Add Formula Field To Legal Delaware Startup For S-Corporation Forms For Free

How it works

-

Import your Delaware Startup For S-Corporation Forms from your device or the cloud, or use other available upload options.

-

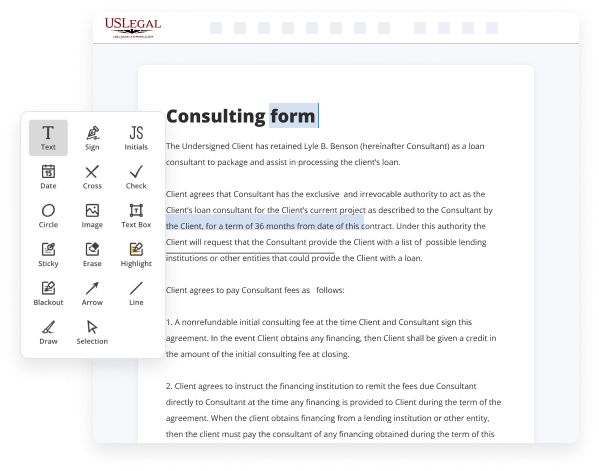

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Delaware Startup For S-Corporation Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Formula Field To Legal Delaware Startup For S-Corporation Forms For Free

Online document editors have demonstrated their trustworthiness and efficiency for legal paperwork execution. Use our secure, fast, and intuitive service to Add Formula Field To Legal Delaware Startup For S-Corporation Forms For Free your documents any time you need them, with minimum effort and maximum accuracy.

Make these simple steps to Add Formula Field To Legal Delaware Startup For S-Corporation Forms For Free online:

- Upload a file to the editor. You can select from several options - add it from your device or the cloud or import it from a template library, external URL, or email attachment.

- Fill out the blank fields. Put the cursor on the first empty field and use our editor’s navigation to move step-by-step to avoid missing anything on your template. Use Text, Initials, Cross, and Check features.

- Make your necessary edits. Update the form with inserted pictures, draw lines and symbols, highlight important elements, or erase any pointless ones.

- Add more fillable fields. Adjust the template with a new area for fill-out if neccessary. Utilize the right-side toolbar for this, place each field where you expect others to provide their data, and make the rest of the fields required, optional, or conditional.

- Organize your pages. Delete sheets you don’t need any longer or create new ones using the appropriate button, rotate them, or alter their order.

- Create electronic signatures. Click on the Sign tool and decide how you’d add your signature to the form - by typing your name, drawing it, uploading its picture, or using a QR code.

- Share and send for eSigning. End your editing with the Done button and send your copy to other parties for signing via an email request, with a Link to Fill option, in an SMS or fax message. Request a prompt online notarization if necessary.

- Save the file in the format you need. Download your document, save it to cloud storage in its current format, or transform it as you need.

And that’s how you can prepare and share any individual or business legal paperwork in minutes. Give it a try today!

Benefits of Editing Delaware Startup For S-Corporation Forms Online

Top Questions and Answers

Individuals included in the composite return must have no income (including spouse's) from sources within the state other than his or her distributive share of corporate or partnership income whose source is within Delaware.

Video Guide to Add Formula Field To Legal Delaware Startup For S-Corporation Forms For Free

No doubt you've heard that a lot of companies are registered in Delaware that's where they're formed you're probably thinking I guess I should register Delaware so should you now half the fortune 500 is there why the main reasons are their corporate code is very modern and up-to-date and their judges they have a special court called the court

Judge Chancery are very well-versed in business law issues so when their shareholder suits in particular it's a pretty good place to be these are public companies were talking about this isn't necessarily your startup you'll also hear things about taxation and cost forget about that stuff we're really not gonna apply to you so here's where you might want

Tips to Add Formula Field To Legal Delaware Startup For S-Corporation Forms For Free

- Identify the specific data you want to calculate in the formula field

- Understand the formula syntax required for the calculation

- Access the S-Corporation forms in the legal Delaware startup platform

- Locate the option to add a formula field within the form builder

- Input the necessary formula using the provided syntax

- Test the formula field to ensure accuracy

When you need to automatically calculate values based on other input fields in S-Corporation forms for your legal Delaware startup, adding a formula field can save time and ensure accuracy in the calculations.

Related Searches

Get answers to all your frequently asked questions about taxes and filing your taxes with the Delaware Division of Corporations. Every S Corporation deriving income from sources within Delaware is required to file an S Corporation Reconciliation and Shareholders. Information Return (Form ... Here are the steps you should take to Add Signature Field To Legal Delaware Startup For S-Corporation Forms easily and quickly: · Upload or import a file to the ... Here are the steps you should take to Add Textbox To Legal Delaware Startup For S-Corporation Forms quickly and effortlessly: Upload or import a file to the ... If the S corporation election was terminated during the tax year and the corporation reverts to a C corporation, file Form 1120-S for the S ... If a foreign person, including a foreign corporation, wholly owns a domestic disregarded entity (DE), the domestic DE is treated as a domestic ... In most states, franchise and LLC taxes are based on earned income; however, in Delaware, these taxes are a low, flat fee that's paid annually. Ready to start your business? Find out the pros and cons of incorporating as a C Corp vs. an S Corp in this helpful guide to all your options. An S Corp owner has to receive what the IRS deems a ?reasonable salary? ... earning enough yet to pay yourself a salary comparable to others in your field. S corporation file Form 100S, California S Corporation Franchise or Income Tax Return. Disregarded entities, see General Information S, Check-the-Box ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.