Add Drop-down Field To Legal Virginia Mortgages Forms For Free

How it works

-

Import your Virginia Mortgages Forms from your device or the cloud, or use other available upload options.

-

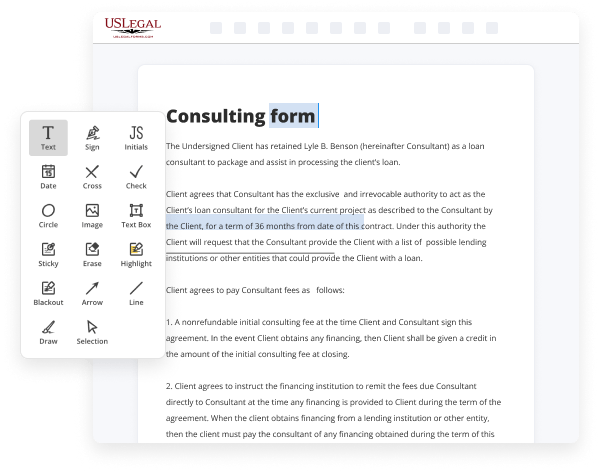

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Virginia Mortgages Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Drop-down Field To Legal Virginia Mortgages Forms For Free

Online document editors have demonstrated their reliability and efficiency for legal paperwork execution. Use our secure, fast, and user-friendly service to Add Drop-down Field To Legal Virginia Mortgages Forms For Free your documents any time you need them, with minimum effort and maximum precision.

Make these quick steps to Add Drop-down Field To Legal Virginia Mortgages Forms For Free online:

- Import a file to the editor. You can select from a couple of options - add it from your device or the cloud or import it from a template library, external URL, or email attachment.

- Fill out the blank fields. Put the cursor on the first empty area and make use of our editor’s navigation to move step-by-step to avoid missing anything on your template. Use Text, Initials, Cross, and Check tools.

- Make your necessary edits. Update the form with inserted images, draw lines and signs, highlight significant components, or remove any unnecessary ones.

- Create additional fillable fields. Modify the template with a new area for fill-out if required. Utilize the right-side tool pane for this, drop each field where you expect other participants to leave their data, and make the rest of the fields required, optional, or conditional.

- Organize your pages. Remove sheets you don’t need anymore or create new ones making use of the appropriate key, rotate them, or alter their order.

- Generate electronic signatures. Click on the Sign option and choose how you’d insert your signature to the form - by typing your name, drawing it, uploading its image, or using a QR code.

- Share and send for eSigning. End your editing with the Done button and send your copy to other parties for signing via an email request, with a Link to Fill option, in an SMS or fax message. Request a quick online notarization if required.

- Save the file in the format you need. Download your document, save it to cloud storage in its present format, or transform it as you need.

And that’s how you can complete and share any individual or business legal paperwork in minutes. Try it today!

Benefits of Editing Virginia Mortgages Forms Online

Top Questions and Answers

A mortgage involves only two parties: the borrower and the lender. A deed of trust has a borrower, lender and a ?trustee.? The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower.

Video Guide to Add Drop-down Field To Legal Virginia Mortgages Forms For Free

Hey guys uh good afternoon angelo christian financial thank you so much for watching our podcast real estate insider i got a fun one for you today things that you should not tell your mortgage lender when you're getting a home loan and you're saying and you're going to wonder hey why is angelo saying there's things you should actually

Hide from your mortgage lender no i'm saying you know when you're getting a home loan you want to be very transparent you want to be honest you don't want to hide anything or be deceitful but obviously when you're buying real estate it's a major transaction uh how many guys out there ever tried to buy a home before

Tips to Add Drop-down Field To Legal Virginia Mortgages Forms For Free

- Identify the specific information you want to capture in the drop-down field

- Choose appropriate options for the drop-down list

- Consider the target audience and their familiarity with the options

- Make sure the drop-down field is clearly labeled and easy to use

- Test the functionality of the drop-down field before finalizing the form

Adding a drop-down field to legal Virginia mortgages forms can provide a more streamlined and organized way to collect information from applicants. This feature may be needed when you want to standardize responses, reduce errors, and make data analysis easier.

Related Searches

Add Required Fields To Legal Virginia Mortgages Forms with a comprehensive online service helping thousands of users process their paperwork quickly and ... Add Watermark To Legal Virginia Mortgages Forms with a comprehensive online service helping thousands of users process their paperwork quickly and easily. From the Mortgage Type Applied For drop-down list, select VA. Note: The First Lien drop-down list option in the Mortgage Lien Type field is the only ... Each document is accompanied by an Instructions document providing: the latest revision date for the document;; the document's purpose and the type of mortgage ... This chapter contains information about legal instruments, liens, escrows, and ... Lenders may use any note and mortgage forms they wish for VA loans. For the purposes of closing the loan, the VA considers the Wood Destroying Insect Inspection and the PC-9 Form to be valid for 90 days. This 90 validity period ... Resources to help you understand and comply with the Dodd-Frank Act mortgage reforms and our regulations, including downloadable guides, are available through ... The following mortgage loans are not considered in determining whether a servicer qualifies as a small servicer: (a) mortgage loans voluntarily serviced by the ... A mortgage is a loan used to purchase or maintain real estate. ... that they meet several requirements, including minimum credit scores and down payments. First-time homebuyers may make mistakes in the mortgage and home-buying processes. Here are some of the most common mistakes to avoid to save money and ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.