Add Field Settings Legal Illinois Fair Credit Reporting Forms For Free

How it works

-

Import your Illinois Fair Credit Reporting Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

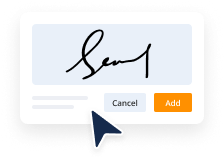

Sign your Illinois Fair Credit Reporting Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Field Settings Legal Illinois Fair Credit Reporting Forms For Free

Legal paperwork requires highest precision and prompt execution. While printing and completing forms frequently takes considerable time, online document editors prove their practicality and effectiveness. Our service is at your disposal if you’re searching for a reputable and straightforward-to-use tool to Add Field Settings Legal Illinois Fair Credit Reporting Forms For Free rapidly and securely. Once you try it, you will be amazed at how simple dealing with formal paperwork can be.

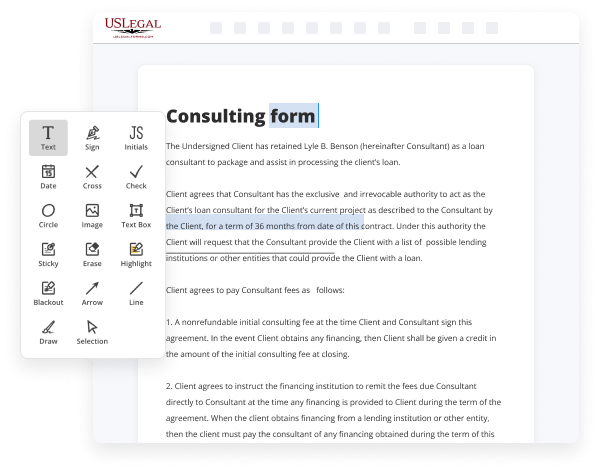

Follow the instructions below to Add Field Settings Legal Illinois Fair Credit Reporting Forms For Free:

- Upload your template via one of the available options - from your device, cloud, or PDF library. You can also get it from an email or direct URL or through a request from another person.

- Utilize the top toolbar to fill out your document: start typing in text fields and click on the box fields to select appropriate options.

- Make other required adjustments: add pictures, lines, or symbols, highlight or remove some details, etc.

- Use our side tools to make page arrangements - add new sheets, change their order, remove unnecessary ones, add page numbers if missing, etc.

- Drop extra fields to your document requesting various types of data and place watermarks to protect the contents from unauthorized copying.

- Check if all information is correct and sign your paperwork - create a legally-binding electronic signature in your preferred way and place the current date next to it.

- Click Done when you are ready and decide where to save your form - download it to your device or export it to the cloud in any file format you need.

- Share a copy with other people or send it to them for signature via email, a signing link, SMS, or fax. Request online notarization and obtain your form rapidly witnessed.

Imagine doing all the above manually on paper when even one error forces you to reprint and refill all the data from the beginning! With online services like ours, things become considerably easier. Give it a try now!

Benefits of Editing Illinois Fair Credit Reporting Forms Online

Top Questions and Answers

"Negative information" means information concerning a customer's delinquencies, late payments, insolvency, or any form of default.

Video Guide to Add Field Settings Legal Illinois Fair Credit Reporting Forms For Free

What gives you the ability to dispute stuff on your credit and what makes them have to respond by law it's real simple its forwards it's called the Fair Credit Reporting Act and today I'm explaining how the Fair Credit Reporting Act was created a long time ago it was created for consumers because there was a lot of airs

On people's reports people were sending in letters saying this was wrong on their credit and Experian was known as TRW before so people could not get them to do anything to take it off their credit reports or fix any errors and it was a big major problem people couldn't get loans things couldn't happen so the government put

Related Features

Tips to Add Field Settings Legal Illinois Fair Credit Reporting Forms For Free

- Understand the specific fields required for legal compliance in Illinois.

- Ensure all personal information fields are secure and confidential.

- Include disclosure statements to inform users about data usage.

- Review forms for accuracy and completeness before use.

- Keep up-to-date with changes in Illinois credit reporting laws.

Editing the Add Field Settings for Legal Illinois Fair Credit Reporting Forms may be needed when making updates to legal requirements or when user feedback suggests improvements.

Related Searches

The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and privacy of information in the files of consumer reporting agencies. Select the area in which you have experienced discrimination to access the CIS form and more information. 30. Fair Credit Reporting Act. This form will assist you in opting yourself and family members living at your address out of LexisNexis data products. Employers must comply with the Fair Credit Reporting Act (FCRA) and obtain your written consent before checking your credit report. Although federal law allows employers to check credit, some states don't. A case filed under chapter 11 of the United States Bankruptcy Code is frequently referred to as a "reorganization" bankruptcy. S.) Government in conducting background investigations, reinvestigations, and continuous evaluations of. IL is preprinted on the form. Field contacted CSC on June 23, 1999 and requested a consumer credit report.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.