Add Tables To Legal Georgia Loans Lending Forms For Free

How it works

-

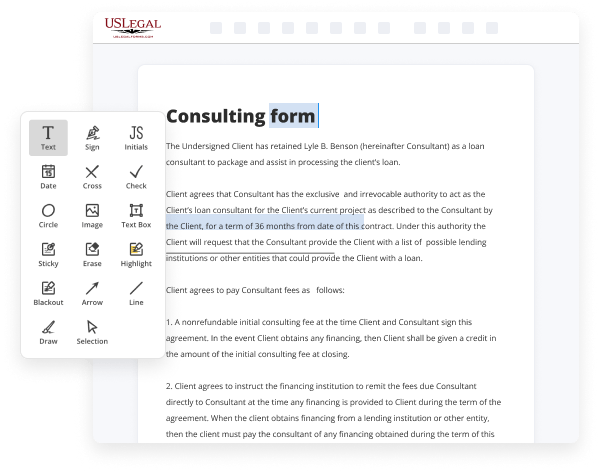

Import your Georgia Loans Lending Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

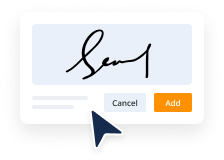

Sign your Georgia Loans Lending Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Tables To Legal Georgia Loans Lending Forms For Free

Legal documentation requires greatest precision and prompt execution. While printing and filling forms out usually takes considerable time, online PDF editors demonstrate their practicality and efficiency. Our service is at your disposal if you’re searching for a trustworthy and simple-to-use tool to Add Tables To Legal Georgia Loans Lending Forms For Free rapidly and securely. Once you try it, you will be surprised how effortless dealing with official paperwork can be.

Follow the guidelines below to Add Tables To Legal Georgia Loans Lending Forms For Free:

- Upload your template through one of the available options - from your device, cloud, or PDF catalog. You can also import it from an email or direct URL or through a request from another person.

- Use the upper toolbar to fill out your document: start typing in text areas and click on the box fields to choose appropriate options.

- Make other essential adjustments: add images, lines, or signs, highlight or remove some details, etc.

- Use our side tools to make page arrangements - add new sheets, alter their order, remove unnecessary ones, add page numbers if missing, etc.

- Add additional fields to your document requesting various types of data and place watermarks to protect the contents from unauthorized copying.

- Check if things are true and sign your paperwork - generate a legally-binding electronic signature in your preferred way and place the current date next to it.

- Click Done when you are ready and decide where to save your form - download it to your device or export it to the cloud in any file format you need.

- Share a copy with other people or send it to them for signature through email, a signing link, SMS, or fax. Request online notarization and get your form promptly witnessed.

Imagine doing all the above manually in writing when even one error forces you to reprint and refill all the data from the beginning! With online solutions like ours, things become much more manageable. Try it now!

Benefits of Editing Georgia Loans Lending Forms Online

Top Questions and Answers

Understanding the Important Clauses in a Loan Agreement #1: Fluctuation Of Interest Rates Clause: ... #2: 'Default' Definition Clause: ... #3: Security Cover Clause: ... #4: Disbursement Clause: ... #5: Force Majeure Clause: ... #6: Reset Clause: ... #7: Prepayment Clause: ... #8: Other Balances Set Off Clause:

Video Guide to Add Tables To Legal Georgia Loans Lending Forms For Free

If you are a real estate agent or you're interested in becoming a real estate agent then you have probably heard these two terms title indeed used interchangeably but I'm going to explain today what is the difference in the fact that they are not exactly the same thing I'm Tiffany Weber I'm a real estate attorney in Mooresville North

Carolina at Thomas and Weber let's get right into it all right first we're going to start with title because this is the foundational concept so title refers to ownership your ownership of the property so title is comprised of a lot of different things if you're sitting in a law school property class right now your professor might describe

Tips to Add Tables To Legal Georgia Loans Lending Forms For Free

- Ensure the table follows the proper format provided in the legal Georgia loans lending forms.

- Clearly label each section of the table for easy reference.

- Use a consistent font and font size throughout the table to maintain professionalism.

- Include all necessary information in the table, such as loan terms, interest rates, and repayment schedules.

- Proofread the table for any errors or inconsistencies before finalizing the form.

The editing feature to add tables to legal Georgia loans lending forms may be needed when you need to present complex data or organize information in a clear and organized manner. It can help improve the readability and understanding of the form for borrowers and lenders alike.

Related Searches

A loan agreement is a written agreement between a lender that lends money to a borrower in exchange for repayment plus interest. The borrower will be ... Updated April 14, 2023. A personal loan agreement outlines the terms of how money is borrowed and when it will be paid back. It is a simple agreement that ... 21-Sept-2022 ? Who Is Required to Have This License? Pursuant to the Georgia Installment Loan Act, located in the Official Code of Georgia Annotated ... Who is required to remit the Georgia Residential Mortgage Act $10 per loan fees (?GRMA fees?) to the Department of Banking and Finance? The Mortgage Industry FAQs page is designed to assist potential and existing mortgage licensees/registrants with common questions about the various Georgia ... 12-Apr-2023 ? Learn how to form an LLC in Georgia with our simple guide. We'll walk you through the process step by step and highlight important ... Each category must submit its own unique forms at uniquely specified deadlines. Bankruptcy: Second chance. The Georgian Law on Insolvency Proceedings provides ... According to Geostat's definition2, SMEs accounted for 99.7% of all firms in 2017.3 Indicators of production, turnover, value added and employment also reflect ... This topic contains information on mortgage loan eligibility requirements, including: Ability to Repay Loan Eligibility Requirements; Acceptable Loan Terms ... This form is a statement of final loan terms and closing costs. Compare this document with your Loan Estimate. Closing Disclosure. Page 2. Borrower ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.