Add Date To Legal Utah Accounting Forms For Free

How it works

-

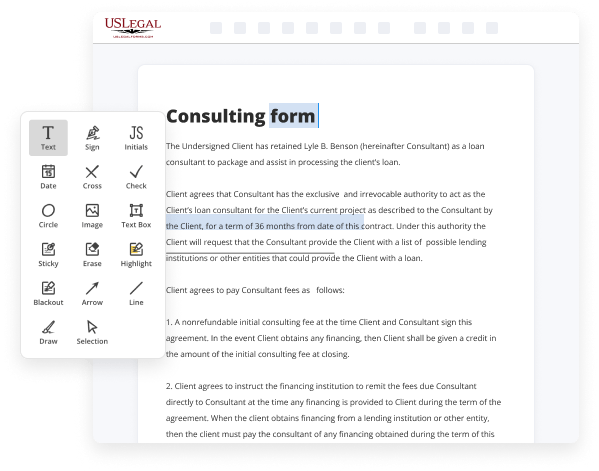

Import your Utah Accounting Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Utah Accounting Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Date To Legal Utah Accounting Forms For Free

Are you tired of endless document printing, scanning, postal delivery, and spending precious time and resources with manual fill-out? The times have moved on, and the easiest way to Add Date To Legal Utah Accounting Forms For Free and make any other essential adjustments to your forms is by handling them online. Choose our quick and reliable online editor to fill out, edit, and execute your legal paperwork with greatest efficiency.

Here are the steps you should take to Add Date To Legal Utah Accounting Forms For Free easily and quickly:

- Upload or import a file to the service. Drag and drop the template to the upload area, import it from the cloud, or use another option (extensive PDF library, emails, URLs, or direct form requests).

- Provide the required information. Complete blank fields using the Text, Check, and Cross tools from our top pane. Use our editor’s navigation to make sure you’ve completed everything. Accentuate the most important facts with the Highlight option and erase or blackout fields with no value.

- Modify and rearrange the template. Use our upper and side toolbars to update your content, drop extra fillable fields for various data types, re-order pages, add new ones, or delete redundant ones.

- Sign and request signatures. Whatever method you select, your eSignature will be legally binding and court-admissible. Send your form to other people for signing through email or signing links. Notarize the paperwork right in our editor if it needs witnessing.

- Share and save the copy. Download or export your completed paperwork to the cloud in the format you need, print it out if you require a physical copy, and choose the most appropriate file-sharing method (email, fax, SMS, or sent by snail mail using the USPS).

With our service, you don’t have any more excuses to prepare legal documents manually. Save time and effort executing them online twice as quickly and more effectively. Try it out now!

Benefits of Editing Utah Accounting Forms Online

Top Questions and Answers

If the judge makes a decision without a hearing or if the judge or commissioner takes the matter under advisement, they will usually decide on the motion within 60 days after the motion was submitted.

Video Guide to Add Date To Legal Utah Accounting Forms For Free

Hey guys today I'm going to cover everything you need to know as a small business owner about paying quarterly taxes so here's a list of everything I'm going to go over in this video first of all how much to pay who has to pay when to pay your quarterlies and how to pay them and finally just a

Few more specific notes about how tax brackets work so let's start out with the hardest question how much do you need to pay in quarterly taxes so just to make sure we're on the same page if you're a small business owner and you owe more than a thousand dollars in taxes in a year then you're going to

Tips to Add Date To Legal Utah Accounting Forms For Free

- Make sure to include the date in the designated section of the accounting form

- Use the correct format for the date, usually month/day/year

- Double check the date for accuracy before submitting the form

- Consider using a date stamp for added convenience and efficiency

Adding the date to legal Utah accounting forms is crucial for record-keeping and compliance purposes. It helps track transactions, financial activities, and deadlines. This editing feature may be needed when completing financial reports, tax filings, or any official documents that require a precise timeline of events.

Related Searches

Forms for annual financial accounting reports are in the forms section below. There is a filing fee for filing the forms with the court. Attorneys are required to eFile all documents with the court. ... Utah Rule of Civil Procedure 6 defines how to calculate deadline dates:. Use form TC-69 to register with the Utah State Tax Commission for the taxes ... Previous or existing accounts: Enter all previous or existing Utah tax. Verify if things are true and sign your paperwork - create a legally-binding electronic signature the way you prefer and place the current date next to it. Use Form 2848 to authorize an individual to represent you before the IRS. See Substitute Form 2848, later, for information. Students who have their classes deleted due to non-payment of Tuition and Housing may NOT reinstate cancelled classes or use ?Late Add Forms? to add classes. ( ... The 2023 guide to Utah landlord-tenant laws for property managers or investors. Includes rules, rights, & responsibilities for rental properties. Start your LLC (Limited Liability Company) in 8 easy steps with our guide, including choosing a state & registered agent, foreign qualification, & more. A legal marriage guarantees many benefits even after the relationship is over. ... such as filing a joint tax return, sharing financial accounts, and so on. Position Summary: Finance Specialist: (Accounts Payable/Payroll) Finance Specialists help facilitate and document their company's financial transactions ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.