Add Formula Field To Legal Maryland Sale Of Business Forms For Free

How it works

-

Import your Maryland Sale Of Business Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Maryland Sale Of Business Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Formula Field To Legal Maryland Sale Of Business Forms For Free

Online document editors have proved their trustworthiness and effectiveness for legal paperwork execution. Use our secure, fast, and user-friendly service to Add Formula Field To Legal Maryland Sale Of Business Forms For Free your documents whenever you need them, with minimum effort and greatest accuracy.

Make these quick steps to Add Formula Field To Legal Maryland Sale Of Business Forms For Free online:

- Import a file to the editor. You can choose from several options - upload it from your device or the cloud or import it from a template library, external URL, or email attachment.

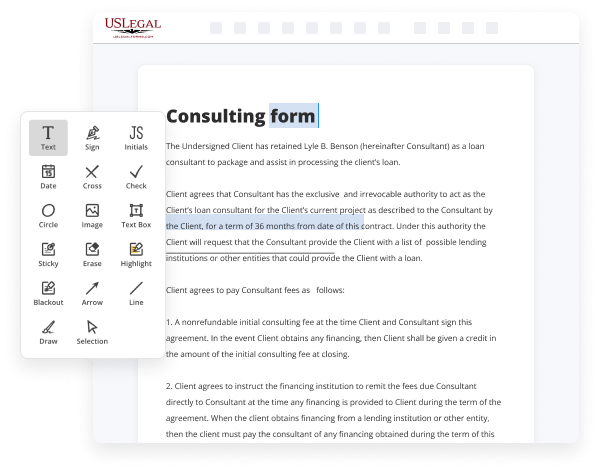

- Complete the blank fields. Place the cursor on the first empty area and use our editor’s navigation to move step-by-step to prevent missing anything on your template. Use Text, Initials, Cross, and Check tools.

- Make your necessary modifications. Update the form with inserted pictures, draw lines and icons, highlight significant parts, or erase any unnecessary ones.

- Add more fillable fields. Adjust the template with a new area for fill-out if required. Make use of the right-side toolbar for this, place each field where you expect others to provide their details, and make the rest of the fields required, optional, or conditional.

- Arrange your pages. Delete sheets you don’t need any longer or create new ones using the appropriate button, rotate them, or change their order.

- Generate electronic signatures. Click on the Sign option and decide how you’d insert your signature to the form - by typing your name, drawing it, uploading its image, or utilizing a QR code.

- Share and send for eSigning. End your editing using the Done button and send your copy to other parties for signing through an email request, with a Link to Fill option, in an SMS or fax message. Request a quick online notarization if necessary.

- Save the file in the format you need. Download your document, save it to cloud storage in its present format, or convert it as you need.

And that’s how you can prepare and share any individual or business legal documentation in minutes. Try it now!

Benefits of Editing Maryland Sale Of Business Forms Online

Top Questions and Answers

Every Maryland pass-through entity must file a return on Form 510, even if it has no income or the entity is inactive. Every other pass-through entity that is subject to Maryland income tax law must also file on Form 510.

Video Guide to Add Formula Field To Legal Maryland Sale Of Business Forms For Free

There are ways when you're designing your form in Microsoft Word to make a particular form field mandatory so if you have a required field that you need your users to fill in that you don't want to let them bypass that field without filling something in there's a way to do that and I'm going to show you how

In this video be sure and check out my playlist on my channel for creating fillable forms alright in this example we're going to use a benefit election form and to create this form I've used legacy tool form fields and we're gonna work with the plain text form field here remember if you don't have the Developer tab enabled

Tips to Add Formula Field To Legal Maryland Sale Of Business Forms For Free

- Understand the purpose of the formula field and what calculation it needs to perform

- Choose the appropriate field type for the formula (text, number, date, etc)

- Write the formula using the available functions and operators provided by the form builder

- Test the formula field to ensure it is accurately calculating the desired result

- Consider any legal or financial implications of the formula field before finalizing

The editing feature for Add Formula Field To Legal Maryland Sale Of Business Forms may be needed when you want to automatically calculate certain values, such as taxes or fees, based on other input fields in the form.

Related Searches

MARYLAND. 2022. FORM 510 - PASS-THROUGH ENTITY INCOME TAX RETURN INSTRUCTIONS. For filing calendar year or any other tax year or period beginning in 2022 ... You can file your Maryland employer withholding tax returns (Form MW506) and sales and use tax returns for free online, using bFile, if you meet the ... This formula allocates income to Maryland based on a ratio of the corporation's sales, property, and payroll located in Maryland to its total sales, property. The simplest and easiest method to file both the Annual Report and Personal Property Tax Return is through Maryland Business Express (MBE), SDAT's award-winning ... Making a change to your business is simple. Select and submit one of the forms listed below. Run Your Business. Make Changes to an Existing Business. State law requires each County's Collector of Taxes to sell these tax liens to collect delinquent taxes and other fees owed to the County. The tax liens are ... Gains from the sale, exchange or other disposition of any kind of property are taxable under the Pennsylvania personal income tax (PA PIT) law. If you sell or transfer your business during the quarter, you and the new owner must each file a Form 941 for the quarter in which the transfer occurred. Use Form 1120, U.S. Corporation Income. Tax Return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a ... The Maryland Wage Payment and Collection Law sets forth the rights by which employees receive wages. The law states when and how often employees must be paid, ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.