Add Required Fields To Legal Connecticut Mortgage Assignment Forms For Free

How it works

-

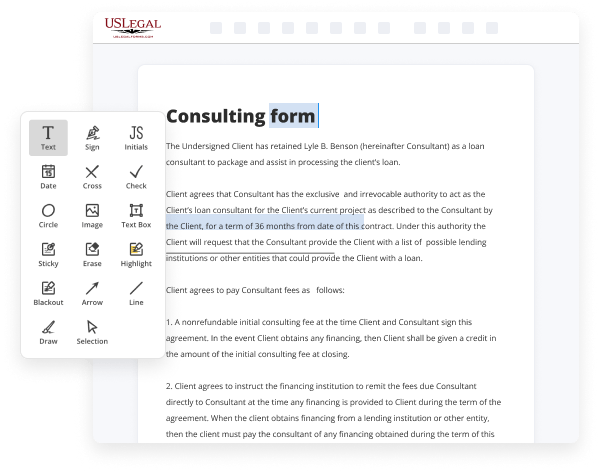

Import your Connecticut Mortgage Assignment Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

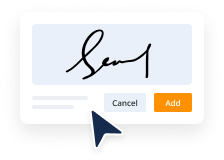

Sign your Connecticut Mortgage Assignment Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Required Fields To Legal Connecticut Mortgage Assignment Forms For Free

Online document editors have proved their trustworthiness and efficiency for legal paperwork execution. Use our secure, fast, and straightforward service to Add Required Fields To Legal Connecticut Mortgage Assignment Forms For Free your documents whenever you need them, with minimum effort and greatest precision.

Make these simple steps to Add Required Fields To Legal Connecticut Mortgage Assignment Forms For Free online:

- Import a file to the editor. You can select from several options - upload it from your device or the cloud or import it from a template library, external URL, or email attachment.

- Fill out the blank fields. Put the cursor on the first empty area and use our editor’s navigation to move step-by-step to prevent missing anything on your template. Use Text, Initials, Cross, and Check tools.

- Make your necessary edits. Update the form with inserted pictures, draw lines and icons, highlight important elements, or remove any unnecessary ones.

- Create additional fillable fields. Adjust the template with a new area for fill-out if neccessary. Make use of the right-side toolbar for this, place each field where you want others to provide their data, and make the rest of the areas required, optional, or conditional.

- Organize your pages. Delete sheets you don’t need any longer or create new ones utilizing the appropriate button, rotate them, or change their order.

- Generate electronic signatures. Click on the Sign tool and choose how you’d add your signature to the form - by typing your name, drawing it, uploading its image, or utilizing a QR code.

- Share and send for eSigning. Finish your editing with the Done button and send your copy to other parties for signing via an email request, with a Link to Fill option, in an SMS or fax message. Request a prompt online notarization if required.

- Save the file in the format you need. Download your document, save it to cloud storage in its present format, or transform it as you need.

And that’s how you can complete and share any individual or business legal documentation in minutes. Try it now!

Benefits of Editing Connecticut Mortgage Assignment Forms Online

Top Questions and Answers

Assignments are generally freely permitted in most modern mortgage agreements. Once the borrower has received proper notice of the assignment, payments will be made to the new creditor. A mortgage assumption occurs when a buyer agrees to take on the seller's current loan and mortgage obligations.

Video Guide to Add Required Fields To Legal Connecticut Mortgage Assignment Forms For Free

Welcome to the presentation at suit inspection to your notary resume by introducing myself my name is Jamie Liggins and the founder and owner of Lauri access and business services and author of the books ten ways as they notarized this when life happens and what's in your notary tool box in addition to being a notary and certified notary

Signing agent of over twenty eight years I am also an NMA ambassador notary law instructor mentor and private investigator in 2004 I was honored to receive the international notary of the Year award as well as be the keynote speaker for 2018 conference I am honored to be a distinguished veteran speaker for internet conferences and even though I

Tips to Add Required Fields To Legal Connecticut Mortgage Assignment Forms For Free

- Consult with a legal professional to ensure all necessary fields are included

- Research state laws and regulations regarding required fields for mortgage assignment forms in Connecticut

- Consider including fields for identification of parties involved, property address, loan details, and signatures

- Clearly label required fields to ensure they are not overlooked or left blank

Editing feature for Add Required Fields To Legal Connecticut Mortgage Assignment Forms may be needed when updating forms to comply with new regulations or if errors are discovered in existing forms.

Related Searches

Assignment of mortgage debt. Form of instrument. Requirements. Sufficient notice of assignment. Allocation of recording fees paid by a nominee of a mortgagee. 6 days ago ? Make these quick steps to Add Required Fields To Legal Mortgage Assignment Templates online: · Import a file to the editor. · Fill out the blank ... A step-by-step guide on how to Insert Mandatory Field to the Assignment Of Mortgage. Drag and drop your document in your Dashboard or add it ... Requirements. Sufficient notice of assignment. Operation of executed assignment. There is a newer version of the Connecticut General Statutes. Affidavit. Section 49-10 - Assignment of mortgage debt. Form of instrument. Requirements. Sufficient notice of assignment. Allocation of recording fees paid by ... All appraisals for. Mortgage Loans must be made by appraisers who are licensed or certified by the State of Connecticut, acceptable to CHFA and as per FNMA ... By AM White · 2012 · Cited by 63 ? Each of these two assignments followed different rules, and required the creation, endorsement and delivery of. different documents, in order to be legally ... Clarification has been made advising that late charges are computed on the full monthly payment (principal, interest, taxes and insurance) due from the ... The most common UCC form is the UCC-1 or Financing Statement. These forms are routine in the case of secured loan, where the lender uses the UCC-1 to place a ... Effective dates for changes to Fannie Mae legal documents ... Notes for regularly amortizing mortgages include the Fannie Mae/Freddie Mac Uniform Fixed-Rate ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.