Add Demanded Field Legal Oklahoma Accounting Forms For Free

How it works

-

Import your Oklahoma Accounting Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Oklahoma Accounting Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Demanded Field Legal Oklahoma Accounting Forms For Free

Online document editors have proved their trustworthiness and efficiency for legal paperwork execution. Use our secure, fast, and user-friendly service to Add Demanded Field Legal Oklahoma Accounting Forms For Free your documents whenever you need them, with minimum effort and highest precision.

Make these simple steps to Add Demanded Field Legal Oklahoma Accounting Forms For Free online:

- Upload a file to the editor. You can select from several options - add it from your device or the cloud or import it from a form catalog, external URL, or email attachment.

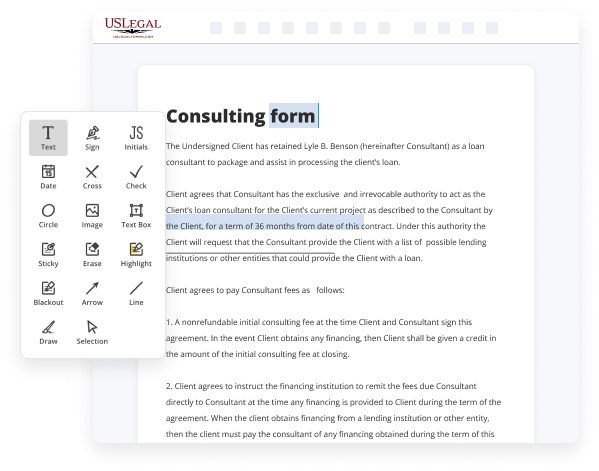

- Fill out the blank fields. Put the cursor on the first empty field and use our editor’s navigation to move step-by-step to prevent missing anything on your template. Use Text, Initials, Cross, and Check features.

- Make your necessary edits. Update the form with inserted pictures, draw lines and signs, highlight important elements, or remove any pointless ones.

- Add more fillable fields. Adjust the template with a new area for fill-out if neccessary. Use the right-side toolbar for this, drop each field where you expect other participants to provide their data, and make the remaining fields required, optional, or conditional.

- Organize your pages. Delete sheets you don’t need any longer or create new ones making use of the appropriate key, rotate them, or alter their order.

- Create eSignatures. Click on the Sign option and choose how you’d add your signature to the form - by typing your name, drawing it, uploading its picture, or using a QR code.

- Share and send for eSigning. Finish your editing using the Done button and send your copy to other parties for approval through an email request, with a Link to Fill option, in an SMS or fax message. Request a prompt online notarization if required.

- Save the file in the format you need. Download your paperwork, save it to cloud storage in its present format, or transform it as you need.

And that’s how you can complete and share any personal or business legal documentation in clicks. Give it a try today!

Benefits of Editing Oklahoma Accounting Forms Online

Top Questions and Answers

The number of withholding allowances claimed on Oklahoma Form OK-W-4 must be used. An individual's withholding allowance amount is the Oklahoma individual income tax personal exemption amount of $1,000 divided by the number of payroll periods in the calendar year.

Video Guide to Add Demanded Field Legal Oklahoma Accounting Forms For Free

If you use the perfect prompt when you prompt chat GPT or if you prompt Bard or Bing you're going to be really Blown Away by the result that you're going to get it's going to save you a ton of time so I've studied this for three to four hours a day since GPT 3 came out I've taken

A bunch of courses anything I could get my hands on and tested a whole lot of different ways to prompt these platforms and I think I've crafted a really useful formula that you could Implement for pretty much any situation so I want to share that with you in this video and hopefully after this you could just copy

Tips to Add Demanded Field Legal Oklahoma Accounting Forms For Free

- Identify the specific fields that need to be added based on the requirements of your accounting task.

- Ensure you have the correct legal context for the forms to maintain compliance.

- Use clear and concise labels for the new fields to avoid confusion.

- Test the new fields to ensure they work properly and capture the needed data effectively.

- Keep a backup of the original forms before making any changes.

- Consult with a legal expert if you're unsure about the changes to ensure everything is lawful.

This editing feature for adding demanded fields to Legal Oklahoma Accounting Forms may be needed when you have specific information that is required for reporting or compliance that is not already covered in the existing forms.

The letter listed for each form represents the group for that GAAP conversion package. No information is available for this page. 1099 Account Code Cross-Reference. Xlsx ; OMES Form 10A, Cash Transfer Request. Upon completion of application please mail to the county assessor's office in which the facility is located. Do not use previous year(s) forms. Many good forms are now in use, and each board of education shall determine if its forms meet the legal requirements. The purpose of this Risk Alert is to provide information on the Act and on some of the potential professional liability ramifications to CPAs. Use Form SS4 to apply for an EIN. The primary program objective is to provide students with a baccalaureate degree with a major other than Accounting to qualify to take the Oklahoma CPA exam.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.