Add Drop-down Field To Legal Connecticut Fair Credit Reporting Forms For Free

How it works

-

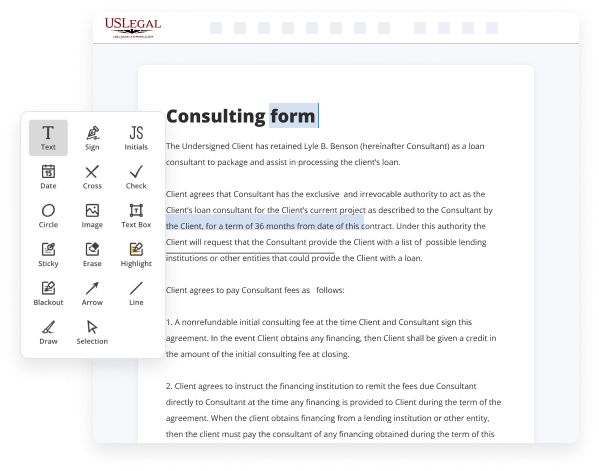

Import your Connecticut Fair Credit Reporting Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Connecticut Fair Credit Reporting Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Drop-down Field To Legal Connecticut Fair Credit Reporting Forms For Free

Online document editors have proved their reliability and efficiency for legal paperwork execution. Use our safe, fast, and user-friendly service to Add Drop-down Field To Legal Connecticut Fair Credit Reporting Forms For Free your documents any time you need them, with minimum effort and maximum precision.

Make these quick steps to Add Drop-down Field To Legal Connecticut Fair Credit Reporting Forms For Free online:

- Import a file to the editor. You can select from a couple of options - upload it from your device or the cloud or import it from a template library, external URL, or email attachment.

- Complete the blank fields. Put the cursor on the first empty area and use our editor’s navigation to move step-by-step to prevent missing anything on your template. Use Text, Initials, Cross, and Check features.

- Make your necessary modifications. Update the form with inserted pictures, draw lines and symbols, highlight important parts, or erase any unnecessary ones.

- Drop more fillable fields. Modify the template with a new area for fill-out if required. Use the right-side tool pane for this, place each field where you expect others to provide their details, and make the remaining areas required, optional, or conditional.

- Arrange your pages. Remove sheets you don’t need any longer or create new ones using the appropriate key, rotate them, or change their order.

- Create electronic signatures. Click on the Sign option and choose how you’d add your signature to the form - by typing your name, drawing it, uploading its picture, or using a QR code.

- Share and send for eSigning. Finish your editing using the Done button and send your copy to other people for approval via an email request, with a Link to Fill option, in an SMS or fax message. Request a quick online notarization if required.

- Save the file in the format you need. Download your paperwork, save it to cloud storage in its current format, or transform it as you need.

And that’s how you can complete and share any personal or business legal paperwork in minutes. Try it now!

Benefits of Editing Connecticut Fair Credit Reporting Forms Online

Top Questions and Answers

AnnualCreditReport.com is the only official site explicitly directed by Federal law to provide them.

Video Guide to Add Drop-down Field To Legal Connecticut Fair Credit Reporting Forms For Free

The Fair Credit Reporting Act is a statute enacted in 1971 by Congress in order to regulate the activities of credit reporting agencies like TransUnion Experian Equifax it also regulates the activities of users of those credit reports it regulates the activities regarding credit of the furnishes of information to those credit reporting agencies and it also provides remedies to

Consumers who are damaged as a result of any violation of its regulations or requirements under the ACT under the Fair Credit Reporting Act furnishers of information are required to provide accurate information on your credit report the credit reporting agencies are responsible for keeping that information making sure that information is accurate so that if you were to write

Tips to Add Drop-down Field To Legal Connecticut Fair Credit Reporting Forms For Free

- Review the Fair Credit Reporting Act (FCRA) regulations to ensure compliance with necessary information.

- Identify the specific fields where a drop-down menu would be beneficial for selection.

- Choose a user-friendly and clear labeling for each drop-down option to facilitate easy selection.

- Utilize a form-building software or platform that allows for easy insertion of drop-down fields.

- Test the functionality of the drop-down field to ensure that data can be easily selected and submitted correctly.

- Consider adding an option for 'Other' with a text field for users to input additional information if needed.

Editing features for adding drop-down fields to Legal Connecticut Fair Credit Reporting Forms may be needed when creating user-friendly and accessible forms for gathering personal information. A drop-down field can streamline the selection process for users and ensure accurate data collection.

Related Searches

Make these simple steps to Add Required Fields To Legal Connecticut Fair Credit Reporting Forms online: · Upload a file to the editor. · Fill out the blank fields ... Add Signature Field To Legal Connecticut Fair Credit Reporting Forms with a comprehensive online service helping thousands of users process their paperwork ... This form provides broad language that allows a credit report to be generated for any type of legal reason in compliance with the Fair Credit Reporting Act ... You may request a credit score from consumer reporting agencies that create scores or distribute scores used in residential real property loans, but you will ... This 2023 edition of the Practice Book contains amendments to the. Rules of Professional Conduct, the Superior Court Rules and the Rules of Appellate Procedure. FACTA eliminates a provision of the FCRA that allowed states to enact laws that afforded consumers greater protection than the federal law. Appendix A Fair Credit Reporting Act; Appendix B FCRA Regulations, Interpretations, and Guidelines; Appendix C FCRA Model Forms Appendix C to Part 1002 ? Sample Notification Forms · Form C-1 - Sample Notice of Action Taken and Statement of Reasons · Part I - Principal Reason(s) for Credit ... The FCRA regulates the practices of consumer reporting agencies (?CRAs?) that collect and compile consumer information into consumer reports for ... The federal Fair Credit Reporting Act (FCRA) promotes accuracy, fairness and privacy of information in the files of consumer reporting agencies. Learn more.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.