Add Lines Legal Indiana Fair Debt Credit Forms For Free

How it works

-

Import your Indiana Fair Debt Credit Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

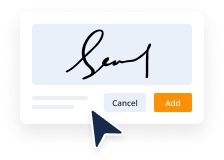

Sign your Indiana Fair Debt Credit Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Lines Legal Indiana Fair Debt Credit Forms For Free

Legal documentation requires greatest precision and prompt execution. While printing and completing forms often takes considerable time, online document editors demonstrate their practicality and effectiveness. Our service is at your disposal if you’re looking for a trustworthy and easy-to-use tool to Add Lines Legal Indiana Fair Debt Credit Forms For Free rapidly and securely. Once you try it, you will be surprised how effortless working with formal paperwork can be.

Follow the guidelines below to Add Lines Legal Indiana Fair Debt Credit Forms For Free:

- Add your template through one of the available options - from your device, cloud, or PDF library. You can also import it from an email or direct URL or through a request from another person.

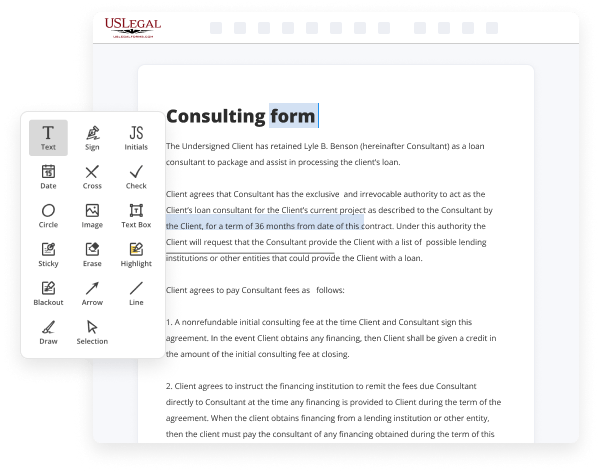

- Use the top toolbar to fill out your document: start typing in text fields and click on the box fields to mark appropriate options.

- Make other required adjustments: insert pictures, lines, or signs, highlight or remove some details, etc.

- Use our side tools to make page arrangements - insert new sheets, alter their order, remove unnecessary ones, add page numbers if missing, etc.

- Add additional fields to your document requesting different types of data and place watermarks to protect the contents from unauthorized copying.

- Verify if things are true and sign your paperwork - create a legally-binding eSignature the way you prefer and place the current date next to it.

- Click Done once you are ready and decide where to save your form - download it to your device or export it to the cloud in whatever file format you need.

- Share a copy with others or send it to them for approval through email, a signing link, SMS, or fax. Request online notarization and obtain your form quickly witnessed.

Imagine doing all of that manually in writing when even one error forces you to reprint and refill all the details from the beginning! With online solutions like ours, things become considerably easier. Try it now!

Benefits of Editing Indiana Fair Debt Credit Forms Online

Top Questions and Answers

?The FDCPA broadly prohibits a debt collector from using 'any false, deceptive, or misleading representation or means in connection with the collection of any debt. ' 15 U.S.C. § 1692e.? The statute enumerates several examples of such practices, 15 U.S.C.

Video Guide to Add Lines Legal Indiana Fair Debt Credit Forms For Free

Hi let's learn about the fair debt collection practices act fdcpa the fair debt collection practices Act is a federal law that limits the actions of third-party debt collectors who are attempting to collect debts on behalf of another person or entity the law restricts the ways that collectors can contact debtors as well as the time of day and

Number of times that contact can be made if the fdcpa is violated the debtor can sue the debt collection company as well as the individual debt collector for damages and attorney fees the Consumer Financial Protection bureaus cfpb debt collection rule clarifies the fdcpa rules about how debt collectors can communicate with debtors the fdcpa creates a structure within

Related Features

Related Searches

The NMLS checklists for collection agencies provide an overview of the filing requirements. The Fair Debt Collection Practices Act is a federal law that governs debt collection agency practices for personal debts. The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and privacy of information in the files of consumer reporting agencies. Indiana debt collection law specifies a sixyear statute of limitations for filing suit against a debtor for breach of an oral agreement or implied contract. First, the FDCPA prohibits debt collectors from misrepresenting the character, amount, or legal status of a debt. Debt collectors cannot pretend to be a police offer and threaten to arrest or press criminal charges against you if you don't repay their debts. Look through our self-help forms, videos, and linked resources on resolving Debt in Indiana. Senate Bill 187 amended the law to explicitly include mortgage debt as a covered consumer debt. 2020. Complete Form 8874, New. These collectors keep all of the money they collect if they're successful.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.