Add Formulas and Calculations Legal Arizona Debt Relief Forms For Free

How it works

-

Import your Arizona Debt Relief Forms from your device or the cloud, or use other available upload options.

-

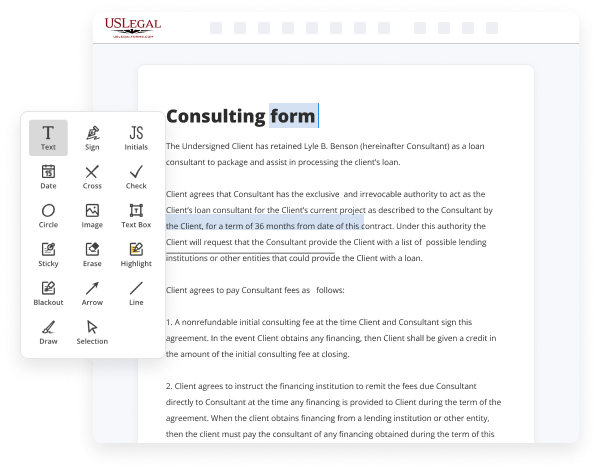

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Arizona Debt Relief Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Formulas and Calculations Legal Arizona Debt Relief Forms For Free

Are you tired of endless document printing, scanning, postal delivery, and wasting precious time and resources with manual fill-out? The times have moved on, and the best way to Add Formulas and Calculations Legal Arizona Debt Relief Forms For Free and make any other essential changes to your forms is by handling them online. Choose our quick and reliable online editor to complete, adjust, and execute your legal documentation with maximum efficiency.

Here are the steps you should take to Add Formulas and Calculations Legal Arizona Debt Relief Forms For Free easily and quickly:

- Upload or import a file to the editor. Drag and drop the template to the upload area, import it from the cloud, or use another option (extensive PDF library, emails, URLs, or direct form requests).

- Provide details you need. Complete empty fields utilizing the Text, Check, and Cross tools from our upper pane. Use our editor’s navigation to make certain you’ve filled in everything. Accentuate the most significant facts with the Highlight option and erase or blackout areas with no value.

- Modify and rearrange the form. Use our upper and side toolbars to change your content, drop additional fillable fields for various data types, re-order pages, add new ones, or remove redundant ones.

- Sign and collect signatures. Whatever method you select, your eSignature will be legally binding and court-admissible. Send your form to others for approval through email or signing links. Notarize the document right in our editor if it needs witnessing.

- Share and save the copy. Download or export your completed documentation to the cloud in the format you need, print it out if you prefer a hard copy, and select the most appropriate file-sharing option (email, fax, SMS, or delivered by snail mail using the USPS).

With our service, you don’t have any more excuses to prepare legal documents manually. Save time and effort executing them online twice as quickly and more effectively. Give it a try now!

Benefits of Editing Arizona Debt Relief Forms Online

Top Questions and Answers

Statute of Limitations in Arizona The statute of limitations for credit card debt is three years. For car loans, mortgages and medical debts it's six years, and for unpaid taxes it's 10 years. The timeframe indicates the amount of time a debt collector has to collect a debt.

Video Guide to Add Formulas and Calculations Legal Arizona Debt Relief Forms For Free

It appears that a lot of the debt buyers have shifted the way that they're looking at settlement instead of just trying to get a lump sum and move on they're trying to get a larger amount and have it paid out in smaller monthly

Chunks so they're kind of playing a long game a bit in thinking we can get more if we just require people to make small monthly payments and so what i would say is to be careful not to get caught in that trap

Related Features

A debtor must enter income and expense information onto the appropriate form (i.e. Free debt consolidation calculator to evaluate the consolidation of debts such as credit cards debts, auto loans, or personal loans based on the real cost. All debt longer than 12 months in duration must be listed on the same form. Follow steps 57 to calculate the total garnishment amount. 5. Enter total Amounts Withheld Under Other Wage Withholding Orders with Priority. Form 1099-C can be issued when a debt you owe is reduced or forgiven. This includes credit card debt, personal loans, and other types of unsecured debt. The following online calculator allows you to automatically determine the amount of simple daily interest owed on payments made after the payment due date. 720, Disaster Recovery Tax Relief, to determine if the taxpayer qualifies for disaster relief.) If an out-of-state business is part of a unitary group filing a. Formula and Calculation of Debt-to-Income (DTI) Ratio.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.