Add Drop-down Field To Legal Pennsylvania Corporations And LLC Forms For Free

How it works

-

Import your Pennsylvania Corporations And LLC Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Pennsylvania Corporations And LLC Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Drop-down Field To Legal Pennsylvania Corporations And LLC Forms For Free

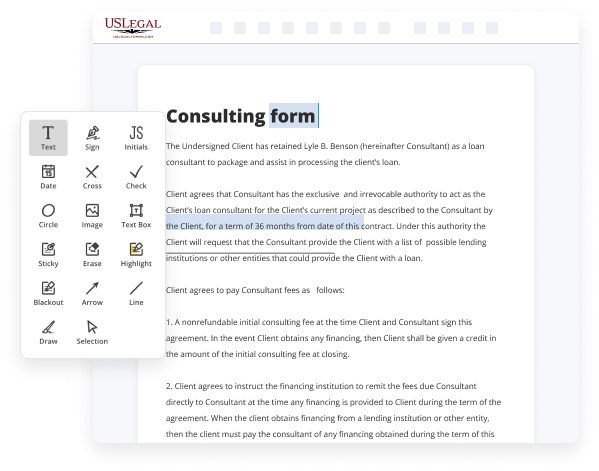

Online PDF editors have demonstrated their trustworthiness and effectiveness for legal paperwork execution. Use our safe, fast, and straightforward service to Add Drop-down Field To Legal Pennsylvania Corporations And LLC Forms For Free your documents whenever you need them, with minimum effort and greatest precision.

Make these simple steps to Add Drop-down Field To Legal Pennsylvania Corporations And LLC Forms For Free online:

- Upload a file to the editor. You can choose from a couple of options - add it from your device or the cloud or import it from a form library, external URL, or email attachment.

- Complete the blank fields. Put the cursor on the first empty field and use our editor’s navigation to move step-by-step to prevent missing anything on your template. Use Text, Initials, Cross, and Check features.

- Make your necessary modifications. Update the form with inserted pictures, draw lines and icons, highlight important parts, or erase any unnecessary ones.

- Create additional fillable fields. Adjust the template with a new area for fill-out if neccessary. Utilize the right-side toolbar for this, drop each field where you expect others to leave their data, and make the remaining areas required, optional, or conditional.

- Arrange your pages. Delete sheets you don’t need any longer or create new ones using the appropriate key, rotate them, or alter their order.

- Generate eSignatures. Click on the Sign tool and decide how you’d add your signature to the form - by typing your name, drawing it, uploading its picture, or using a QR code.

- Share and send for eSigning. Finish your editing using the Done button and send your copy to other people for signing via an email request, with a Link to Fill option, in an SMS or fax message. Request a prompt online notarization if necessary.

- Save the file in the format you need. Download your document, save it to cloud storage in its current format, or convert it as you need.

And that’s how you can prepare and share any personal or business legal documentation in clicks. Try it today!

Benefits of Editing Pennsylvania Corporations And LLC Forms Online

Top Questions and Answers

Online filings: In total, online filing approvals for Pennsylvania LLCs take 5-6 weeks. Since you can download your documents as soon as they're approved by the Department of State, there is no extra transit time. But because Pennsylvania gets so many business filings, their processing time is pretty long.

Video Guide to Add Drop-down Field To Legal Pennsylvania Corporations And LLC Forms For Free

A corporation is a type of formal business structure that is more complicated than an llc but offers benefits that llcs do not corporations are great if you are looking to raise money from venture capital or looking to list on a stock exchange corporations are also able to more efficiently carry money over between tax years the nine largest

Corporations in pennsylvania employ almost eight hundred thousand people and bring in an average annual revenue of over 23 billion dollars if you are starting a business and not sure which business structure is best for you check out our other video choosing the right business structure for your business linked below there are two ways to form a corporation

Related Features

Tips to Add Drop-down Field To Legal Pennsylvania Corporations And LLC Forms For Free

- Identify the appropriate legal terminology for the drop-down options

- Include all relevant options that may be needed for the form

- Ensure the drop-down is user-friendly and easy to navigate

- Test the drop-down functionality to ensure it is working correctly

- Provide clear instructions on how to use the drop-down field

Adding a drop-down field to legal Pennsylvania Corporations and LLC forms can provide a more efficient way for users to select options from a predetermined list. This feature may be needed when there are multiple options for a specific field, such as type of business entity or legal language to be used in the form.

Related Searches

The Bureau of Corporations and Charitable Organizations makes available a wide range of forms housed in the Business Filing Services portal to assist ... A Certificate of Organization is not required by law to be prepared by an attorney. However, because of complex legal issues involved when starting any business ... Q: When can I anticipate receiving my filed documents? A: Please allow 15 business days for processing. Q: Why do so many businesses file in Pennsylvania? These are Pennsylvania corporations organized for profit. A corporation is a legal entity created under state statutory law that acts as a legal person. A fictitious name is any assumed name, style or designation other than the proper name of the entity using such name. The term fictitious name includes a ... This form may be submitted online at . Fee: $70. Check one: Limited Partnership (§ 8622). Limited Liability Company (§ 8822). This form and all accompanying documents shall be mailed to the address stated above. A foreign corporation (both business and nonprofit corporation) is ... Total PA S Corporation or Partnership Income (Loss) ... (QSSS) or disregarded entity, list below the FEIN, name and address for each entity. All corporations and limited liability companies doing business in Pennsylvania are required to pay corporate net income tax. Businesses that elect federal ... TABLE OF CONTENTS. TITLE 15. CORPORATIONS AND UNINCORPORATED ASSOCIATIONS. PART I. PRELIMINARY PROVISIONS. Chapter 1. General Provisions.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.