Add Formulas and Calculations Legal Nevada Small Estates Forms For Free

How it works

-

Import your Nevada Small Estates Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Nevada Small Estates Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Formulas and Calculations Legal Nevada Small Estates Forms For Free

Online document editors have proved their trustworthiness and efficiency for legal paperwork execution. Use our secure, fast, and user-friendly service to Add Formulas and Calculations Legal Nevada Small Estates Forms For Free your documents any time you need them, with minimum effort and highest precision.

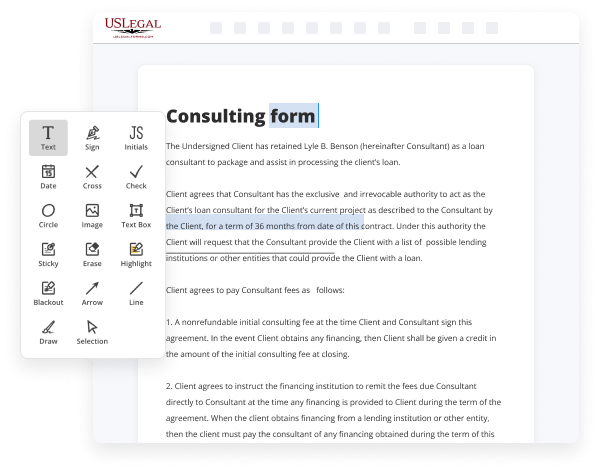

Make these simple steps to Add Formulas and Calculations Legal Nevada Small Estates Forms For Free online:

- Import a file to the editor. You can select from a couple of options - upload it from your device or the cloud or import it from a form library, external URL, or email attachment.

- Complete the blank fields. Place the cursor on the first empty field and use our editor’s navigation to move step-by-step to avoid missing anything on your template. Use Text, Initials, Cross, and Check features.

- Make your necessary modifications. Update the form with inserted pictures, draw lines and signs, highlight important components, or erase any pointless ones.

- Create additional fillable fields. Modify the template with a new area for fill-out if neccessary. Make use of the right-side tool pane for this, drop each field where you expect other participants to provide their data, and make the remaining areas required, optional, or conditional.

- Organize your pages. Remove sheets you don’t need anymore or create new ones utilizing the appropriate key, rotate them, or change their order.

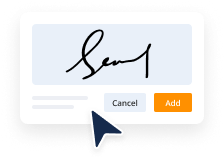

- Generate electronic signatures. Click on the Sign tool and decide how you’d add your signature to the form - by typing your name, drawing it, uploading its image, or utilizing a QR code.

- Share and send for eSigning. Finish your editing using the Done button and send your copy to other people for signing through an email request, with a Link to Fill option, in an SMS or fax message. Request a prompt online notarization if necessary.

- Save the file in the format you need. Download your paperwork, save it to cloud storage in its current format, or transform it as you need.

And that’s how you can prepare and share any individual or business legal paperwork in minutes. Give it a try today!

Benefits of Editing Nevada Small Estates Forms Online

Top Questions and Answers

Requirements for a Small Estate Affidavit in Michigan Obtain a certified copy of the deceased's death certificate. Provide proof of relationship to the deceased, usually through birth certificate. Settle all outstanding debts. Complete form PC-598 and have it notarized.

Video Guide to Add Formulas and Calculations Legal Nevada Small Estates Forms For Free

I want to explain to you how tax brackets work in the USA so let's say that you make $100,000 a year this pile of money represents $100,000 so let's get this organized by tax brackets so you're looking at a total of $100,000 in the first pile of money is $111,000 in the second pile $ 33,785 thirdd pile

$50,605 $4,625 the reason why I'm showing you this $100,000 organized into these four piles is because that's how tax brackets work so you see the first $111,000 that you make will be taxed at 10% the next $33,750 that you make will be taxed at a rate of 12% the next $50,605 of 22% the next $4,625 that you

Related Searches

The Nevada Small Estate Affidavit (probate shortcuts in Nevada) allows inheritors to skip the probate process if specific criteria are met. Use our small estate affidavit to help you inherit a deceased's property when the value is low and speed up the summary probate claims. In Nevada, small estates can avoid full probate via small estate affidavit, small estate set aside, or simplified summary administration. Nevada, and practices in trial and appellate Family Law. A legal resource guide for Nevada real estate licensees. When benefits are payable to an estate, payment can be made under one of the following procedures: • Formal administration (legal representative appointed). Second, list all your property and place a fair market value on the assets. Second, list all your property and place a fair market value on the assets. B. Tax Computation Method. NRS 116.1201 Applicability; regulations.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.