Add List Legal Connecticut Fair Debt Credit Forms For Free

How it works

-

Import your Connecticut Fair Debt Credit Forms from your device or the cloud, or use other available upload options.

-

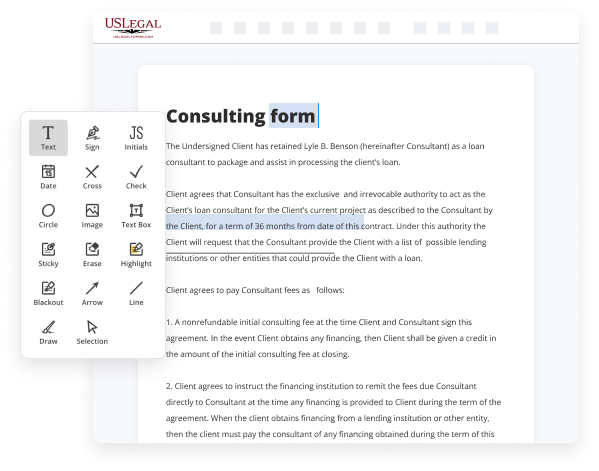

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Connecticut Fair Debt Credit Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add List Legal Connecticut Fair Debt Credit Forms For Free

Are you tired of endless document printing, scanning, postal delivery, and wasting precious time and resources with manual fill-out? The times have moved on, and the easiest way to Add List Legal Connecticut Fair Debt Credit Forms For Free and make any other critical updates to your forms is by handling them online. Choose our quick and trustworthy online editor to complete, modify, and execute your legal documentation with maximum effectiveness.

Here are the steps you should take to Add List Legal Connecticut Fair Debt Credit Forms For Free quickly and effortlessly:

- Upload or import a file to the service. Drag and drop the template to the upload pane, import it from the cloud, or use an alternative option (extensive PDF library, emails, URLs, or direct form requests).

- Provide the required information. Complete empty fields using the Text, Check, and Cross tools from our top pane. Use our editor’s navigation to make sure you’ve filled in everything. Accentuate the most important details with the Highlight option and erase or blackout areas with no value.

- Adjust and rearrange the form. Use our upper and side toolbars to change your content, drop extra fillable fields for various data types, re-order pages, add new ones, or remove redundant ones.

- Sign and request signatures. Whatever method you select, your electronic signature will be legally binding and court-admissible. Send your form to others for signing using email or signing links. Notarize the document right in our editor if it needs witnessing.

- Share and save the copy. Download or export your accomplished documentation to the cloud in the format you need, print it out if you require a hard copy, and choose the most suitable file-sharing option (email, fax, SMS, or delivered by snail mail using the USPS).

With our service, you don’t have any more excuses to accomplish legal documents manually. Save time and effort executing them online twice as quickly and more successfully. Give it a try now!

Benefits of Editing Connecticut Fair Debt Credit Forms Online

Top Questions and Answers

Connecticut has a six-year statute of limitations for debt collection actions resulting from simple and implied contracts (CGS § 52-576; attachment 1).

Video Guide to Add List Legal Connecticut Fair Debt Credit Forms For Free

What is the fdcpa the fair debt collection practices Act was originally passed back in 1978 and was designed to protect consumers from debt collectors that were using unethical practices to collect money at one time debt collectors were free to use almost any means imaginable to get debtors to pay up including threatening them with physical harm this act

Put rules and regulations in place to protect the consumer a Federal Trade Commission is responsible for enforcing the fdcpa as well as other laws while this act covers a wide range of regulations it can be summed up as limiting how and when debt collectors can contact you what they can do to get you to pay and Empower

Tips to Add List Legal Connecticut Fair Debt Credit Forms For Free

- Gather all necessary legal documents related to debt and credit.

- Review the Connecticut Fair Debt Collection Practices Act for compliance details.

- Ensure that your list includes the names and contact information of all creditors.

- Clearly outline the debts you wish to address, including amounts and due dates.

- Consider consulting with a legal professional for advice on your rights and obligations.

- Keep records of all communications related to your debts.

- Stay organized to ensure that you do not miss any deadlines or required information.

The editing feature for adding List Legal Connecticut Fair Debt Credit Forms may be needed when individuals need to update their information due to changes in their financial situation or when errors are found in the initial submission.

Related Searches

Connecticut Law About Debt Collection: useful links to research guides, statutes, regulations, and pamphlets concerning debt collection. This Legal Guide covers the federal and California fair debt collection practices statutes. Congress enacted the Fair Debt Collection Practices Act. The FTC also brought the first federal law enforcement action combatting unlawful "debt parking. Conversely, they can't lead you to think that papers they send you aren't legal forms if they are. Right to Sue: If debt collectors break the law. No creditor shall use any abusive, harassing, fraudulent, deceptive or misleading representation, device or practice to collect or attempt to collect any debt. The CCA prohibits consumer debt collection agencies from adding additional or duplicate collection fees if they are not in the contract. If a debt management plan is developed during required credit counseling, it must be filed with the court. The Fair Debt Collection Practices Act (FDCPA)(15 U.S.C. 1692 et seq.), which became effective.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.