all details are accurately recorded and easily accessible for reference or dispute resolution.

Related Searches

The law requires all No Tax Due Reports originally due after Jan. 1, 2016 to be filed electronically. For the 2022 report year, a passive entity as defined in ... Upon acceptance, the form will be stamped with the name of the filing officer, date and hour of filing and a consecutive file number. An acknowledgment copy ... What types of documents are filed with the Secretary of State or county clerk? Where can I file my documents? What are the filing fees? Do I need to send in ... For this method, use the record layouts described in AR Process 2; the records are posted with the IBDU010 only. Invoice Number. Both of the interface methods ... Find forms for Financial Aid and Student records. Contact Texas One Stop with any questions about the forms. FMO Forms. Expand all. Access and Security ... from Texas state sales tax. Operational Accounting ... from Texas state sales tax. Sales and Receivables. If a student wants to make multiple payments, there will be three (3) tuition payment due dates ? August 17 (week before classes start), September 10 (12th ... TAMUCC cannot help students or parents fill out their tax form for liability reasons. ... The dates the Accounts Receivable and Business Office will begin ... In order to receive the extension, you must submit the request to the Gregg County Appraisal District in writing before the April 15 rendition filing deadline. Reduction in Income Appeal. After you have completed either your FAFSA or TASFA, use this appeal form to request consideration of student and/or parent ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.