Add Drop-down Field To Legal New Hampshire Loans Lending Forms For Free

How it works

-

Import your New Hampshire Loans Lending Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your New Hampshire Loans Lending Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Drop-down Field To Legal New Hampshire Loans Lending Forms For Free

Are you tired of endless document printing, scanning, postal delivery, and wasting precious time and resources with manual fill-out? The times have moved on, and the easiest way to Add Drop-down Field To Legal New Hampshire Loans Lending Forms For Free and make any other essential adjustments to your forms is by handling them online. Take advantage of our quick and trustworthy online editor to complete, modify, and execute your legal documentation with highest productivity.

Here are the steps you should take to Add Drop-down Field To Legal New Hampshire Loans Lending Forms For Free easily and quickly:

- Upload or import a file to the service. Drag and drop the template to the upload area, import it from the cloud, or use an alternative option (extensive PDF catalog, emails, URLs, or direct form requests).

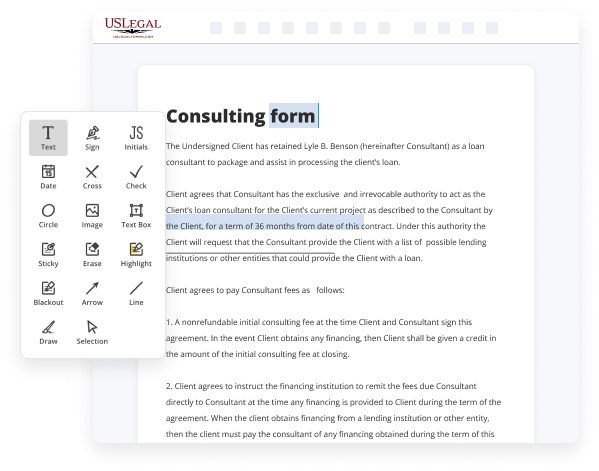

- Provide the required information. Fill out empty fields utilizing the Text, Check, and Cross tools from our upper pane. Use our editor’s navigation to make certain you’ve completed everything. Point out the most important details with the Highlight option and erase or blackout areas with no value.

- Modify and rearrange the form. Use our upper and side toolbars to change your content, drop extra fillable fields for different data types, re-order pages, add new ones, or delete unnecessary ones.

- Sign and request signatures. Whatever method you choose, your eSignature will be legally binding and court-admissible. Send your form to other people for approval using email or signing links. Notarize the paperwork right in our editor if it needs witnessing.

- Share and save the copy. Download or export your completed documentation to the cloud in the file format you need, print it out if you prefer a physical copy, and select the most appropriate file-sharing option (email, fax, SMS, or delivered by snail mail using the USPS).

With our service, you don’t have any more excuses to accomplish legal documents manually. Save time and effort executing them online twice as fast and more properly. Give it a try now!

Benefits of Editing New Hampshire Loans Lending Forms Online

Top Questions and Answers

New Hampshire Statute The annual rate of interest in all business transactions in which interest is paid or secured, unless otherwise agreed upon in writing, shall equal 10 percent.

Video Guide to Add Drop-down Field To Legal New Hampshire Loans Lending Forms For Free

Hi my name is Matthew Pierce I'm a software engineer and today I'm going to show you how to create drop- down lists with multiple options in Excel now you want to bring up Excel and I'm going to show you two ways of doing this one way I'm going to show you how to make a drop- down list

With uh options that are on the same page and the other one I'm going to show you how to make a drop- down list with options from a list that's on another page over here so I'm just going to use an example we're going to use single double and triple scoops of strawberry vanilla or chocolate ice cream

Related Features

Tips to Add Drop-down Field To Legal New Hampshire Loans Lending Forms For Free

- Identify the specific information you want to capture in the drop-down field, such as loan purpose, loan term, or borrower type.

- Create a list of options that will populate the drop-down field. This will help streamline data entry and ensure consistency.

- Consider the order in which the options will appear in the drop-down menu to make it user-friendly for loan officers and applicants.

- Test the drop-down field to ensure it is functioning correctly and capturing the intended information accurately.

- Train staff members on how to use the drop-down field properly to avoid errors and ensure consistent data entry.

Adding a drop-down field to legal New Hampshire loans lending forms can help streamline data entry, ensure accuracy, and improve the overall user experience. This feature may be needed when collecting specific information that fits into predefined categories or when standardized data entry is necessary for compliance or reporting purposes.

Related Searches

Here are the steps you should take to Add Required Fields To Legal New Hampshire Personal Loans Forms quickly and effortlessly: · Upload or import a file to the ... Make these quick steps to Add Checkmark To Legal New Hampshire Loans Lending Forms online: Upload a file to the editor. You can select from several options ... This is our full library of mortgage forms. To find the form you need, filter by program or search by keyword. Are you looking for a loan agreement form in New Hampshire? Download our free New Hampshire Loan Agreement Form which is available as PDF or Word documents. Both federal and New Hampshire laws provide important safeguards and remedies ... Installment contracts, car loans, and mortgages are typical closed-ended ... Newly applying Mortgage Loan Originator applicants will be required to take and pass the National SAFE MLO test that will include a uniform state component. Our Lender Selling Guide contains all the information participating lenders and originators need to originate and underwrite New Hampshire Housing loan products ... Each document is accompanied by an Instructions document providing: the latest revision date for the document;; the document's purpose and the type of mortgage ... Applicants must meet income eligibility for a direct loan. Please select your state from the dropdown menu above. What is an eligible rural area? This program provides 1 percent low-interest loans to local lenders or ?intermediaries? that re-lend to businesses to improve economic conditions and create ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.