Add Signature Field To Legal Connecticut Fair Credit Reporting Forms For Free

How it works

-

Import your Connecticut Fair Credit Reporting Forms from your device or the cloud, or use other available upload options.

-

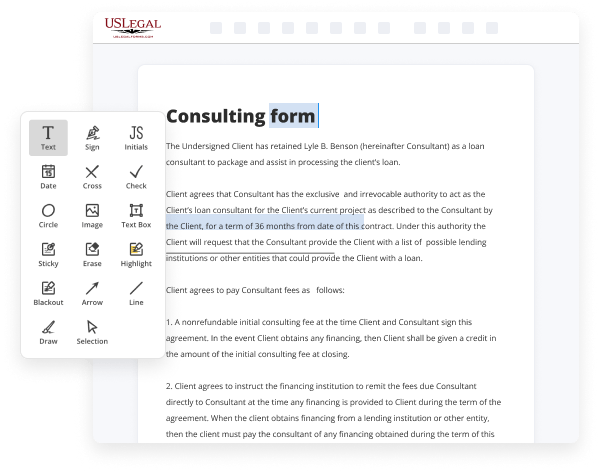

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Connecticut Fair Credit Reporting Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Signature Field To Legal Connecticut Fair Credit Reporting Forms For Free

Online document editors have proved their reliability and effectiveness for legal paperwork execution. Use our secure, fast, and user-friendly service to Add Signature Field To Legal Connecticut Fair Credit Reporting Forms For Free your documents whenever you need them, with minimum effort and maximum precision.

Make these simple steps to Add Signature Field To Legal Connecticut Fair Credit Reporting Forms For Free online:

- Import a file to the editor. You can select from several options - add it from your device or the cloud or import it from a template library, external URL, or email attachment.

- Fill out the blank fields. Put the cursor on the first empty area and use our editor’s navigation to move step-by-step to avoid missing anything on your template. Use Text, Initials, Cross, and Check tools.

- Make your necessary modifications. Update the form with inserted images, draw lines and signs, highlight important components, or erase any unnecessary ones.

- Create additional fillable fields. Adjust the template with a new area for fill-out if neccessary. Utilize the right-side toolbar for this, place each field where you expect others to leave their details, and make the remaining areas required, optional, or conditional.

- Arrange your pages. Delete sheets you don’t need any longer or create new ones while using appropriate button, rotate them, or change their order.

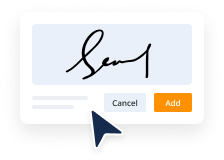

- Create eSignatures. Click on the Sign option and decide how you’d add your signature to the form - by typing your name, drawing it, uploading its picture, or using a QR code.

- Share and send for eSigning. End your editing using the Done button and send your copy to other people for signing via an email request, with a Link to Fill option, in an SMS or fax message. Request a quick online notarization if required.

- Save the file in the format you need. Download your document, save it to cloud storage in its present format, or transform it as you need.

And that’s how you can prepare and share any individual or business legal paperwork in minutes. Give it a try today!

Benefits of Editing Connecticut Fair Credit Reporting Forms Online

Top Questions and Answers

The Fair Credit Reporting Act (FCRA) regulates the consumer credit reporting industry. In general, the FCRA requires that industry to report your consumer credit information in a fair, timely, and accurate manner. Banks and other lenders use this information to make lending decisions. Credit Reporting - OCC.gov treas.gov ? topics ? consumer-protection treas.gov ? topics ? consumer-protection

Video Guide to Add Signature Field To Legal Connecticut Fair Credit Reporting Forms For Free

Hey guys welcome to this video my name is john watts i'm a consumer protection lawyer and i want us to do a quick overview of the fair credit reporting act the fcra i'm not sure exactly how long this will take i only have three slides i do have a lot of information on those slides which i don't

Normally do but i think for purposes of this presentation it will help to be able to see this information and so let's start off first of all with what are our claims against the credit bureaus now the credit bureaus we're talking about equifax experian transunion and then there are 100 or 200 specialty credit bureaus these are also

Tips to Add Signature Field To Legal Connecticut Fair Credit Reporting Forms For Free

- Ensure you have the appropriate legal authorization to add a signature field to the forms.

- Use a digital signature tool to create a digital signature field on the forms.

- Clearly label the signature field with instructions on how to sign.

- Test the signature field to make sure it is working properly before distributing the forms.

- Consider using a secure platform to collect and store the signed forms.

The editing feature to add a signature field to Legal Connecticut Fair Credit Reporting Forms may be needed when you require recipients to provide their consent or acknowledgement in a legally binding way. This feature ensures that the forms are completed accurately and securely.

Related Searches

Follow the guidelines below to Add Watermark To Legal Connecticut Fair Credit Reporting Forms: Add your template via one of the available options - from your ... Sign and request signatures. Whatever method you select, your electronic signature will be legally binding and court-admissible. Send your form to others for ... This form provides broad language that allows a credit report to be generated for any type of legal reason in compliance with the Fair Credit Reporting Act ... The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and privacy of information in the files of consumer reporting agencies. Model forms for risk-based pricing and credit score disclosure exception notices (Appendix H to Part 1022). Download PDF ; Summary of consumer identity theft ... ?Matching procedures? refers to the broader set of practices and procedures consumer reporting agencies use to link information to a consumer's ... I hereby authorize, without reservation, any financial institution, law enforcement agency, information service bureau, school, employer or insurance company ... Background screening reports are ?consumer reports? under the FCRA when they ... legal jargon or adding extra acknowledgements or waivers. I understand Sterling Infosystems Inc.'s (?STERLING?) investigation may include obtaining information regarding my credit background, bankruptcies, lawsuits, ... You may request a credit score from consumer reporting agencies that create scores or distribute scores used in residential real property loans, but you will ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.