Add Tables To Legal Connecticut Personal Loans Forms For Free

How it works

-

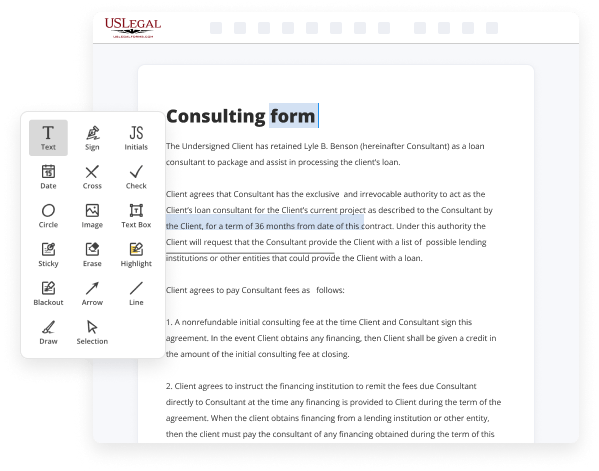

Import your Connecticut Personal Loans Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Connecticut Personal Loans Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Tables To Legal Connecticut Personal Loans Forms For Free

Online PDF editors have proved their trustworthiness and efficiency for legal paperwork execution. Use our secure, fast, and intuitive service to Add Tables To Legal Connecticut Personal Loans Forms For Free your documents any time you need them, with minimum effort and highest accuracy.

Make these quick steps to Add Tables To Legal Connecticut Personal Loans Forms For Free online:

- Upload a file to the editor. You can choose from several options - add it from your device or the cloud or import it from a template library, external URL, or email attachment.

- Fill out the blank fields. Put the cursor on the first empty field and use our editor’s navigation to move step-by-step to prevent missing anything on your template. Use Text, Initials, Cross, and Check tools.

- Make your necessary modifications. Update the form with inserted images, draw lines and icons, highlight important parts, or erase any unnecessary ones.

- Add more fillable fields. Modify the template with a new area for fill-out if required. Utilize the right-side toolbar for this, place each field where you want other participants to leave their data, and make the rest of the fields required, optional, or conditional.

- Organize your pages. Delete sheets you don’t need anymore or create new ones utilizing the appropriate key, rotate them, or alter their order.

- Generate eSignatures. Click on the Sign option and choose how you’d add your signature to the form - by typing your name, drawing it, uploading its picture, or using a QR code.

- Share and send for eSigning. Finish your editing using the Done button and send your copy to other people for approval through an email request, with a Link to Fill option, in an SMS or fax message. Request a prompt online notarization if needed.

- Save the file in the format you need. Download your paperwork, save it to cloud storage in its current format, or transform it as you need.

And that’s how you can prepare and share any personal or business legal documentation in minutes. Try it today!

Benefits of Editing Connecticut Personal Loans Forms Online

Top Questions and Answers

A promissory note usually includes an interest rate and the terms of repayment. Usually, IOUs and promissory notes are signed by the borrower, although they may also be signed by the lender. A loan agreement is a document that contains all of the details of the loan and is signed by both parties.

Video Guide to Add Tables To Legal Connecticut Personal Loans Forms For Free

If you are a real estate agent or you're interested in becoming a real estate agent then you have probably heard these two terms title indeed used interchangeably but I'm going to explain today what is the difference in the fact that they are not exactly the same thing I'm Tiffany Weber I'm a real estate attorney in Mooresville North

Carolina at Thomas and Weber let's get right into it all right first we're going to start with title because this is the foundational concept so title refers to ownership your ownership of the property so title is comprised of a lot of different things if you're sitting in a law school property class right now your professor might describe

Related Features

Tips to Add Tables To Legal Connecticut Personal Loans Forms For Free

- Use a table editor tool to easily create and format tables in the form.

- Label each row and column clearly for easy reference.

- Make sure the table is aligned with the rest of the form for a cohesive look.

- Include all necessary information within the table to avoid confusion.

- Review the table for accuracy and completeness before finalizing the form.

Adding tables to legal Connecticut personal loans forms can help organize and present data in a clear and professional manner. This feature may be especially needed when detailing repayment schedules, interest rates, and loan terms for borrowers to easily understand and reference.

Related Searches

Are you looking for a loan agreement form in Connecticut? Download our free Connecticut Loan Agreement Form which is available as PDF or Word documents. Here are the steps you should take to Add Image To Legal Connecticut Personal Loans Forms quickly and effortlessly: Upload or import a file to the service. Drag ... How would you rate your free form? ... A personal loan agreement outlines the terms of how money is borrowed and when it will be paid back. It is a simple ... A loan agreement is a written agreement between a lender that lends money to a borrower in exchange for repayment plus interest. The borrower will be ... 15-Apr-2023 ? Enter the amount from Form CT-1040, Schedule 1, Line 38. ... Add all entries in Column C (including the additional amount. Investments and loans held by Connecticut banks on January 1, 1995. ... otherwise all kinds of personal property, including papers, documents and evidences ... CNBC Select rounded up some personal loan lenders that allow you to apply for as little as $3,000. We looked at key factors like interest rates, fees, ... Additional information or documents may be requested to confirm your account is in compliance with all local laws and regulations. Personal loan apps or apps ... CNBC Select rounded up some personal loan lenders that may still approve applicants who don't have a sufficient enough credit history to generate a credit ... Accept loan applications online with a free Personal Loan Application Form. Embed in your bank or credit union's website. Customize in seconds!

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.