Add Payment Field Legal Illinois Gifts Forms For Free

How it works

-

Import your Illinois Gifts Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

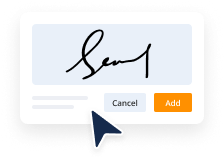

Sign your Illinois Gifts Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Payment Field Legal Illinois Gifts Forms For Free

Legal documentation requires maximum precision and timely execution. While printing and completing forms normally takes considerable time, online PDF editors prove their practicality and efficiency. Our service is at your disposal if you’re searching for a trustworthy and easy-to-use tool to Add Payment Field Legal Illinois Gifts Forms For Free quickly and securely. Once you try it, you will be amazed at how simple working with official paperwork can be.

Follow the guidelines below to Add Payment Field Legal Illinois Gifts Forms For Free:

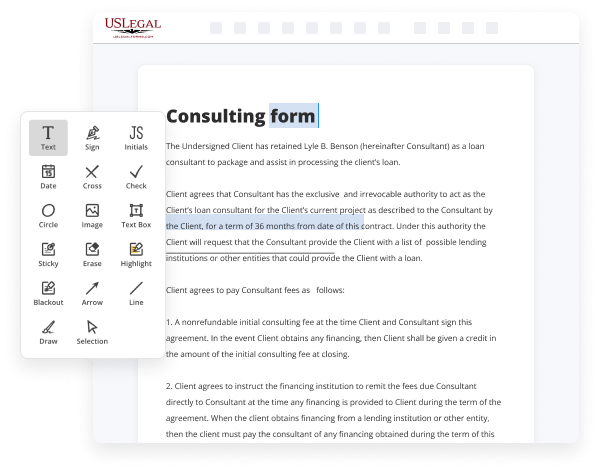

- Add your template through one of the available options - from your device, cloud, or PDF library. You can also import it from an email or direct URL or using a request from another person.

- Make use of the top toolbar to fill out your document: start typing in text areas and click on the box fields to choose appropriate options.

- Make other necessary adjustments: insert pictures, lines, or signs, highlight or delete some details, etc.

- Use our side tools to make page arrangements - insert new sheets, alter their order, delete unnecessary ones, add page numbers if missing, etc.

- Add extra fields to your document requesting different types of data and place watermarks to protect the contents from unauthorized copying.

- Check if things are correct and sign your paperwork - generate a legally-binding electronic signature the way you prefer and place the current date next to it.

- Click Done when you are ready and choose where to save your form - download it to your device or export it to the cloud in any file format you need.

- Share a copy with other people or send it to them for signature through email, a signing link, SMS, or fax. Request online notarization and obtain your form rapidly witnessed.

Imagine doing all of that manually on paper when even one error forces you to reprint and refill all the details from the beginning! With online solutions like ours, things become much more manageable. Give it a try now!

Benefits of Editing Illinois Gifts Forms Online

Top Questions and Answers

(Gov't. Code § 89503.) Gifts of $50 or more, or aggregating $50 or more, from a single source must be reported on the Form 700.

Video Guide to Add Payment Field Legal Illinois Gifts Forms For Free

Hey everyone chad pavel cpa here the big question i often get from first-time entrepreneurs very very very very often is how do i pay myself and how do i pay taxes on a single member llc all right so this is your first time opening a business if you've never run an llc before you've never had a tax

Return and you're just thinking about how do i actually pay myself and how do i make sure that i'm keeping track of all the profit and loss how do i pay taxes i don't want to have penalties and interest how do i stay on top of all this stuff so you're definitely asking yourself the right question so

Tips to Add Payment Field Legal Illinois Gifts Forms For Free

- Start by gathering all necessary information that the payment field will require, such as payment amount, payment methods, and any required donor information.

- Ensure that the payment field complies with Illinois state laws regarding gift forms and taxation.

- Use clear and concise labels for each part of the payment field to make it easy for donors to understand what information they need to provide.

- Incorporate secure payment options to protect donor information and encourage more contributions.

- Test the payment field with a few sample transactions to ensure that everything is working smoothly before making it live.

You might need this editing feature for Add Payment Field Legal Illinois Gifts Forms when you're updating payment options, changing donation amounts, or revising your compliance with state regulations.

List all reportable gifts made during the calendar year on one Form 709. If an estate's gross value exceeds. Making a gift to Illinois online is easy and secure. Gifts that are direct skips and are subject to both gift tax and generation-skipping transfer tax. You must list the gifts in chronological order. This system allows State of Illinois vendors and commercial payees to view and download detailed, non-confidential remittance information. Complete Form PTAX-203-B, Illinois Real Estate Transfer Declaration Supplemental Form B. 11 Full actual consideration. Fill out Affidavit of Gift: You'll need to complete an Affidavit of Gift form. If you haven't saved any cards yet, we'll ask you to add one or more credit or debit cards or Walmart gift cards. Some gifts may seem to fit within an exception, but still give the appearance of having undue influence over the employee or agency.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.