Add Formula Field To Legal New Hampshire Loans Lending Forms For Free

How it works

-

Import your Land Loans New Hampshire from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your New Hampshire Loans Lending Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Formula Field To Legal New Hampshire Loans Lending Forms For Free

Online PDF editors have demonstrated their trustworthiness and efficiency for legal paperwork execution. Use our safe, fast, and intuitive service to Add Formula Field To Legal New Hampshire Loans Lending Forms For Free your documents whenever you need them, with minimum effort and greatest accuracy.

Make these quick steps to Add Formula Field To Legal New Hampshire Loans Lending Forms For Free online:

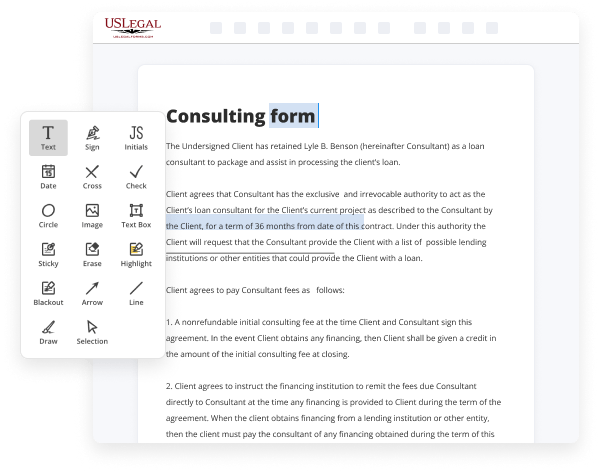

- Upload a file to the editor. You can choose from a couple of options - upload it from your device or the cloud or import it from a form catalog, external URL, or email attachment.

- Complete the blank fields. Place the cursor on the first empty area and make use of our editor’s navigation to move step-by-step to prevent missing anything on your template. Use Text, Initials, Cross, and Check tools.

- Make your necessary edits. Update the form with inserted pictures, draw lines and symbols, highlight significant elements, or erase any unnecessary ones.

- Add more fillable fields. Adjust the template with a new area for fill-out if neccessary. Make use of the right-side tool pane for this, drop each field where you want other participants to provide their details, and make the rest of the areas required, optional, or conditional.

- Arrange your pages. Delete sheets you don’t need any longer or create new ones using the appropriate button, rotate them, or change their order.

- Create electronic signatures. Click on the Sign tool and choose how you’d insert your signature to the form - by typing your name, drawing it, uploading its picture, or using a QR code.

- Share and send for eSigning. Finish your editing using the Done button and send your copy to other people for signing via an email request, with a Link to Fill option, in an SMS or fax message. Request a quick online notarization if necessary.

- Save the file in the format you need. Download your document, save it to cloud storage in its present format, or transform it as you need.

And that’s how you can complete and share any individual or business legal documentation in clicks. Try it now!

Benefits of Editing New Hampshire Loans Lending Forms Online

Top Questions and Answers

While payday loans are generally designed for low-credit borrowers, you may still have a difficult time getting one without a steady income. Many credible lenders will want to confirm your income to make sure that you have the ability to repay the loan before they issue one to you.

Video Guide to Add Formula Field To Legal New Hampshire Loans Lending Forms For Free

How does bail bonds work in New Hampshire? The defendant's Manchester bail bond amount is established by the courts or Bail Commissioner. A defendant or co-signer can hire a licensed New Hampshire bail bondsman to post bail. The New Hampshire bail bond is in effect until the trial is complete. If you have

A friend or loved one that needs a Nashua bail bond be sure to check http://HowBailBondsWork.com get more information about how do bail bonds work; how to find bail bondsmen in Manchester area and get the best rate on Concord & Nashua bail bond loans. How bail bonds work in New Hampshire!

Tips to Add Formula Field To Legal New Hampshire Loans Lending Forms For Free

- Determine the specific formula that needs to be added to the legal New Hampshire loans lending forms

- Make sure to gather all necessary information and variables required for the formula

- Use a form editing tool or software that supports adding formula fields

- Carefully input the formula into the designated field, ensuring accuracy and proper syntax

- Test the formula field to make sure it calculates correctly before finalizing the form

When editing legal New Hampshire loans lending forms, you may need to add a formula field to automatically calculate interest rates, total loan amounts, or other financial information. This feature is especially useful for streamlining the loan approval process and ensuring accurate calculations on the forms.

Related Searches

Make these quick steps to Add Required Fields To Legal New Hampshire Loans Lending Forms online: · Import a file to the editor. · Complete the blank fields. · Make ... Home First Program Limits (for loans reserved on or after 6/1/2023) · 1stGenHomeNH Borrower Affidavit · 1stGenHomeNH Borrower Affidavit for ... Forms, licenses, information on examinations and disposition fees. What's New. Newly applying Mortgage Loan Originator applicants will be required to take and ... The New Hampshire Regulation of Consumer Credit Transactions Act (RSA 358-K) imposes some technical requirements on lenders regarding the timing and method for ... My Mortgage App. Make payments anytime, anywhere. Easily view your current home loan information. Up-to- ... H. New Hampshire Right to Know Law. HFA 109.12 Projects Financed by Tax-Exempt ... New construction (adding new units to housing markets). Through USDA Rural Development's Community Facility (CF) Guaranteed Loan. Program, we partner with private lenders to finance public facilities in rural areas. Disaster Areas - North Carolina, Vermont, New Hampshire and an. Additional County ... Single Family Lending Area (09/14/2015) . A payday loan is a type of short-term borrowing where a lender will extend high-interest credit based on your income. Home Flex Plus: Provides cash assistance (in the form of a second mortgage) for up to 3% of the base loan amount toward down payment or closing costs; in order ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.